The Coming U.S. Economic Collapse Will Trigger a Revolution

Economics / US Economy Aug 19, 2014 - 03:03 PM GMTBy: Harry_Dent

When the next economic collapse comes, and it’s inevitable, the revolution against the upper class will kick into higher gear!

When the next economic collapse comes, and it’s inevitable, the revolution against the upper class will kick into higher gear!

Let me explain using my long-term economic cycle — the new 80-year, four season, Generation Wave — and an important 250-year cycle…

Just like the weather, the economy shifts through four seasons as generations pass through it: spring, summer, fall and winter. There are dynamic fluctuations that favor innovation… then efficiency… then inflation… then deflation… all through different booms and busts.

A boom in the fall follows the summer inflationary season. During this fall boom, new technologies move into the mainstream and entrepreneurs and financiers gain the most (as we have witnessed since the late 1970s).

That, in turn, creates a longer-term trend…

That is, everyday people gain as well, thanks to higher wages and increased productivity.

These trends occurred frequently from 1933 to 1972. Everyday people adopted the technologies that enabled a rise in productivity, and so enjoyed an increase in their wages, bringing lower-cost products and a better standard of living.

In fact, we saw the last broad, middle-class boom during the spring season of the economic revolution from 1942 to 1968. During that time, overall income of the average household grew faster than the income of the top 1% and top 10%!

In 1929, the top 1% held 50% of the wealth, but they lost their grip on it. By 1976, they only held 24% of the wealth. Then they regained some of that lost wealth, holding 50% again by 2007.

During normal cycles, 2007 would have been the peak of such income inequality. But not this time…

Since 2000, the middle class in developed countries like America and Europe has seen their wages stagnate as emerging countries like China take over the manufacturing and office tasks at lower prices. We call it “The Great Asian Deflation.”

And the cost of education has inflated so fast that it’s increasingly out of reach of the average person (but that’s a whole other topic for a future article).

However, entrepreneurs have done well, as they create long-term gains for the economy and everyday people through their innovations, new industries and business models.

And financial engineering on Wall Street has accelerated (unfortunately), creating greater speculation and leverage in the economy and generating greater profits for those invested (along with the potential for bubbles to burst like in the 1930s).

The Federal Reserve and central banks around the world have also done some engineering of their own, artificially maintaining stock and debt bubbles. They’ve poured free money into the economy, benefiting the banks, financial institutions and the top 1%.

But here’s the rub.

All of this “engineering” has altered the natural cycle. Instead of peaking in 2007, as it should have, the rich have continued to prosper while everyday people have stagnated or declined.

The thing is, when you fight against nature, you eventually lose. And I believe that all the manipulations and engineering that has distorted the natural cycle will eventually be the Western world’s undoing.

This extended bubble is now (belatedly) reaching its peak, a fact we know because income inequality has become so extreme. We’re rapidly approaching the point where, unless something changes, everyday people will start to revolt.

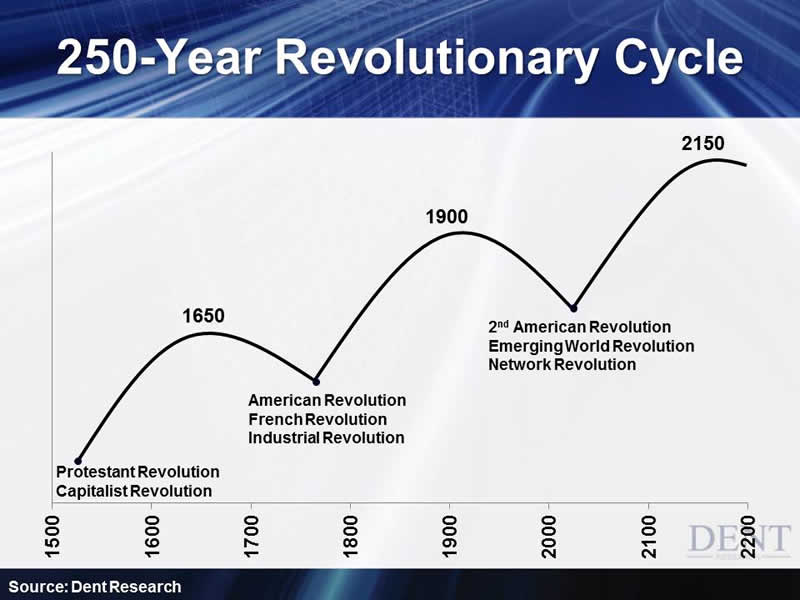

This is a fact further supported by the larger political and social revolutionary cycle that occurs about every 250 years, when the average Joe rises up against the excessive gains and tyranny of the rich.

In the past we had the Protestant Revolution (early to mid-1500s) against the tyranny of the Catholic Church and the American and French Revolutions in the mid- to late-1700s…

And now it’s time for the next one.

I think that income inequality and special interests have created such an extreme situation today that everyday people will begin to revolt in developed countries. It won’t just be those in the dictator-driven economies of the emerging world trying to make themselves heard and force democracy for the first time.

Sure, the coming “Western” revolution won’t be pretty, but it will usher in the next great resurgence of the middle class in developed countries, and it will accelerate the new middle-class surge in emerging countries.

This revolution will raise the everyday person up and bring the upper class back down to size — as has every economic revolution in history. And as new technologies move mainstream and become less exclusive, the uprising will gather momentum.

So if you’re rich, protect your gains now before Rome falls.

If you’re middle class, hunker down and wait for your day in the sun. It will be well worth it when that time comes.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.