Bank of England Panic! Scottish Independence Bank Run Already Underway!

Politics / UK Banking Sep 15, 2014 - 04:39 AM GMTBy: Nadeem_Walayat

Whilst most of the people of the UK are focused on the increasing frenzy of the too and fro politicking going on in Scotland in the build up to September 18th referendum, unbeknown to most including the mainstream media is that there is already a bank run underway not only in terms of flight of capital from Scottish banks but that is hitting the whole of the UK hard in terms of capital outflows.

Whilst most of the people of the UK are focused on the increasing frenzy of the too and fro politicking going on in Scotland in the build up to September 18th referendum, unbeknown to most including the mainstream media is that there is already a bank run underway not only in terms of flight of capital from Scottish banks but that is hitting the whole of the UK hard in terms of capital outflows.

Understand this - It does not matter what the Bank of England states following a YES vote on September 18th - There will be a run on Scottish Banks by panicking depositors just as there was on Northern Rock.

UK Accelerating Capital Out Flow

Whilst the epicentre of the bank run is Scotland as Scottish banks haemorrhage bank deposits, however the risks of Scottish independence is resulting in a flight of capital out from the whole of the UK which so far this year has seen more than £100 billion leave the UK which is set against an inflow of approx £50 billion for 2013. And the amount of capital outflow is accelerating as evidenced by the mainstream press recently partially waking up to what is taking place by reporting on the £17 billion of outflow for the month of August alone.

However, we won't know the statistics for September until well into October so the place to look for the answer as to the intensity of capital flight from the UK is the British Pound, for depositors and investors pulling funds out of the UK would SELL Pounds for other currencies such as the Dollar and Euro. In this respect sterling's slide has accelerated during September reaching a recent low of £/$1.60, near twice the decline for the whole of August which suggests that the UK could have seen as much as £34 billion leave the UK so far this month that could more than triple if Scotland actually does Vote YES. Where it would not surprise me if the the British Pound plunged to under £/$1.50 as panicked investors sold UK assets.

Therefore by the end September, following a YES vote the UK could have experienced its worst month ever in terms of capital flight of as much as £100 billion that would be in addition to the 100 billion already pulled out of the UK upto the end of August, and there would be little that the politicians or Bank of England could do or say to prevent the exodus of capital continuing for many months more to come.

Independent Scotland's Trojan Horse

Whilst Alex Salmond continues to deluge the airwaves with propaganda surrounding the potential for 'sharing' of the Bank of England, the fact remains that UK politicians of all three major parties unequivocally continue to reject the SNP's cunning plan to effectively permanently park a Trojan Horse outside the Bank of England on Scottish Independence day that would effectively allow Scotland to go on an deficit spending binge on a sterling credit card by printing debt without the consequences of currency panic that normally would result in very high if not hyperinflation, but instead like a cancer seek to consume its English host over a number of years as the policy of sterling sharing sucks the financial life blood out of the British Pound.

However such scottish nationalists central bank sharing delusions are just not going to happen as two nations CANNOT effectively share the same bank account! The scottish people should not be taken in by these blatant LIES because it is just NOT GOING TO HAPPEN!

For instance recently Scotland's SNP Finance Minister, John Swinney was caught in the act when had made the following false statement -

“The Scottish government has had technical discussions with the Bank of England regarding our proposal for a currency union and we welcome their continued acknowledgement that the Bank will introduce whatever the politicians decide,”

To which the Bank of England responded.

"To be clear, consistent with its statement in December 2012, the Bank of England has not entered into discussions with representatives of the Scottish Government about proposals for future monetary arrangements in Scotland"

Which prompted a humiliating climb down by John Swinney who stated :

“If by my choice of words last week I have given the impression that the Bank of England has been involved in negotiating a currency union, I can say to parliament that was not my intention.”

Foreign investor fears of an Independent Scotland effectively parking a trojan horse outside the Bank of England is triggering flight of capital out of the UK that can only intensify AFTER Scotland votes YES that will act as a tightening noose around the British Economy for the duration of a near 2 years of bitter negotiations of separation that investors will just not put up with the uncertainty of.

Scotland Banking Panic Underway

Whilst the Scottish Nationalists convientely try to forget the fact that had Scotland been Independent at the time of the financial crisis of 2008 then its bankrupt banks, namely RBS and HBOS given their more than £2 trillion of liabilities would have bankrupted Scotland's £160 billion economy more than 14 times over! in an economic collapse many times worse than Greece, and probably worse even than the spectacular near overnight collapse of Iceland. The bottom line is that the likes of RBS and HBOS will be able to run rings around Scotland's inexperienced, inept or corrupt politicians which ensures that another financial collapse would be CERTAIN no matter the promises politicians make today. IT WILL HAPPEN AGAIN and probably far sooner than anyone can imagine.

Scotland's financial sector is near twice the size relative to the Scottish economy than were that of Ireland, Iceland, Cyprus or Greece!

The Scottish nationalists are delusional if they imagine that the financial markets would accept such a risk following a YES vote as today Scotland does not underwrite the Scottish banks but rather it is the whole of the UK which effectively means ENGLAND that stands behind Scotland's banks. No one is going to keep a single penny in a Scottish bank following a YES vote backed by the Scottish government because they fully understand that it would be impossible for Scotland to ever make good on any bank deposit guarantees that SNP politicians would make because the credit ratings agencies would immediately rate Scotland and ALL of its banks as JUNK as a consequence of bank liabilities, that effectively would instantly make ALL of Scotland's banks insolvent that no financial institution would want to do business with.

While no banker will officially acknowledge that a bank run is under way due to the obvious reason of intensifying the panic underway. However the signs of banking sector panic are clearly apparent as ALL of Scotland's major banks who had previously committed themselves to staying silent during the independence campaign, instead early last week panicked into announcing statements attempting to reassure fleeing depositors that they would effectively become ENGLISH banks following Scottish Independence YES vote as they declared contingency plans to move their headquarters and legal entities South of the border which translates into Should Scotland vote YES then ALL of Scotland's major banks will in large part quit Scotland.

Lloyds / Halifax Bank of Scotland

“Lloyds Banking Group has seen an increased level of inquiries from our customers, colleagues and other stakeholders about our plans post the Scottish referendum on Thursday, September 18,”

“While the scale of potential change is currently unclear, we have contingency plans in place, which include the establishment of new legal entities in England. This is a legal procedure and there would be no immediate changes or issues which could affect our business or our customers.”

“There will be a period between the referendum and the implementation of separation, should a Yes vote be successful, that we believe is sufficient to take any necessary action,”

“As a group we are committed to supporting our customers across Scotland and the rest of the UK.”

RBS

The Royal Bank of Scotland Group plc ("RBS") confirms that, as set out in the risk disclosures in RBS’s Annual Report, there are a number of material uncertainties arising from the Scottish referendum vote which could have a bearing on the Bank’s credit ratings, and the fiscal, monetary, legal and regulatory landscape to which it is subject. For this reason, RBS has undertaken contingency planning for the possible business implications of a ‘Yes’ vote. RBS believes that this is the responsible and prudent thing to do and something that its customers, staff and shareholders would expect it to do.

As part of such contingency planning, RBS believes that it would be necessary to re-domicile the Bank’s holding company and its primary rated operating entity (The Royal Bank of Scotland plc) to England. In the event of a 'Yes' vote, the decision to re-domicile should have no impact on everyday banking services used by our customers throughout the British Isles. However, RBS believes that it would be the most effective way to provide clarity to all our stakeholders and mitigate the risks previously identified in our Annual Report.

Furthermore, I would not be surprised that that it won't be long before the likes of the Royal Bank of Scotland (RBS) that despite a near 300 year history of existence will announce that it is changing its name to the Royal Bank of England (RBE), all to prevent the bank run panic from worsening.

Standard Life

In view of the uncertainty around Scotland's constitutional future, we have put in place precautionary measures which would help enable us to provide customers with continuity. This includes planning for new regulated companies in England to which we could transfer parts of our business if there was a need to do so.

This transfer of our business could potentially include pensions, investments and other long-term savings held by UK customers to ensure:

- All transactions with customers outside of Scotland continue to be in Sterling (money paid in and money paid out)

- All customers outside of Scotland continue to be part of the UK tax regime

- All customers outside of Scotland continue to be covered by existing consumer protection and regulatory arrangements e.g. the Financial Services Compensation Scheme and Financial Conduct Authority

We will continue to serve our customers in Scotland and will consider what additional measures we may need to take on their behalf as a consequence of constitutional change once further clarity and certainty is received.

Meanwhile global banks have also been issuing dire consequences for Scotland and Britain following a YES Vote

The chief economist at Deutsche Bank David Folkerts-Landau said "voters and politicians had failed to grasp the potential severity of the negative consequences of separation.

"A Yes vote for Scottish independence would go down in history as a political and economic mistake on a par with Winston Churchill’s decision in 1925 to return the pound to the Gold Standard or the failures by the Federal Reserve in America that triggered the Great Depression in the 1930s.

"Scotland risked a similar depression if voters backed the Yes campaign on Thursday, and described the desire for independence as an "incomprehensible" one which could have negative consequences "far beyond" what people had imagined.

Additionally Deutsche Bank's global strategist Bilal Hafeez warned that "the economic uncertainty that would ensue from independence, the unstable banking system that would also result, would really result in the Scottish debt having to offer much higher interest rates to attract investors."

The Bank of England and UK Treasury are effectively now in crisis mode ahead of Thursdays vote as they attempt to formulate contingency plans, which will mostly amount to open ended promises backed by UK tax payers in an attempt to to bring to a halt the run on British assets, much as took place during the Lehman's crisis of 2008 that was followed by 6 years of economic depression.

The Bank of England and UK Treasury are effectively now in crisis mode ahead of Thursdays vote as they attempt to formulate contingency plans, which will mostly amount to open ended promises backed by UK tax payers in an attempt to to bring to a halt the run on British assets, much as took place during the Lehman's crisis of 2008 that was followed by 6 years of economic depression.

To illustrate the degree of behind the scenes panic both the Chancellor George Osborne and Bank of England Governor Mark Carney announced yesterday that they would be pulling out of the G20 Finance Minister Summit due to take place this weekend.

George Osborne stated - "For my own perspective I have taken the decision that I won't go to G20 finance ministers meeting in Australia next week. I think it is important, given the economic risks of one potential outcome of that referendum, that I'm here in the UK.

"The Governor of the Bank of England has quite independently come to the same conclusion."

A whole host of major business also warned of the dire consequences of breaking up the United Kingdom such as Asda, John Lewis,Tesco's.

The bottom line is that following a YES vote Scotland's financial sector that lives off over 90% of its business coming from outside of Scotland would shrink to less than 10% of its current size, which is not going to be conducive to a newly independent Scotland's financial or economic stability.

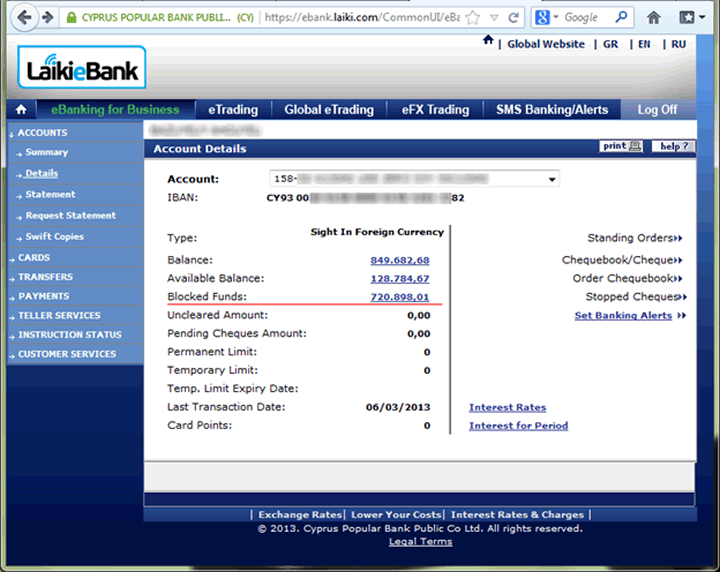

Sterlinglisation Scottish Government Would SIEZE Bank Accounts

Alex Salmond's plan to continue to use sterling after independence 'sterlinglisation' ensures that when the newly independent nation soon runs out of currency reserves both as a consequence of socialist deficit spending and financial crisis, then the only place left to obtain such currency reserves would be to literally steal the bank deposits of the Scottish people Cyprus style, which I am certain will take place within a few months of Independence day.

Yes or No - The Damage Has Already Been Done

Businesses and individuals are realising that Scottish separation is inevitable therefore even if Scots vote NO this time people will now have to formulate and enact a strategy to deal with an Scottish exit from the UK.

The bottom line is that for Scottish Nationalists independence is a religion in the pursuit of which they are willing sacrifice everything, therefore what England needs to do is to formulate a sustainable dissolution of the United Kingdom to protect England from the mayhem that would follow its destruction, even if it means constructing a new Hadrian's wall! For if destruction of the union does not happen on September the 18th then it will 20 or so years down the road!

This is a wake up call for England to start to take measures to limit the huge amount of damage that will done to England from when the Scottish nationalist eventually succeed in committing suicide.

More reasons on the consequences of Scotland separating from the UK and why they will vote NO in my recent in-depth analysis and video -

Scottish Independence YES Vote Panic - Scotland Committing Suicide and Terminating the UK?

Source and comments: http://www.marketoracle.co.uk/Article47337.html

By Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.