Gold Or Crushing Paper Debt Stocks Crash?

Commodities / Gold and Silver 2014 Oct 22, 2014 - 06:23 PM GMTBy: DeviantInvestor

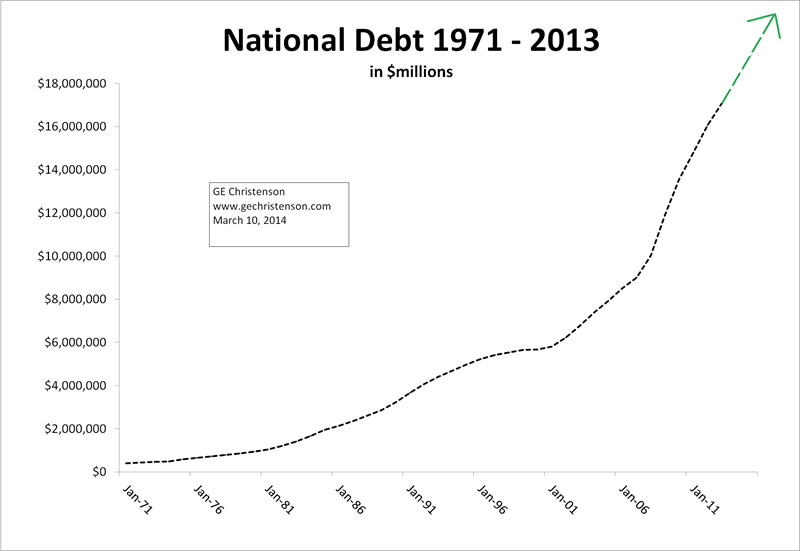

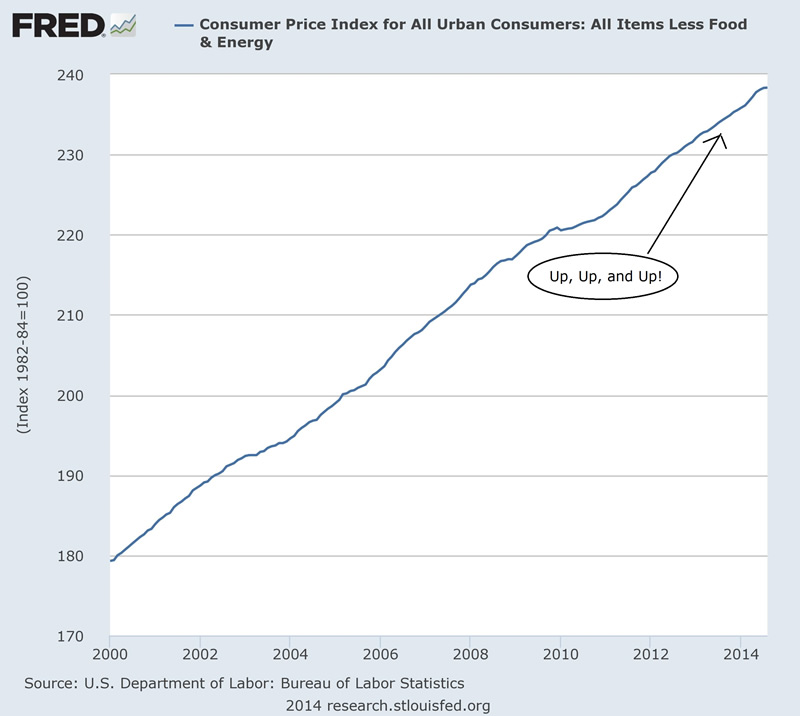

A Yahoo headline: Pentagon Readying For Long War in Iraq, Syria. More war means more debt and higher inflation. Increasing national debt is as certain as death and taxes. Increasing consumer prices follow.

A Yahoo headline: Pentagon Readying For Long War in Iraq, Syria. More war means more debt and higher inflation. Increasing national debt is as certain as death and taxes. Increasing consumer prices follow.

CPI – Less Food and Energy, of course

Then the “something for nothing” crowd adds to the trauma.

- More programs are funded by government – Medicare, disability, military contractors, “war on poverty,” banker bail-outs, “food stamps,” and many more.

- Central banks “print” currency (something for nothing) and pretend that new dollars, euros, yen, and pounds are valuable. The result is more currency in circulation, higher prices, and more economic distortions.

- “It’s all good” propaganda from governments and banks disorients the populace. The antidote is truth. (Thanks to James Quinn at www.theburningplatform.com)

Governments respond to problems with more spending (stimulus), central banks support the bond and stock markets (QE), and we pretend debt and deficit spending can increase forever (delusional). The U.S. official national debt is nearly $18,000,000,000,000.

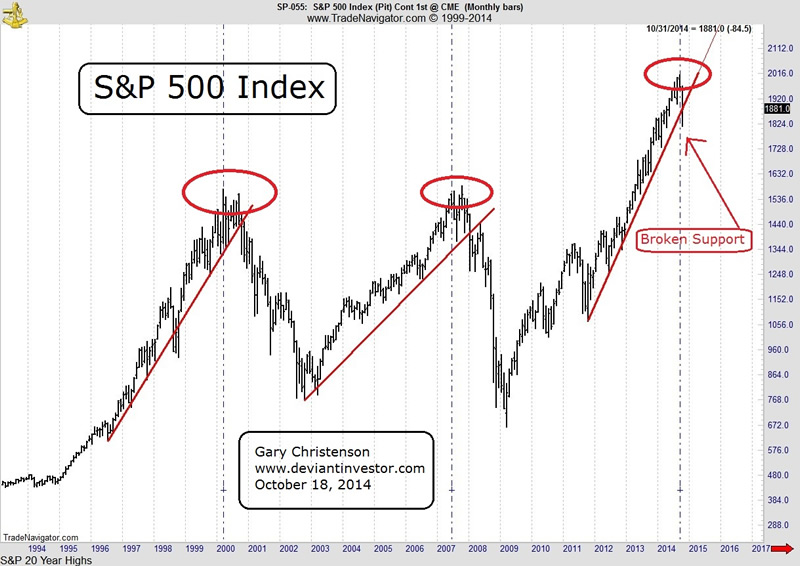

Occasionally a 1987 or 2000 stock market crash occurs, a 9-11 event changes the world as we know it, a housing bubble deflates, and major wars are created.

What could dramatically change our world – again – like 9-11 did?

- Smaller wars expand to become bigger wars, or even global wars.

- An Ebola pandemic, or merely the fear of a pandemic, temporarily paralyzes the global economy.

- Loss of confidence in fiat currencies and never-ending debt causes a major depression or financial collapse. What could create such a loss of confidence? Insolvent governments, a global pandemic, derivatives implosion, massive bank failures, financial melt-down, crude oil price spike, debts that will never be repaid, and leaders who don’t lead – are just a few.

- Stocks peak and crash as they often do about every 7 years.

Could Anther Crash Occur?

Our financial world seems more unstable and more dangerous than usual. Which has been safer under difficult economic and political conditions during the past 3,000 years – gold or debt based paper?

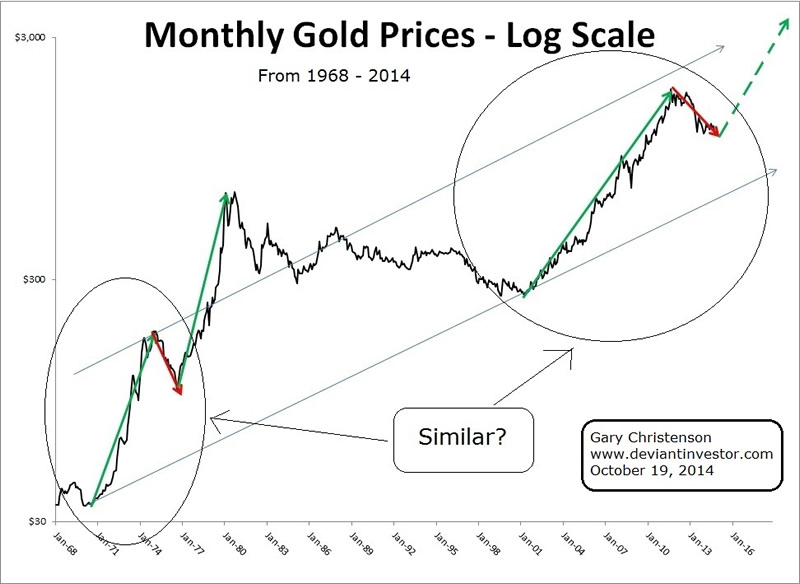

Consider the following graph of gold (log scale) since 1968. Note the rally into the mid 1970s and the subsequent correction. Is that pattern similar to the rally into 2011 and the correction since then?

Our financial world is dangerous and volatile. It is possible that:

- The S&P will rise for another decade.

- Middle-east wars will resolve into peace and prosperity.

- The Ebola panic will fade away.

- Confidence in paper currencies and dodgy debt will persist for another decade or two.

- Global peace and harmony are just over the horizon.

- The US gold supposedly at Fort Knox and the NY Fed is still there.

- Derivatives will continue generating revenue for banks with only positive consequences to economies and the 99%.

- Governments will expand the funding for the “something for nothing” programs to buy votes, all without consequences.

- And we will tax and legislate ourselves into wealth and prosperity.

But I doubt it!

I think gold will survive as a store of value far longer than any government, fiat currency, or debt-based paper investment.

GE Christenson aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.