Innovation Sparks Wealth Creation

Companies / Technology Dec 04, 2014 - 10:18 AM GMTBy: Harry_Dent

Most people almost always reject radically new things or ideas at first. Ask Galileo or Jesus. That’s why it takes extreme personalities to take the necessary risks and to persevere against all odds, criticism and rejection.

Most people almost always reject radically new things or ideas at first. Ask Galileo or Jesus. That’s why it takes extreme personalities to take the necessary risks and to persevere against all odds, criticism and rejection.

I should know. I’m such a personality.

I’m an entrepreneur and innovator in the arena of economics. If it hadn’t been that, it would have been some other kind of arena. It’s just in my blood.

I began my career as a high-level business-strategy consultant at Bain and Company, but I ended up developing my greatest breakthrough insights into economics when I started working with entrepreneurial companies in the early 1980s.

Entrepreneurs are the 0.1% to 1% who create all of the major innovations in the economy and among them I felt at home. But I also learned the most from them…

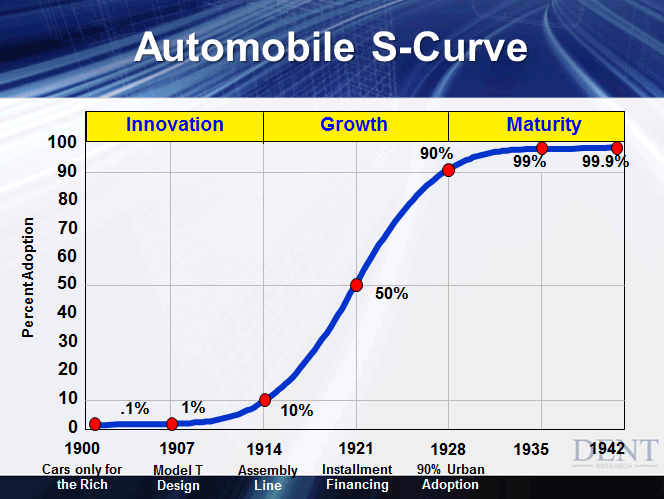

You can see the future by watching what the leading edge innovators are doing today. Everyone else simply follows behind them on an S-curve.

You see, entrepreneurs think differently. They’re like the random mutations that create changes in genetics, only they’re changing humanity… or, at the very least, society.

The thing is, most mutations and entrepreneurs fail! Even the most astute and well-funded venture capitalists only make it big on one out of 11 investments. That first part of the S-curve, from 0.1% to 10% is a minefield filled with the rotting remains of failed innovations.

The innovations that survive to the tipping point, at 10% market penetration, are the killer apps that blaze into the mainstream. When you think of social media and companies like Facebook and Twitter, you can see them moving into the mainstream pretty quickly after the last year or so.

And no biotech is one of the leading-edge sectors among others like robotics, alternative energy and nanotechnology. They’re just starting to move from the fringes of the leading edge into early mainstream applications.

Stiff Competition

Many innovative firms have already failed in these emerging fields. But today new leaders are taking up the charge and are leading into the forefront. Many such firms will have to bring in management and systems to keep up with the 10% to 90% growth phase ahead.

For every great strength entrepreneur’s display, they also have major weaknesses as Peter Drucker, the greatest management guru of our time, points out.

Those who drive the innovation phase (0.1% to 10%) are rarely suited to manage the growth phase that follows soon after. These individuals are the rule breakers, experimenters, perfectionists, all of which interfere with the process of infiltrating the mainstream.

Henry Ford is the perfect example. He played a huge part in the creation of the first middle class in our economy’s history through his innovations with the Model T and the assembly line. But he was also known as a tyrant and dictator.

Those weaknesses allowed Alfred Sloan, the greatest organizational innovator of the 1920s on to trump Ford in the end at General Motors.

Take A Bite Out of the Apple

A more contemporary example is Steve Jobs. From the very beginning, he had a similar vision to Ford, but instead of cars, he saw computers bringing power to everyday people. He was a tyrant and very stubborn, much like Ford.

And as a result, he was eventually kicked out of his own company when Microsoft beat Apple by becoming the standard operating system for all computers outside of Apple.

This is what entrepreneurs do! We’re different. We’re highly creative. We advance precisely by breaking the rules… and accept that the failure rates are astronomical.

It’s thanks to such entrepreneurs that we enjoy an ever-increasing standard of living. And it’s thanks to them that there are always new and exciting investment opportunities that we can take advantage of.

That’s where Adam O’Dell, Rodney Johnson, Ben Benoy and I come in. We strive to find those investments for you. We work to develop systems and tools that maximize your investment gains while minimizing your losses in a time period when traditional investment strategies just don’t work anymore.

Ben Benoy is the latest addition to our strategic investment team. He has found a way to combine the new intelligence from social media, such as Facebook and Twitter, to find the best opportunities in the hottest emerging high-tech arena — biotech. His returns prove that such a combination is powerful.

We will continue to push the leading edge to bring you the best economic research and alternative investment opportunities — ones that can thrive in the “new normal” of increasing volatility and in markets that are pointing down much more so than up.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2014 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.