Where Are Crude Oil Bulls?

Commodities / Crude Oil Dec 11, 2014 - 04:40 AM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

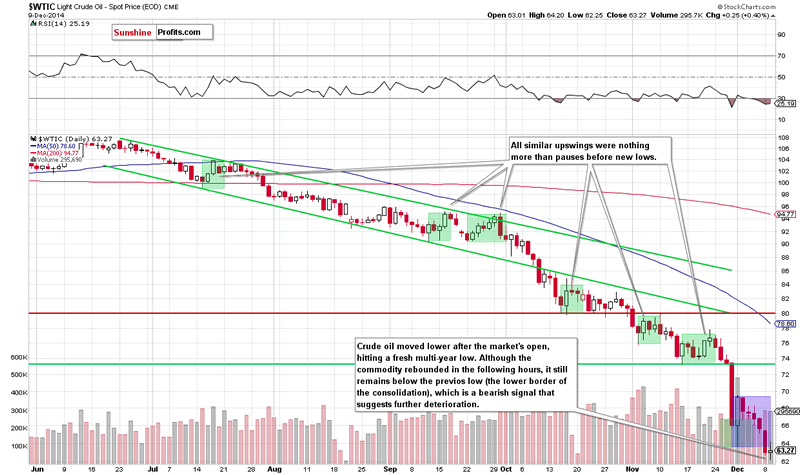

Although crude oil hit a fresh multi-year low after the market's open, the commodity rebounded in the following hours supported by a weaker greenback. In this way, light crude gained 0.40%, but still remains under the previous lows. What's next?

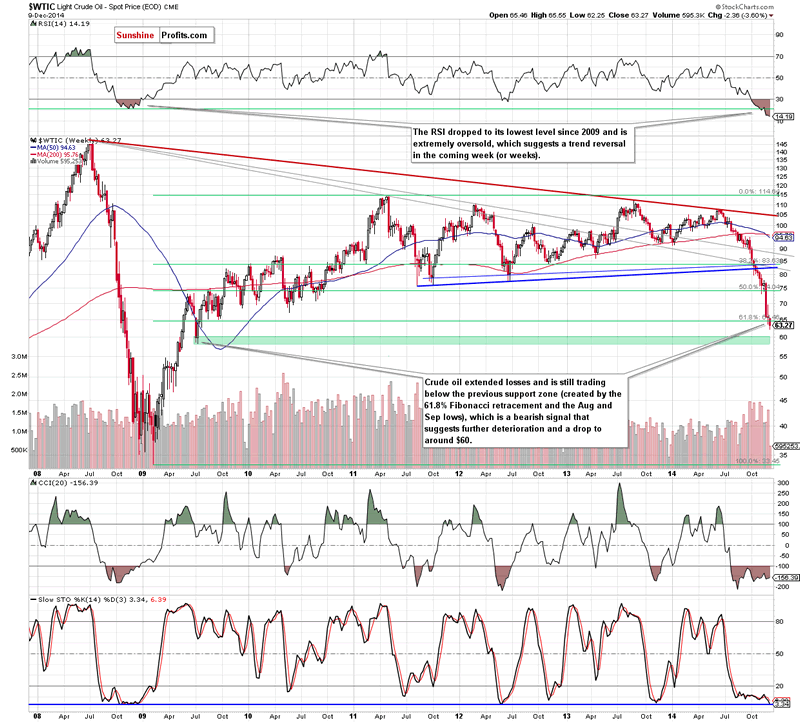

Yesterday, after the market's open crude oil extended losses from the previous session as Monday's Iraq's decision to lower prices for its oil sold to Asia and the U.S continued to weigh. In this way, light crude hit a fresh multi-year low of $62.25. However, in the following hours, the commodity rebounded as the USD Index (which tracks the performance of the U.S. currency against a basket of six major currencies) declined, moving away from Monday's high of $89.56. Did this move change anything? (charts courtesy of http://stockcharts.com).

Quoting our last Oil Trading Alert:

(...) light crude broke below the lower border of the consolidation and hit a fresh multi-year low of $62.78. This is a negative signal that suggests further deterioration.

As you see on the charts, the situation developed in line with the above-mentioned scenario and light crude hit a new 2014 low of $62.25 after the market's open. Although the commodity rebounded in the following hours, yesterday's upswing didn't change anything as crude oil is still trading below the previous low (the lower border of the consolidation). In our opinion, this move could be only a verification of the breakdown, which suggests that the commodity will likely drop to our downside target in the coming days. Taking the above into account, we believe that our last commentary is up-to-date:

(...) What could happen if oil bears win and push the commodity lower? If crude oil extends losses and broke below the (...) support zone, we could see a drop even to around $58.32-$60, where the Jul 2009 lows (in terms of intraday and weekly closing prices) are.

Finishing today's alert, we would like to draw your attention to an important fundamental factor, which could drive the price of crude oil lower. Later in the day, the EIA will release its weekly report on crude oil inventories. It is expected that the report will show a drop in stockpiles by 2.24 million barrels. Meanwhile, yesterday, the American Petroleum Institute showed that stockpiles rose 4.4 million barrels in the week ended Dec. 5. Therefore, if today's government report confirms these numbers, we could see a fresh 2014 low.

Summing up, although crude oil rebounded slightly and moved away from the new low, this upswing didn't change anything in the short term (not to mention the medium term, where this move is barely visible) as the commodity still remains not only below the Dec 1 low, but also under the previously-broken 61.8% Fibonacci retracement. All the above provides us with bearish implication and suggests that we'll likely see another attempt to move lower later in the day (especially if the EIA report disappoints). Nevertheless, we do not recommend opening short positions as the space for further declines seems limited - especially when we factor in the current situation in the USD Index (we wrote more about it on Monday).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.