Crushing The U.S. Oil and Gas Energy Export Dream

Commodities / Crude Oil Jan 22, 2015 - 10:59 AM GMTBy: OilPrice_Com

Exporting crude oil and natural gas from the United States are among the dumbest energy ideas of all time.

Exporting crude oil and natural gas from the United States are among the dumbest energy ideas of all time.

Exporting gas is dumb.

Exporting oil is dumber.

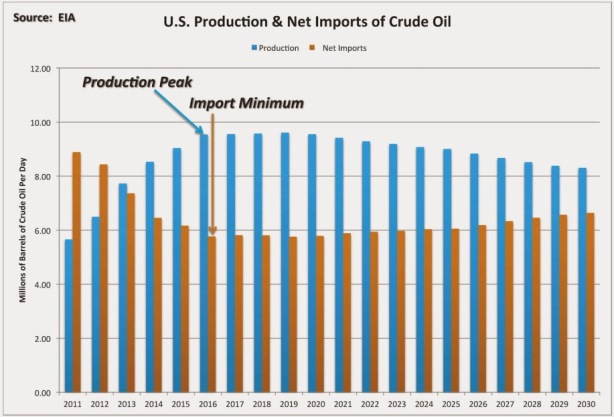

The U.S. imports almost half of the crude oil that we use. We import 7.5 million barrels per day. The chart below shows the EIA prediction that production will slowly fall and imports will rise (AEO 2014) after 2016.

What about the tight oil that is produced from shale? That's included in the chart and is the whole reason that U.S. production has been growing. But there's not enough of it to keep production growing for long.

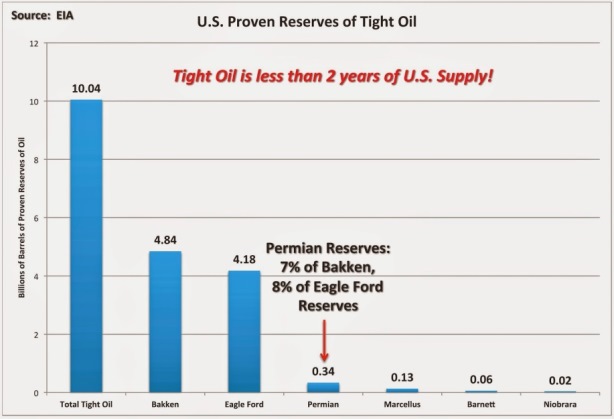

Here is a chart showing the proven tight oil reserves just published last month by the EIA.

Total tight oil reserves are 10 billion barrels (including condensate). The U.S. consumes about 5.5 billion barrels per year, so that's less than 2 years of supply. Almost all of it is from two plays--the Bakken and Eagle Ford shales. We hear a lot of hype from companies and analysts about the Permian basin but its reserves are only 7% of the Bakken and 8% of the Eagle Ford.

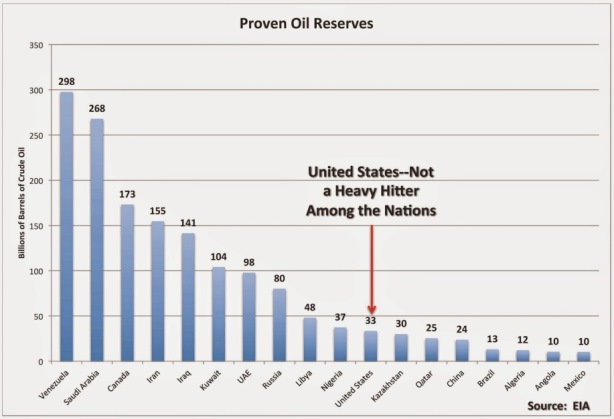

Tight oil comprises about one-third of total U.S. crude oil and condensate reserves. The U.S. is only the 11th largest holder of crude oil reserves (33.4 billion barrels) in the world with only 19% of Canada's reserves and 12% of Saudi Arabia's reserves.

In other words, the U.S. is a fairly minor player among the family of major oil-producing nations. For all the fanfare about the U.S. surpassing Saudi Arabia in production of crude oil, we are not even players in reserves. What that means is that we may temporarily pass Saudi Arabia in production because it chooses to restrict full capacity, and U.S. production will fade decades before Saudi Arabia's production begins to decline.

Let's put all of this together.

• The U.S. will never be oil self-sufficient and will never import less than about 6 million barrels of oil per day.

• U.S. total production will peak in a few years and imports will increase.

• The U.S. is a relatively minor reserve holder in the world.

How does this picture fit with calls for the U.S. to become an exporter of oil? Very badly. For tight oil producers to become the swing producers of the world? Give me a break.

Perhaps we should send congressional proponents of oil export like Joe Barton (R-TX), Ted Cruz (R-TX) and Lisa Murkowski (R-AK) to "The Shark Tank" TV show to try to sell their great idea to the investors and judges.

I'm out.

Source: http://oilprice.com/Energy/Energy-General/Crushing-The-U.S.-Energy-Export-Dream.html

By Arthur E. Berman for Oilprice.com

© 2015 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.