How Global Interest Rates Deceive Markets

Interest-Rates / Global Financial System Jan 26, 2015 - 08:32 PM GMTBy: John_Mauldin

“You keep on using that word. I do not think it means what you think it means.”

“You keep on using that word. I do not think it means what you think it means.”

– Inigo Montoya, The Princess Bride

“In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

“There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

“Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.”

– From an 1850 essay by Frédéric Bastiat, “That Which Is Seen and That Which Is Unseen”

All right class, it’s time for an open book test. I’m going to give you a list of yields on various 10-year bonds, and I want to you to tell me what it means.

United States: 1.80%

Germany: 0.36%

France: 0.54%

Italy: 1.56%

UK: 1.48%

Canada: 1.365%

Australia: 2.63%

Japan: 0.22%

I see that hand up in the back. Yes, the list does appear to tell us what interest rates the market is willing to take in order to hold money in a particular country’s currency for 10 years. It may or may not tell us about the creditworthiness of the country, but it does tell us something about the expectations that investors have about potential returns on other possible investments. The more astute among you will notice that French bonds have dropped from 2.38% exactly one year ago to today’s rather astonishing low of 0.54%. Likewise, Germany has seen its 10-year Bund rates drop from 1.66% to a shockingly low 0.36%. What does it mean that European interest rates simply fell out of bed this week? Has the opportunity set in Europe diminished? Are the French really that much better a credit risk than the United States is? If not, what is that number, 0.54%, telling us? What in the wide, wide world of fixed-income investing is going on?

Quick segue – but hopefully a little fun. One of the pleasures of having children is that you get to watch the classic movie The Princess Bride over and over. (If you haven’t appreciated it, go borrow a few kids for the weekend and watch it.) There is a classic line in the movie that is indelibly imprinted on my mind.

In the middle of the film, a villainous but supposedly genius Sicilian named Vizzini keeps using the word “inconceivable” to describe certain events. A mysterious ship is following the group at sea? “Inconceivable!” The ship’s captain starts climbing the bad guys’ rope up the Cliffs of Insanity and even starts to gain on them? “Inconceivable!” The villain doesn’t fall from said cliff after Vizzini cuts the rope that all of them were climbing? “Inconceivable!” Finally, master swordsman – and my favorite character in the movie – Inigo, famous for this and other awesome catchphrases, comments on Vizzini’s use of this word inconceivable:

“You keep on using that word. I do not think it means what you think it means.”

(You can see all the uses of Vizzini’s use of the word inconceivable and hear Inigo’s classic retort here.)

When it comes to interpreting what current interest rates are telling us about the markets in various countries, I have to say that I do not think they mean what the market seems to think they mean. In fact, buried in that list of bond yields is “false information” – information so distorted and yet so readily misunderstood that it leads to wrong conclusions and decisions – and to bad investments. In today’s letter we are going to look at what interest rates actually mean in the modern-day context of currency wars and interest-rate manipulation by central banks. I think you will come to agree with me that an interest rate may not mean what the market thinks it means.

Let me begin by briefly summarizing what I want to demonstrate in this letter. First, I think Japanese interest rates not only contain no information but also that markets are misreading this non-information as meaningful because they are interpreting the data as if it were normal market information in a familiar market environment, when the truth is that we sailed beyond the boundaries of the known economic world some time ago. The old maps are no longer reliable. Secondly, Europe is making the decision to go down the same path as the Japanese have done; and contrary to the expectations of European central bankers, the potential to end up with the same results as Japan is rather high.

The false information paradox is highlighted by the recent Swiss National Bank decision. Couple that with the surprise decisions by Canada and Denmark to cut rates, the complete retracement of the euro against the yen over the past few weeks, and Bank of Japan Governor Kuroda’s telling the World Economic Forum in Davos that he is prepared to do more (shades of “whatever it takes”) to create inflation, and you have the opening salvos of the next skirmish in the ongoing currency wars I predicted a few years ago in Code Red. All of this means that capital is going to be misallocated and that the current efforts to create jobs and growth and inflation are insufficient. Indeed, I think those efforts might very well produce a net negative effect.

But before we go any farther, a quick note. We will start taking registrations for the 12th annual Strategic Investment Conference next week. There will be an early-bird rate for those of you who go ahead to register quickly. The conference will run from April 29 through May 2 at the Manchester Grand Hyatt in San Diego. For those of you familiar with the conference, there will be the “usual” lineup of brilliant speakers and thought leaders trying to help us understand investing in a world of divergence. For those not familiar, this conference is unlike the vast majority of other investment conferences, in that speakers representing various sponsors do not pay to address the audience. Instead, we bring in only “A-list” speakers from around the world, people you really want to meet and talk with. This year we’re going to have a particularly large and diverse group of presenters, and we structure the conference so that attendees can mingle with the speakers and with each other.

I am often told by attendees that this is the best economic and investment conference they attend in any given year. I think it is a measure of the quality of the conference that many of the speakers seek us out. Not only do they want to speak, they want to attend the conference to hear and interact with the other speakers and conference guests. This conference is full of speakers that other speakers (especially including myself) want to hear. And you will, too. Save the date and look for registration and other information shortly in your mail.

Now let’s consider what today’s interest rates do and do not mean as we navigate uncharted waters.

Japan is an interesting case study. It’s a highly developed nation with a very sophisticated culture, increasingly productive in dollar terms (although in yen terms nominal GDP has not moved all that much), and carrying an unbelievable 250% debt-to-GDP burden, but with a 10-year bond rate of 0.22%, which in theory could eventually mean that the total interest expenses of Japan would be less than those of the US on 5-6 times the amount of debt. Japan has an aging population and a savings rate that has plunged in recent years. The country has been saddled with either low inflation or deflation for most of the past 25 years. At the same time, it is an export power, with some of the world’s most competitive companies in automobiles, electronics, robotics, automation, machine tools, etc. The Japanese have a large national balance sheet from decades of running trade surpluses. If nothing else, they have given the world sushi, for which I will always hold them in high regard.

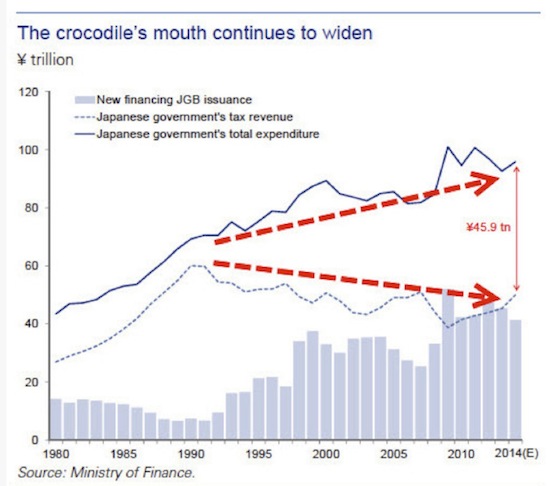

We talk about Japan’s “lost decades” during which growth has been muted at best. They are just coming out of a triple-dip recession after a disastrous downturn during the Great Recession. And through it all, for decades, there is been a widening government deficit. The chart below shows the yawning gap between Japanese government expenditures and revenues.

This next chart, from a Societe Generale report, seems to show that the Japanese are financing 40% of their budget. I say “seems” because there is a quirk in the way the Japanese do their fiscal accounting. Pay attention, class. This is important to understand. If you do not grasp this, you will not understand Japanese budgets and how they deal with their debt.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.