What Does The Strong U.S. Dollar Mean For The Economy?

Economics / US Economy Apr 30, 2015 - 12:40 PM GMTBy: Arkadiusz_Sieron

The Fed no longer keeps promises of being "patient". The March's FOMC statement was, however, interpreted as dovish, which caused the plunge in the U.S. dollar. Nevertheless, the renewed expectations of the interest rate hike (caused by some Fed officials' hawkish statements or stronger economic data in the second quarter due to low base in the first quarter) may cause the U.S. dollar to rally further, which could harm the emerging markets and unwind the carry trade. It is then high time we explain the consequences of the possible next bull in the greenback for the global economy.

The Fed no longer keeps promises of being "patient". The March's FOMC statement was, however, interpreted as dovish, which caused the plunge in the U.S. dollar. Nevertheless, the renewed expectations of the interest rate hike (caused by some Fed officials' hawkish statements or stronger economic data in the second quarter due to low base in the first quarter) may cause the U.S. dollar to rally further, which could harm the emerging markets and unwind the carry trade. It is then high time we explain the consequences of the possible next bull in the greenback for the global economy.

Let's begin from the impact on the U.S. economy - it seems there is lot of confusion concerning what a strong dollar means for America. First, the rise in the U.S. dollar index is definitely positive for the American consumers (and companies importing raw materials and intermediate goods), because it allows them to buy foreign goods and services (like travelling) cheaper, hence increasing their real purchasing power. It also helps to put downward price pressure on prices of commodities, as they are denominated in the U.S. dollar. The U.S. being a big net importer of goods and services, the strong dollar should be really welcomed.

Second, it may, but not has to, be detrimental for exporters or multinational concerns which derive some of their revenue in other currencies than U.S. dollar (and for the companies competing with imports). It depends whether there is gradual appreciation or abrupt change in exchange rates due to sudden capital inflows. The former phenomenon usually reflects the strength of the economy, the stable inflation environment and rising productivity, so it is clearly positive, while the latter may be quite harmful, because it surprises companies who failed to hedge themselves.

The natural question arises: what kind of changes we were witnessing in March? Some analysts believe that the stronger greenback meant economic recovery. Undoubtedly, the U.S. economy is in a much better shape than it was a few years ago (and than other developed markets), however the pace of March's rally in the U.S. dollar suggests that the greenback gained not due to rising productivity and greater competitiveness, but rather because of the unprecedented divergence in the global monetary policies and following capital flows.

This is why the stronger U.S. dollar has already hurt American exporters and could dampen their investment plans next year, according to the Duke University/CFO Magazine Global Business Outlook Survey. Also the new export order sub-index of the ISM manufacturing survey has been in contraction territory for the past two months, which clearly indicates that sharp changes in the exchange rate this year lowered the price competitiveness of the American companies.

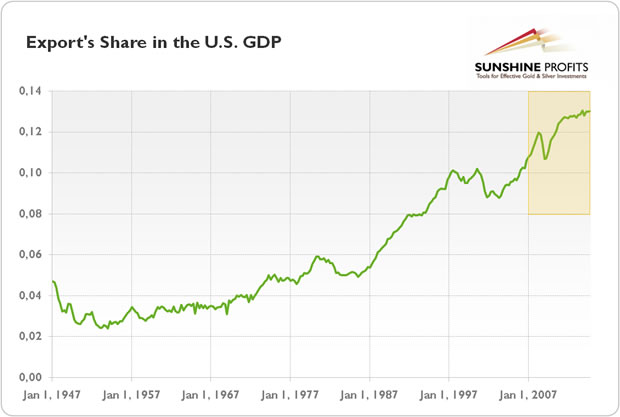

However, the U.S. is a closed economy, mostly driven by domestic factors. Exports amount to less than 15 percent (see the chart below). It means that although a rising dollar may negatively affect the exporters, the net effect for the economy will be positive.

Graph 1: Export's share in the U.S. GDP (in real terms) from January 1947 to October 2014.

What about the impact of a rising U.S. dollar on the stock market? Theoretically, the stock market should reflect the real economy. However the U.S. stock indices include more companies with revenues coming from foreign markets as a percentage than the aggregate economy. Foreign sales account for 30-40 percent of total S&P 500 sales, with more than half of the companies in the index receiving more than 15 percent of their revenues abroad. On the other hand, a similarly big percentage of listed companies' expenses (raw materials, intermediate goods, labor costs) come from abroad. This is probably why since the late 1970s the stock market has performed twice as well during dollar bull markets than during dollar bear markets. The reason is simple: the strong economy supports both: the currency and equities.

However, it does not mean that the stock market is going to rise in tandem with the greenback. Why? First, sharp exchange-rate movements can be negative in the short run. Second, according to many indicators, the U.S. stock market is now in the bubble territory, so it may burst in the medium term. Third, the rising U.S. dollar may not reflect the strong economy, but only the divergence in monetary policies. Therefore, over the tightening cycle and interest rate hikes, the U.S. stock market may be falling with a gaining greenback.

With regards to the impact of the rising U.S. dollar on other countries, it may be positive for the Europe and Japan in the short run, since weaker euro and yen may boost their exports (it seems that the depreciation of euro and yen is responsible for the current 'economic growth momentum' in the Eurozone and Japan). However, the impact on the emerging markets, as we have already pointed out, may be much worse, due to large indebtedness in the U.S. dollar, in which over half of all the global cross-border deposits and lending are transacted. We hope that you remember how the "taper tantrum" hit the emerging markets.

As we have already explained, the possible next U.S. dollar bull market may be negative for gold prices. However, the unwinding of the emerging market carry trade may trigger some global havoc, which could spur demand for the yellow metal. Moreover, the real interest rates are still relatively low, which may be a shield against the headwind from the rising greenback. And the Eurozone, despite its structural problems, is now showing some small signs of recovery, which may put some upward pressure on the EUR/USD exchange rate, which would be supportive for gold prices.

To sum up, the Fed removed the promise to be patient in March and probably will finally hike its interest rates this year (markets believe that in September or October, if the data will be supportive enough, of course). According to the FOMC's Summary of Economic Projections, the pace of hikes will be slower than Fed's officials have anticipated so far. Although it may weaken the greenback in the short run, the divergences in the global monetary policies and economic performances can lay the foundation of the next U.S. dollar bull market (with caveat that the possible U.S. economic slowdown or recession could change the currency outlook). The strengthening greenback would be a headwind for the gold prices; however in terms of other currencies (except maybe the British pound) the yellow metal should gain. The historically real low interest rates and global risks (unwinding of the emerging markets carry trade, global economic slowdown and bursting of another bubble, Ukraine conflict, further negotiations between Greece and its creditors) may support gold prices.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.