Bitcoin Price Stands Still but Will It for Long?

Currencies / Bitcoin Jun 12, 2015 - 03:51 PM GMTBy: Mike_McAra

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

In an article on International Business Times, a former MasterCard employee turned Bitcoin company manager offers some comments on how credit card companies respond to the Bitcoin technology. We read:

In an interview with IBTimes UK, Roelants [Marcel Roelants, general manager in Europe for BitPay, who also worked for MasterCard for five years] made reference to Visa's V.me digital wallet and its opposite number at MasterCard, MasterPass: "They come with solutions that are inside out technology driven. I heard from a lot of merchants integrating features of V.me and MasterPass is a nightmare.

(…)

"That to me is a perfect example of where these large corporations are missing the connection with the market. They don't listen to customers, they don't listen to merchants, and then it takes them five years to develop something. All the time this technology is moving faster and faster. We are ramping up faster with bitcoin payments than PayPal did in its early days, for example. (…)”

(…)

"Are these guys looking into it? Definitely. But are they moving fast enough, or are they stuck in the mind set of – 'we make enough money doing what we are doing' and so stay with the core business and not going to change – this could become their worst enemy. The same could happen to Visa. They have got their eyes closed."

The question whether MasterCard and Visa are reacting too remains open. Right now, it seems that credit card companies are, in fact, reacting slowly. Bitcoin startups are far more involved in the Bitcoin system, even Nasdaq and IBM might be doing more progress than MasterCard and Visa. Of course, this can’t be said with certainty since the credit card companies might be working on Bitcoin behind closed doors not making any public announcements. On the other hand, the lack of news might simply mean that not much is happening.

Even if credit card companies are lagging behind, it doesn’t mean that they will go extinct. Both MasterCard and Visa are large multinationals with much capital and a significant customer base. Simply put, even if they do absolutely nothing to catch up on Bitcoin and ledger technologies, they still will most likely prevail for years. If Bitcoin or Bitcoin-based systems gain widespread attention, MasterCard and Visa will still have opportunities to get up to speed. They could always acquire Bitcoin companies to get the needed know-how. So, the fate of credit card companies is far from being sealed. We still have years before we know what kind of impact Bitcoin will have on this industry.

For now, let’s focus on the charts.

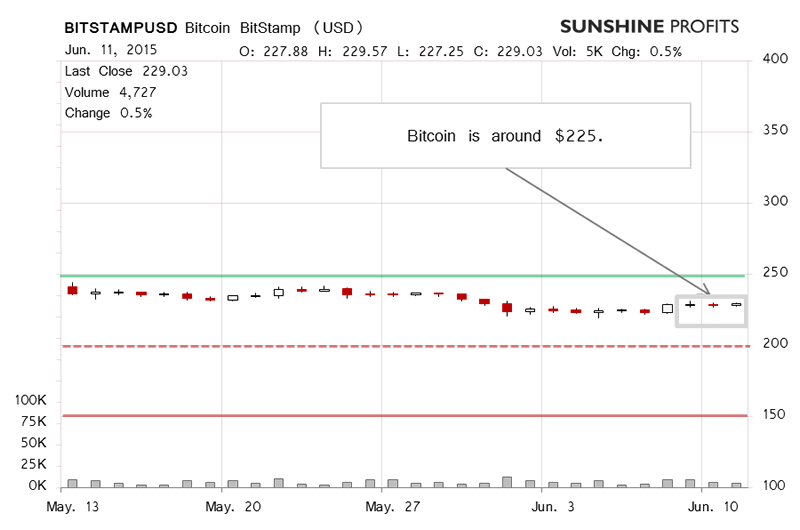

On BitStamp, yesterday was yet another day of not much action. Bitcoin went up slightly but the volume was lower than on the day before and relatively low altogether. Recall our comments from yesterday:

Currently (…), Bitcoin has gone up but not strongly so and the volume has been, again, relatively weak, possibly weaker than yesterday (the day is still not over, mind). In such an environment, the short-term outlook has just gotten even more bearish than it was yesterday. While it is not sure, nothing in the market is, we might see a move in line with the medium-term trend, which has been down.

Today, we’ve seen similar action. Bitcoin has gone up again (this is written around 10:30 a.m.) but not strongly and the volume has been relatively weak. It seems that today is pretty similar to yesterday (at least so far) and the implications remain unchanged – they are bearish, in our opinion.

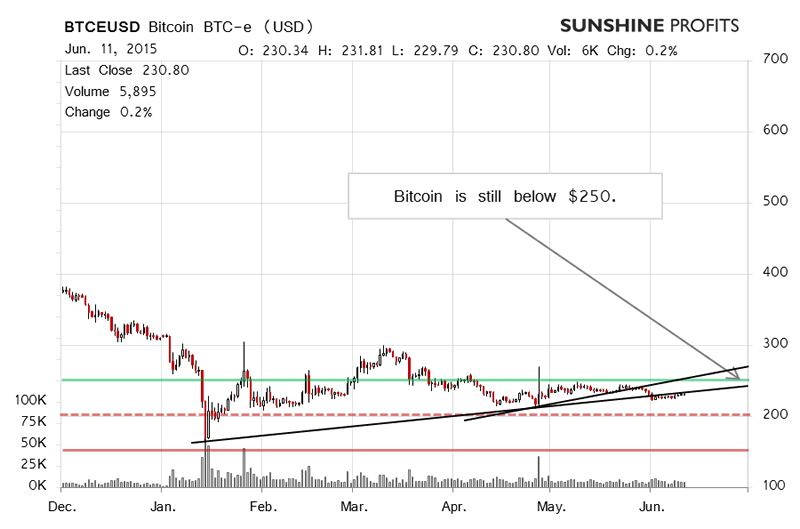

On the long-term BTC-e chart there are basically no changes. Let’s quote our comments from yesterday:

The situation is still very tense as any move here could result in more action. The fact that Bitcoin might have been losing momentum and it hasn’t moved up more significantly might suggest that the currency is now consolidating before yet another move to the downside. This is not sure, as no market moves quite in the way anybody wants them to, but the current environment suggests that depreciation might be the next big move.

We haven’t really seen a move up above the possible rising trend line, at which Bitcoin seems to have stopped. This might be only temporary. If Bitcoin doesn’t move to the upside in a visible way, we might see yet another move to the downside. This seems like a bearish environment, which might become even more bearish in the days to come, in our opinion.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.