Bitcoin Situation Getting Tenser

Currencies / Bitcoin Jun 26, 2015 - 02:36 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Bitcoin is getting more and more attention from the banks and exchanges but it still remains relatively unknown to consumers, we read on CoinDesk:

A new survey published by Goldman Sachs has found that just over half of US millennials believe they will never use bitcoin.

Fifty-one percent of the 752 survey respondents said that they had never used bitcoin nor do they have any plans to do so. Twenty-two percent said they currently use it or have used it in the past, and intend to use it again.

An additional 22% said that they have never used bitcoin before but plan on using the digital currency. Just 5% of respondents said they have used bitcoin but do not intend to use it again.

The data forms part of a broader look at the financial inclinations of millennials, including how the demographic chooses financial services and how they manage money.

Among a group of payment options that included credit cards, Apple Pay and Square, bitcoin wallets scored relatively low in terms of trust. Less than 5% of respondents indicated they trust using wallet services, with Coinbase and BitPay being named directly in the survey data.

This shows that there’s still a lot to be done to make Bitcoin a more viable payment option. The survey shows that more people than not don’t really know Bitcoin or feel the need to use the cryptocurrency. Bitcoin might be becoming more popular in the sense that more people are using it and more companies are looking into the Bitcoin technology but this is still a far cry from the kind of popularity credit cards enjoy.

Of course, there might also be another angle to this sort of data. Bitcoin might create a need for cryptocurrency payments. Think “smartphones.” Did cell phone users complain about the lack of smartphones or did they even know about smartphones? For the most part, they didn’t. Yet now we can hardly imagine cell networks without smartphones. Similar outcomes might happen with Bitcoin – the advantages of cryptocurrencies might help customers turn to them. This is far from certain, but there is a possibility, particularly given the fact that Bitcoin is already interesting for a bunch of relatively large companies.

For now, we focus on the charts.

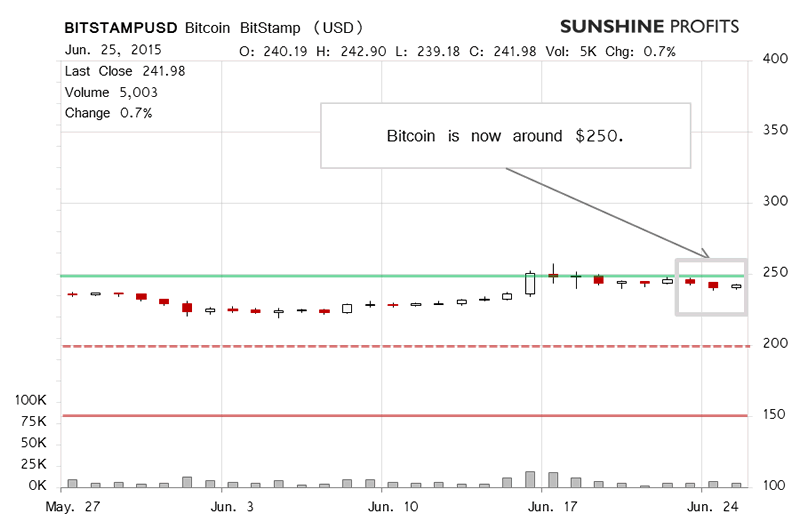

On BitStamp, we saw a day of slight appreciation yesterday. The action was not strong and the volume was lower than on the day before yesterday. Bitcoin was still below $250 (green line in the chart). We wrote:

Today, we’ve seen appreciation but one of a very weak nature, at least so far (…). We haven’t seen a move to $225 or even to $230 and the volume has not been very significant. The situation remains largely unchanged from yesterday.

If we look at the action today, we see that there’s been a move down (this is written just after 10:00 a.m. ET). The action hasn’t been strong so far, actually it is similar to what we wrote yesterday in terms of the strength of the move. This means that there hasn’t really been a confirmation of a move down. The situation is still unclear, with a bearish tilt but not clear enough to suggest hypothetical short positions.

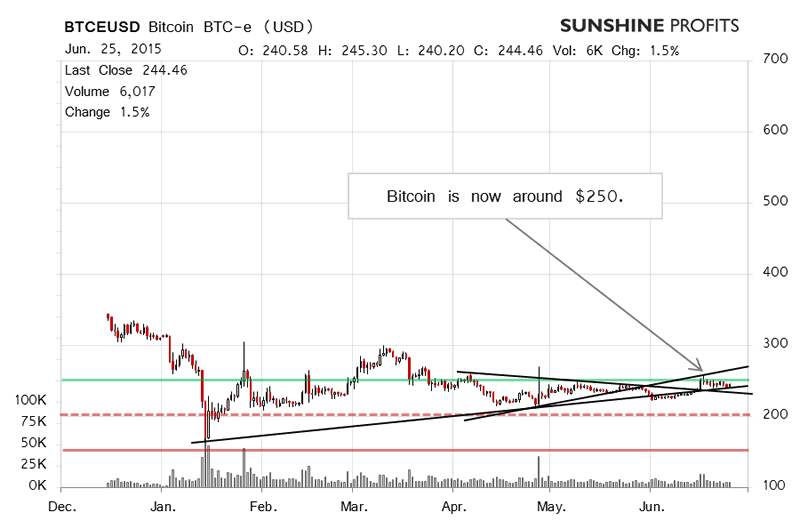

On the long-term BTC-e chart, we see that Bitcoin is now very close to a possible rising trend line and not far from a declining one. This means that the situation is not at all boring. The action yesterday was without a resolution. In our previous alert, we wrote:

The situation became more bearish yesterday at the close but Bitcoin has been moving up today. The currency remains in a tense territory. Declines in the following days could trigger a more pronounced downswing but currently Bitcoin is still above two possible trend lines making the possibility of a further upswing too significant to simply ignore. As such, waiting for a confirmation seems to be the best approach.

This is still the case today. If anything, the situation is tenser than it was yesterday but we haven’t really seen any kind of a signal just now. The wait-and-see approach, albeit not the most exciting way to go, seems the right mode as far as the short-term outlook is concerned.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.