The Myth of Gold Price Manipulation

Commodities / Gold and Silver 2015 Aug 07, 2015 - 02:26 PM GMTBy: Clif_Droke

How eager are gold bugs to believe their ill fortune over the last four years is the result of sinister forces rather than a lack of prudence on their own part? The answer is easily seen in the writings of gold commentators over the last few months. References to organized manipulation and an official conspiracy to suppress the gold price abound among many analysts and their followers.

How eager are gold bugs to believe their ill fortune over the last four years is the result of sinister forces rather than a lack of prudence on their own part? The answer is easily seen in the writings of gold commentators over the last few months. References to organized manipulation and an official conspiracy to suppress the gold price abound among many analysts and their followers.

The collective passion behind this belief has reached a fever pitch and has created something akin to mass hysteria within the gold investing community. To even question this ingrained belief is to elicit the scorn of the conspiracy crowd. So ingrained is their belief that gold’s losses in the last four years are the result of manipulation that they refuse to pay heed to the underlying fundamental and technical reasons for the metal’s 4-year bear market.

This should come as no surprise, however. As Niccolo Machiavelli wrote, “Men in general live as much by appearances as by realities: indeed, they are often moved more by things as they appear than by things as they really are.” This explains the eagerness of many gold investors to believe that the metal’s value has diminished due to the acts of organized manipulators instead of owing to the natural market forces of supply and demand.

Indeed, the main reason why so many gold bugs incessantly chant the mantra that “gold is manipulated” is because most of them stubbornly refused to sell at the 2011 top. That the bull market for gold ended in September that year was made abundantly clear by the actions of the CME Group, which raised margin requirements for precious metals several times that year. This, in no uncertain terms, established that the regulatory and liquidity framework were no longer friendly for metals, thus speculators no longer had an incentive to load up on it.

Upon realizing that the 10-year upward trend in gold prices had broken in 2011, long-term investors still had plenty of time to sell at least some of their gold holdings in order to book healthy profits. The worst ravages of the 4-year bear market in gold which began in September 2011 occurred in 2013. That gave investors more than a year in which to distribute their holdings so as to minimize the impact of the decline that followed. Yet true to form, the years since 2011 have proven to be a “slope of hope” for the many investors who refused to sell.

In its original conception, the term “manipulation” was simply a term used to describe high pressure salesmanship in the marketing of securities. The process by which investment assets are either accumulated or distributed fell under the rubric of manipulation, since without wide public participation a bull market cannot occur. The professionals who undertake to either purchase or sell assets must, at times, play against the public, hence the impact of professional “manipulation” in the broadest sense. This is not the same thing, though, as the willful engineering of a sustained market decline for the express purpose of keeping an asset’s price permanently depressed (as many gold bugs allege).

In 1933, John Durand and A.T. Miller wrote the following on the subject of manipulation: “In the broadest sense of the word, manipulation, in the form of purposeful effort to control prices, is seldom absent from the market. Practically every [market] has at least one professional guardian who watches to see that it does not fluctuate too erratically, and protects it against violent onslaughts.” The authors concluded that manipulation “need have no terrors for the intelligent speculator who will take the trouble to learn its ways: he should in fact profit by its leadership.”

As far back as the early 1900s, traders who knew how to “read the tape” could easily spot the operations of would-be manipulators. Consider the words of Richard Wyckoff in his 1910 book, “Studies in Tape Reading.” He wrote: “The element of manipulation need not discourage any one. Manipulators are giant traders, wearing seven-leagued boots. The trained ear can detect the steady ‘clump, clump’ as they progress, and the footprints are recognized in the [tape].”

If Wyckoff’s words be true, why then do so many complain of manipulation when they should be able to counteract its negative influence with prudent market analysis? Perhaps because of a lack of technical trading skill, the influence of manipulators is grossly exaggerated.

Gold’s 4-year slide can be explained in terms that even novice investors instinctively understand: whenever an asset is the subject of a speculative bubble and its price is driven to unsustainably high levels, the bubble must inevitably burst. Or as they say in commodity parlance, “High prices cure high prices.” That is, when a commodity’s price is driven to extremes, the demand for the commodity diminishes. A decline then sets in which returns prices to more reasonable levels. When the bear market pushes prices to unreasonably low levels, investors who recognize the undervaluation step in and begin accumulating it until eventually a new bull market commences and the cycle repeats. This is the fundamental law which governs all tradable assets; gold is no exception.

The question I posed in my original commentary on gold manipulation remains unanswered: why invest in gold at all if one truly believes the market for it is manipulated? If one truly believes that gold is controlled by manipulators who want to depress its price, then owning it must surely rank as the ultimate fool’s errand. Or could it be that there’s another reason for gold bugs’ stubborn refusal to sell?

The drawing below by the political cartoonist Darkow is worth a thousand words. This was during the investing public’s hue and cry over High Frequency Trading (HFT) on Wall Street and the supposedly “rigged” nature of the stock market in consequence of it. Of course the real reason for the outcry over HFTs is because the public needed a scapegoat to blame their lack of participation in the stock market rally of 2009-2012. But like every other specter, HFTs gradually disappeared from the public’s consciousness and was replaced by another fear, namely manipulation.

As an 18-year veteran of the gold market, I fully understand the mindset of most gold bugs. They believe that gold prices should proceed higher in a non-stop linear fashion until it reaches what they consider to be “fair value,” that is, somewhere between $10,000 and $20,000 an ounce (if not higher). A gold price anywhere south of $10,000 is considered by this crowd to be an outrage and the obvious work of evil conspirators. Any decline in gold prices is most emphatically the result of dark and sinister forces bent on establishing a New World Order.

This leads us to our next question, viz. what is the driving force behind the conspiratorial mindset? What exactly motivates the conspiracy theorist into believing that his world is shaped by powerful manipulative forces? The answer is that there is a certain measure of emotional comfort in the belief that big market declines are completely outside one’s control. Hence there is no need for actively evaluating one’s investment decisions. That the 4-year bear market in precious metals can be explained by a far-reaching conspiracy to depress gold prices provides a cathartic effect to many investors. It soothes the sting of the losses these investors have suffered since 2011 as they’ve watched the value of their gold holdings continuously plummet.

The belief in a conspiracy to suppress gold prices originates from the accrued losses that many buy-and-hold investors suffer whenever gold enters an extended bear market. In just the last couple of years we’ve seen the gold market conspiracy theory belief grow into a rather profitable cottage industry for some. Indeed, certain commentators have made a lucrative living from books, newsletter and websites devoted to explaining gold manipulation. There’s even an organization dedicated to uncovering and stopping the participants alleged to be involved in it.

The words of Robert Edwards & John Magee are worth quoting: “The market is big, too big for any person, corporation or combine to control as a speculative unit. Its operation is extremely free, and extremely democratic in the sense that it represents the integration of the hopes and fears of many kinds of buyers and sellers. Not all are short-term traders. There are investors, industrialists, employees of corporations, those who buy to keep, those who buy to sell years later – all grades and types of buyers and sellers.”

Yet, as previously mentioned, there’s also no denying that some degree of manipulation exists in the everyday operations of gold and other asset markets. With the stakes as high as they are, this is to be expected. An experienced investor recognizes this truth and can generally avoid the ill effects of manipulation. Certainly any investor worth his salt would not be so foolish as to risk his hard-earned capital on an extended period where markets are showing signs of undergoing distribution (i.e. organized selling) or other periods of extreme volatility. If an experienced investor suspects that any of his investments are the subject of organized manipulation he certainly would have enough sense to unload them rather than suffer the vagaries of such a campaign. “Holding and hoping” is the last refuge of the naïve and inexperienced.

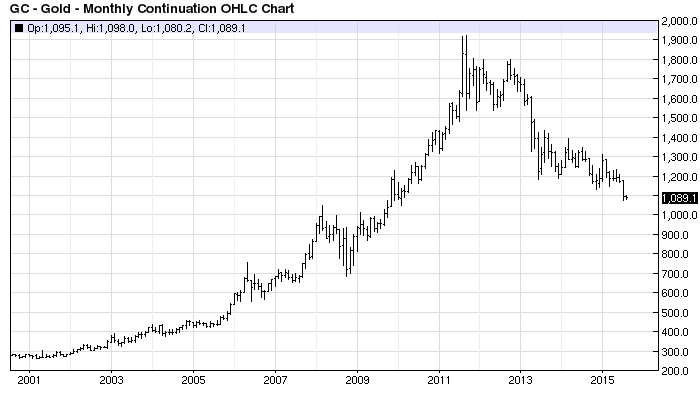

None of this is to say that gold is a poor long-term investment. It’s worth pointing out that gold has outperformed many other commodities and asset categories in the last decade. Even today, after a 4-year bear market, its price per ounce is still well above its previous bear market low of 2001. Moreover, as one of my readers has pointed out, “Gold price has kept pace with inflation and then some since 1970s.” Claims of manipulation notwithstanding, gold has done an admirable job of maintaining value over the last 40 years. When viewed from the perspective of the long-term chart (below), its performance since 2001 is even more impressive. In fact, it’s hard to understand the gold bugs’ cries of “manipulation!” when looking at the following graph.

This is cold comfort for the conspiracy-obsessed gold bugs, though. They won’t be satisfied until gold rockets to $10,000/oz. and the gold standard is reinstated. Until that day arrives they will continue to vilify the invisible hordes of manipulators and conspirators who seek to bring about an Orwellian slavery by eliminating gold ownership and replacing it with “monopoly money.”

There is consolation, however, in the knowledge that this, too, shall pass. In due time the prevailing fears over organized gold market manipulation will be replaced by yet another fear. This is how public opinion proceeds -- from fear to fear and from outrage to outrage. Eventually all discussion of manipulation will be forgotten as this phantasm disappears into the fog of the collective consciousness.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.