Data, Charts, History Show Rising Interest Rates Good For Gold

Commodities / Gold and Silver 2015 Dec 18, 2015 - 12:50 PM GMTBy: GoldCore

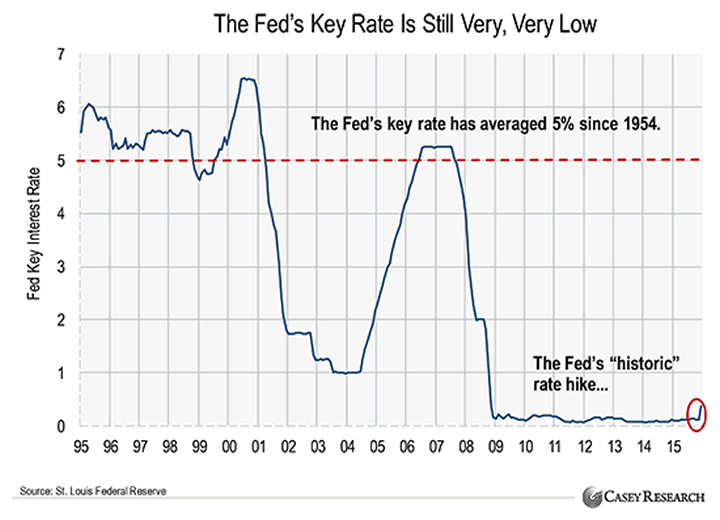

Gold fell to the lowest level in dollar terms since 2009 yesterday after the Fed’s “historic” 25 basis point interest rate rise on Wednesday. The rate hike has been heralded as the “end of cheap money.” This may or may not be the case but what is more important for precious metal buyers is the impact of potential rising rates on gold prices.

Gold fell to the lowest level in dollar terms since 2009 yesterday after the Fed’s “historic” 25 basis point interest rate rise on Wednesday. The rate hike has been heralded as the “end of cheap money.” This may or may not be the case but what is more important for precious metal buyers is the impact of potential rising rates on gold prices.

Most pundits on Wall Street are nearly universal in seeing the rate increase as negative for gold. Especially vocal in this regard has been Goldman Sachs. One headline this week, screamed ‘Gold sags as higher U.S. rates are ‘very negative’ for bullion’. However, the consensus is likely once again wrong and it is important to examine the widely held belief that rising rates are bad for gold, by looking at the data and the historical record.

Source: New York Federal Reserve for Fed Funds Rate, LBMA.org.uk for Gold (PM fix)

Firstly, let’s look at the basis for the simplistic “rising rates will lead to lower gold prices” narrative. It comes about due to the belief that rising rates will lead to higher yields and thus investors allocating more funds to bonds and deposits. As gold is a non yielding asset, this therefore is negative for gold or so the narrative goes.

Goldman Sachs is the leading propagator of the narrative and is unquestioningly quoted in the media as seen in this article from Bloomberg in October:

“The Federal Reserve will probably raise interest rates in December and follow that with a further 100 basis points of increases over 2016, according to Goldman Sachs Group Inc., which said the shift in U.S. monetary policy will hurt gold”

As with all narratives, there is a small degree of truth to it. However, as ever the devil is in the detail. Janet Yellen increased the Fed’s key interest rate by a meager 25 basis points to between 0.25 percent and 0.50 percent. Thus, ultra loose monetary policies will continue for the foreseeable future – an environment that is unquestionably favourable to gold.

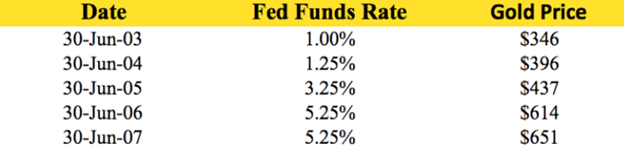

Fed Funds Rate and Gold Price (USD) – 2003 to 2007

Despite the rate rise, depositors are not getting the benefit of the rate rise. Quite the opposite, immediately after the decision, many of America’s leading banks announced that they were increasing their prime lending rates — the rate at which individual banks lend to their most creditworthy customers — to 3.5 percent effective the following day. Already, many American companies are being impacted by the rate rise. The deposit rate, however, which is the interest rate banks pay to its account holders, will remain unchanged.

The average interest rate on a savings account is a tiny 0.5 percent right now, according to Bankrate. Even after the rate hike, interest on deposits will remain near zero and are negative when inflation is taken into account. Thus, savers are losing money keeping their cash on deposit and today they are also at risk of having their savings expropriated due to the real risk of bail-ins in most G20 nations.

Negative real interest rates is positive for non-yielding, but counterparty risk free gold bullion.

Having looked at the basis for the simplistic narrative, lets now look at the data and historical record.

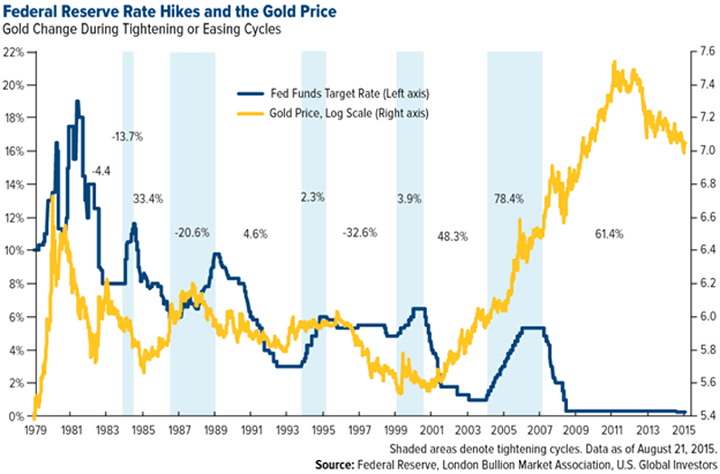

The most recent example we have of rising interest rates is when the Fed increased interest rates from 2003 to 2006. As can be seen in the charts and table above, in June 2003, the Fed funds rate was at 1% and by June 2006, it had been increased to over 5.5%.

At the time, there was a similar narrative that rising interest rates would scupper the gains gold had seen in 2001 and 2002. Instead, the period of rising interest rates saw gold rise from $361/oz in June 2003 to $633/oz in June 2006 – a gain of 75%.

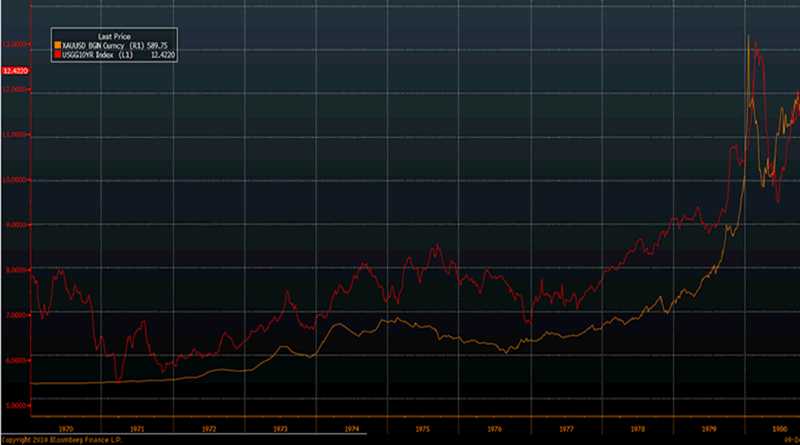

The other data set and a second clear example of a rising interest rate environment and rising gold prices is from the 1970s. The Federal Funds Rate rose from below 4% in 1971 to over 18% in 1980. During the same period, gold rose by 2,400% – from $35/oz to $850/oz.

Gold and US 10 Year – 1970 to 1980 (GoldCore via Bloomberg)

In the short term, increases in interest rates can be negative for gold. But, in the medium to long term rising interest rates are positive for gold as they were in the 1970s and the 2003 to 2006 period. When interest rates return to more normal levels – above 5% – and positive real returns, only then gold will be vulnerable to weakness as savers and investors become enticed by higher yields.

We are a long way from there yet and gold is likely to be correlated with rising interest rates and only fall towards the end of an interest rate hiking cycle. It is important to remember that the 1970s gold bull market only ended with interest rates close to 20%.

Also rising interest rates are not positive for margin and debt-dependent, equities and property and volatility or further falls in these asset classes should lead to renewed safe haven demand for gold.

As long as central banks continue to debase their currencies by trying to inflate their way out of weak economic growth and recessions through zero interest rate policies and massive digital currency creation, gold will be supported and should indeed begin to make new gains.

Today, interest rates remain close to zero not just in the U.S but in most major economies. Thus, there is no opportunity cost to owning the non yielding gold. Indeed there remains significant counterparty and systemic risk in keeping one’s savings in a bank and government bonds look like a bubble that is being supported by money printing and debt monetisation.

Today, after a near 50% correction in recent years, gold again has significant potential for substantial capital gains. This and gold’s important safe haven diversification attributes make gold increasingly attractive for investors internationally.

DAILY PRICES

Today’s LBMA Gold Prices: USD 1065.85, EUR 982.71 and GBP 713.06 per ounce.

Yesterday’s LBMA Gold Prices: USD 1065.75, EUR 975.65 and GBP 710.33 per

Gold Bars At 2% Premium and Free Storage For Six Months On Orders Before December 31st

- 2016 looks set to be stormy – arguably it has never been a better time to buy gold

- Gold bars (1 oz, LBMA) at just 2% on orders placed prior to December 31st

- One of lowest premiums in market today for one ounce bullion coins and bars

- Currently sell gold bars (1 oz) at 3.75% so this is nearly 50% reduction in premium

- Free storage for six months – allocated and segregated storage of your bars in safest vaults in world

* This is a phone offer only

** A minimum order of 5 gold bars applies

*** Gold coins and bars are tax free – no stamp duty, VAT or sales tax

Call Us Today To Secure Your Allocation - IRL +353 (0)1 632 5010

- UK +44 (0)203 086 9200

- US +1 (302) 635 1160

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.