Fourth Industrial Revolution: Robots, Artificial Intelligence Will Destroy 5.1 Million U.S. Jobs by 2020

Economics / Technology Jan 23, 2016 - 05:26 PM GMTBy: Mike_Shedlock

Fourth Industrial Revolution Coming

Fourth Industrial Revolution Coming

A new study on the "Future of Jobs " by the World Economic Forum at Davos claims a Fourth Industrial Revolution is Coming.

The Fourth Industrial Revolution includes developments artificial intelligence, robotics, nanotechnology, 3-D printing, genetics, and biotechnology.

Although no industrial revolution has ever destroyed jobs, the study concludes a net 5.1 million jobs will vanish in the world's 15 leading countries. Those countries account for roughly two-thirds of the global workforce.

The report is a 167 page PDF slog. Here are a couple of tables I created from the report data.

Job Family Losers

| Job Family Losers | Job Losses in Thousands |

| Office and Administrative | 4,759 |

| Manufacturing and Production | 1,609 |

| Construction and Extraction | 497 |

| Arts, Design, Sports, Media | 151 |

| Legal | 109 |

| Installation and Maintenance | 40 |

| Total | 7,165 |

Job Family Gainers

| Job Family Gainers | Gains in Thousands |

| Business and Financial Operations | 492 |

| Management | 416 |

| Computer and Mathematical | 405 |

| Architecture and Engineering | 339 |

| Sales and Related | 303 |

| Education and Training | 66 |

| Total | 2,021 |

I understand the losses, at least part of them. But gains in financial operations?

Everything Rosy but Healthcare

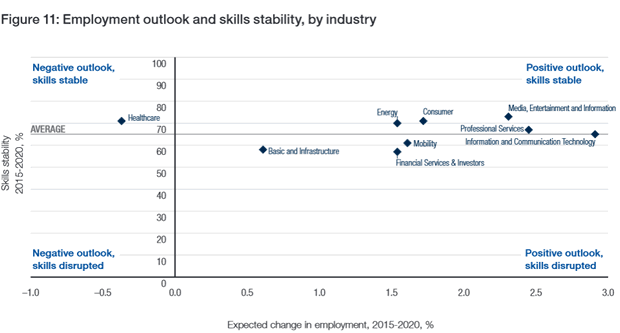

Curiously, the following chart from the report makes everything look rosy except healthcare.

I don't accept that chart, at least for the implied reasons. Yet, after boomers die off en masse, I foresee all kinds of health-related jobs will vanish until the next retirement boom hits.

Trucks and Taxis

What about truck and taxi drivers? I expect millions of truck hauling and taxi jobs will vanish soon, in the USA alone, by 2025.

I searched the report for the word "truck" and found this lone reference: "Advanced robots with enhanced senses, dexterity, and intelligence can be more practical than human labour in manufacturing, as well as in a growing number of service jobs, such as cleaning and maintenance. Moreover, it is now possible to create cars, trucks, aircraft, and boats that are completely or partly autonomous, which could revolutionize transportation, if regulations allow, as early as 2020."

That paragraph was under the category "Advanced Robotics and Autonomous Transport" given a disruptive weighting of 9%.

Let's dig deeper with a look at disruptive weightings.

Technological Drivers of Change

The last column is my set of abbreviated notes, condensed from descriptions in the report. The first three columns are as presented in the report.

Discussion of Disruptive Factors

I fail to see what big advances in computing power will do. Nor do I see crowdsourcing as a big factor.

I suspect crowdsourcing is one of those things with huge potential that never really flies because there is no money in it for anyone.

Remote sensors will eliminate the need for some humans, but hasn't that been underway for quite some time? If not, we can certainly get rid of all the meter maids.

On the energy side, fracking is an environmental disaster, and a bust for now, perhaps for a long time. And much of the clean energy systems only work with government subsidies. Battery technology will likely improve and replace or greatly reduce the need for gasoline. If so that will be very disruptive indeed.

But will batteries destroy jobs or just disrupt them?

Gas stations could become battery switching stations. That may require people to change the batteries, but it will also eliminate gas delivery and gas production jobs. Regardless, this type of change won't be in place by 2020.

I struggled mightily with the report's 34% rating for "Mobile Internet".

It's possible for huge numbers of teaching jobs to vanish with classes over the internet. And applications like Uber will also have an impact. Yet, this category is over-rated.

Biggest Disruptive Force

My number one job destructive force is advanced robotics and autonomous transport. Uber ties into this category as well.

Uber is adding jobs for now. In the not so distant future, long-haul trucking jobs, Uber driving jobs, and all taxi driving jobs will vanish.

Millions of driving jobs of all kinds will vanish in the US alone, by 2025 though, not 2020.

By Mike "Mish" Shedlockhttp://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.