New U.S. Home Sales Unexpectedly Plunge 9.2%, Median House Prices Down 5.7%

Housing-Market / US Housing Feb 25, 2016 - 05:18 AM GMTBy: Mike_Shedlock

New Home Sales Report Dismal Many Ways

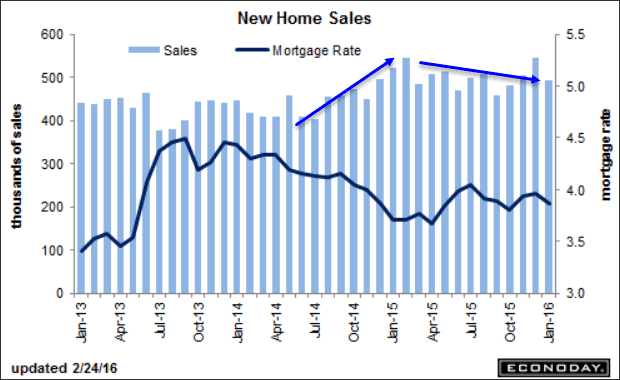

Today's new homes sales report was a disaster. Sales fell 9.2% overall, sales in the west plunged 32%, the median price fell 5.7%, and supply rose to 5.8% from 5.1%.

The Econoday consensus estimate was 520,000 (seasonally adjusted annualized) in a range of 505,000 to 550,000. The report shows 494,000.

Highlights

A downturn out West helped pull new homes sales down a steep 9.2 percent in January to a lower-than-expected annualized rate of 494,000. The level, however, is still respectable given that there is no revision to December which stands at a very solid 544,000. Sales in the West, which is a key region for the new home market, fell 32 percent in the month which pulls down the region's year-on-year rate to minus 24 percent. The South and Midwest show only marginal year-on-year contraction with the Northeast, the smallest new home region however, up sharply.

Price discounting seems to be at play as it was in yesterday's existing home sales report. The median price fell 5.7 percent in the month to $278,800 for a year-on-year decline of 4.5 percent. Sales had been ahead of prices before this report but not anymore, with a nearly double-digit year-on-year pace now falling into contraction at minus 5.2 percent.

Supply has been very slow to enter the market, the result largely of constraints in the construction sector. But more new homes did enter the market in the month, up 2.1 percent to 238,000 and supply relative to sales, given the slowdown in sales, is up sharply, to 5.8 months vs 5.1 months.

The slope for the housing sector has been volatile but is trending upward. Price discounts will help boost sales but will also pull down home-price appreciation which has been a central area of strength for household wealth.

Recent History

Samples are small and monthly data swing wildly but new home sales did surge going into year-end. The gains, however, were likely driven by discounting as the median price fell to a year-on-year minus 4.3 percent in December. Econoday forecasters are calling for slowing in January, to a 520,000 annualized rate vs December's outsized 544,000 that was, in the latest example of volatility, more than 40,000 over consensus.

Discounts

Once again, homebuilders had to reduce prices to sell homes. The existing home sales report from yesterday also shows discounting. The median price of existing homes fell 4.2%.

Are we scraping the bottom of the barrel in buyers?

Bloomberg says "The slope for the housing sector has been volatile but is trending upward." Let's do a reality check of that statement using Bloomberg's own chart.

Given the volatility it's hard to know precisely how to draw the trends. Regardless, the trend is definitely not upward sloping. At best, it's flat.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.