“Somebody” Stepped In to Prop Up Stocks Friday

Stock-Markets / Stock Markets 2016 Feb 28, 2016 - 05:14 PM GMTBy: Graham_Summers

At this point the manipulations are getting ridiculous.

At this point the manipulations are getting ridiculous.

“Someone” decided to step in a prop up stocks yesterday. How do we know it was a market prop and not real investors?

There were several “tells.”

They were:

- The jump in stocks was based on a sudden move in one of the key asset classes the PPT are using to prop up the markets (they are: Oil, the VIX and Yen).

- The price action was sudden and vertical: neither are the hallmarks of actual buyers.

- The trading session differed dramatically from recent other sessions.

Regarding #1, as everyone knows, the majority of market action today is controlled by trading algorithms.

These trading algorithms operate based on correlations between asset classes. Currently two of the biggest correlations are Oil (a direct correlation, meaning when Oil rallies, algorithms buy stocks) and the VIX (an inverse correlation meaning when the VIX falls, algorithms buy stocks).

Yesterday, Oil staged a MASSIVE 5% intraday price move on the fact inventories rose less than expected. Yes, a 5% price move based on a single secondary data point (inventories are near record highs).

This was a clear manipulation as evinced by the fact that Oil slid for the rest of the day following the price move. Real buyers buying Oil based on perceived value would have maintained the price. Instead we had a vertical move followed by pronounced weakness.

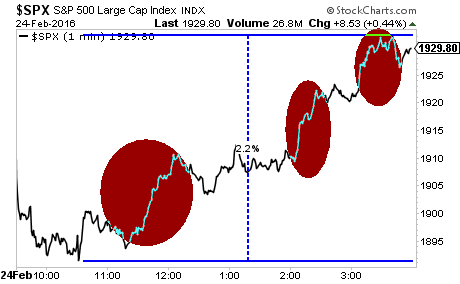

This spike in Oil was what triggered the first “stock buying panic” from trading algorithms. In a matter of minutes around 11:15 AM, stocks exploded higher by almost 1% based on nothing other than the move in Oil.

This wasn’t the end of the manipulation either. There were two other instances in which stocks went vertical on NO NEWS.

How do we know these were interventions and not the products of real buyers?

Real buyers do not suddenly buy billions of dollars worth of futures contracts based on spurious news releases. Real investors use professional traders or algorithms to open positions in a careful manner so as not to boost prices.

After all, if the asset you are trying to buy on the cheap explodes higher the value is gone.

Compare that to yesterday’s price action where stocks staged an intraday rally of 2% with the bulk of the action coming in three near vertical ramp jobs, the first of which was triggered by an obvious intervention in Oil.

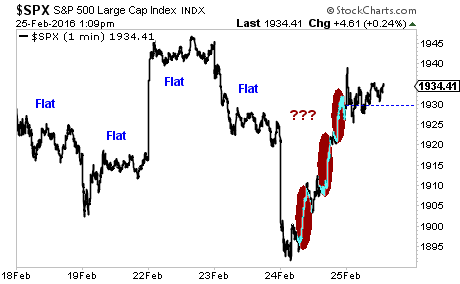

The financial media will claim the above analysis is conspiracy theory and that yesterday was the result of real buyers. This is bunk. Consider stocks’ price actions over the previous four trading sessions. Every day stocks opened up or down and then basically flat-lined for the rest of the session.

Yesterday’s session stands out like a sore thumb.

In short… yesterday stocks exploded higher, staging an intraday rally of 2% on no news other than a secondary data point in the Oil market. Either someone panic-bought at three separate instances buying billions of Dollars worth of futures contracts or this was an intervention.

Based on the above, I’m going with the latter.

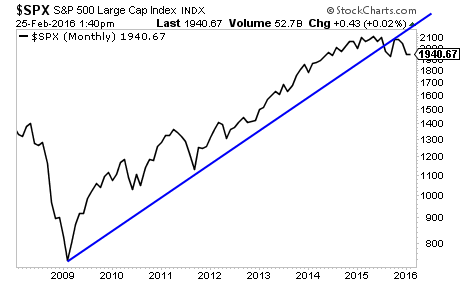

The intervention may have bought some time but the trend is now down. Stocks have taken out their bull market trendline going back to 2009. The bull market is over.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.