US Dollar Crashes, Gold And Bitcoin Skyrocket As Economic Recovery Lie Is Exposed

Currencies / US Dollar Jun 03, 2016 - 06:43 PM GMTBy: Jeff_Berwick

It’s going to be a long weekend for those holding stocks and believing in the “recovery” lie.

It’s going to be a long weekend for those holding stocks and believing in the “recovery” lie.

Today, the US government released its jobs report and the market was expecting an additional 200,000 jobs were added in May. Instead, the number came in at a paltry 38,000.

One analyst, Naseem Aslam of Think Forex UK said, “The U.S. nonfarm payroll data was crazy and completely unbelievable and this is the last set of important data before the Fed meeting. When you look at the data set, it really boggles your mind because the unemployment rate has ticked lower. The productivity picture is even more confusing as it is not increasing.”

It can seem confusing IF you fell for the “recovery” story that the Federal Reserve, Barack “Peddling Fiction” Obama and the mainstream media have been peddling.

It’s not confusing to us. There was no recovery. And there won’t be. The only slight point of confusion is why the US government allowed these numbers to be released. They have free reign over making up nearly any number they can dream up. They’ve been doing that for decades.

As we’ve stated in the past, if you want to get a better gauge of real employment, this stat is the one to watch:

Unlike the employment number, the government and the Federal Reserve haven’t figured out how to manipulate this number yet. As can be seen, by this statistic, the US has been in a depression since the start of the millennium.

So, why did the government allow such bad job numbers to come out at this time? My guess is that the Federal Reserve needed a reason to not raise rates as they know that even another 0.25% rate hike could implode the worldwide economy and potentially set off a crisis that would be unimaginable in scale. And, we believe the big crisis is planned to begin this fall, or perhaps somewhat earlier, maybe in August like last year.

And so, they allowed the bad jobs report to come out and now the Federal Reserve can use it as a reason for not raising rates, yet again.

The market immediately saw through it all, though.

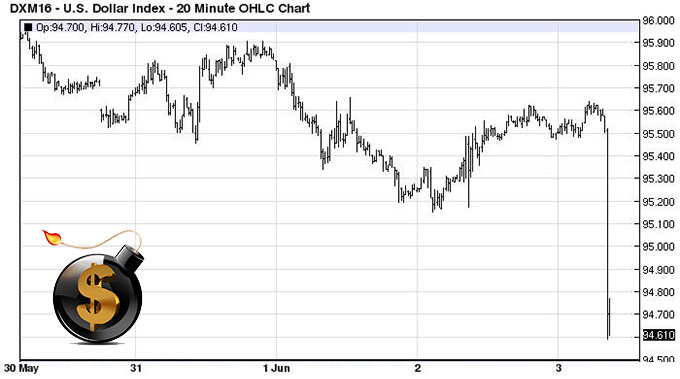

Within minutes the US dollar took a massive dive by currency standards, falling one entire cent in just a few seconds.

Gold skyrocketed, rising 2.5% in a flash.

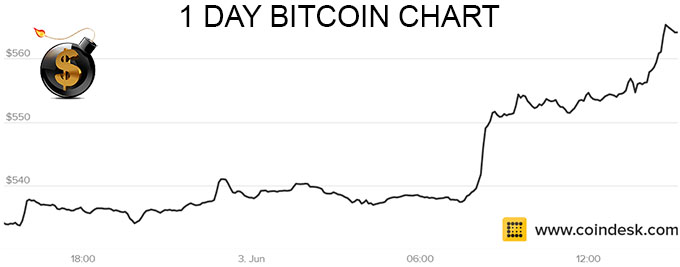

And bitcoin, which already has risen dramatically, by more than 25% in the last week gained another $30 in quick fashion on the news.

Gold stocks also soared, with one of our holdings, the Direxion Daily Gold Miners Bull 3X ETF (NUGT) rising 30% in just a few hours!

It was only yesterday, here at the TDV blog, that we posted an interview with TDV’s Senior Analyst, Ed Bugos, entitled “The US Dollar Is The Biggest Bubble On The Planet And Has Just Began To Pop.”

A day later and it looks like the US dollar has popped!

In that interview Ed outlined three myths that would soon be realized by the markets that will unhinge the US dollar.

The three myths are:

- The US economy is recovering

- The Federal Reserve will raise rates

- Foreign central banks are inflating faster than the Fed

Today, it looks as though the first 2 myths have just begun to be realized by the market. And the market’s response was very swift!

As the markets continue to realize that there is no recovery in the US and that the Fed is not, and cannot, raise rates, we’ll see the dollar continue to crash and gold, silver, precious metals stocks and bitcoin continue to soar.

Ed Bugos nailed it yet again. And our subscriber’s portfolios swelled yet again. Here’s a comment from a subscriber, Andrew, who just upgraded to our Premium service on how happy he is to be part of our worldwide group:

We are still in the early stages of what is coming. Today may have been just the beginning. If you haven’t already, join us to get the best information and analysis on what is really going on and become a part of our worldwide community of dollar collapse survivors.

While other analysts are “shocked” at today’s job report and losing their clients bucket loads of money, subscribe to The Dollar Vigilante newsletter where we are not only not surprised, but fully predicted this… and are making our subscribers a fortune.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.