Stock Market Returns – The Wonder of Compounding Dividends

InvestorEducation / Dividends Jul 25, 2008 - 07:33 AM GMT Albert Einstein described compound growth as the eighth wonder of the world. Although he may have passed away in 1955 – coincidentally the year when yours truly saw daylight for the first time – the concept of compounding remains the single most important principle governing investment.

Albert Einstein described compound growth as the eighth wonder of the world. Although he may have passed away in 1955 – coincidentally the year when yours truly saw daylight for the first time – the concept of compounding remains the single most important principle governing investment.

Back to basics: Compounding simply means that you can earn interest on your principal investment amount, as well as earn interest on top of interest. The power of compounding can make an investment grow much faster than would otherwise have been the case, and is obviously based on the assumption that interest or dividends are reinvested in the same asset.

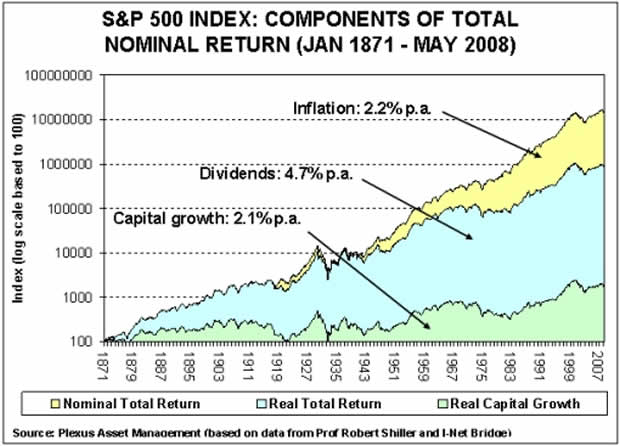

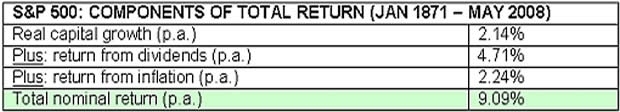

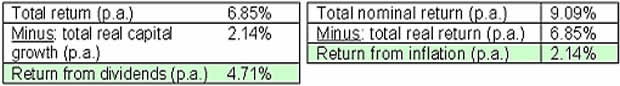

The raison d'être of investment or wealth management is to maintain, or hopefully improve, one's standard of living, i.e. to earn a real return on the investment amount. This sounds easy enough if one considers that the S&P 500 Composite Index (and its predecessors) delivered a nominal return of 9.1% per annum from January 1871 to May 2008. With an average inflation rate of 2.2% per annum over the period, this meant a real return of 6.9% per annum.

These figures may not particularly appeal to many of today's market participants with their gun-slinging approach. I am deliberately refraining from using the word “investors” and can hear these people arguing that much better returns can be generated by “playing” the market cycles. Ah, the art of market timing! Perhaps, but keep in mind that very few people have succeeded in consistently outperforming the market over any extended period of time, especially once costs and taxes are factored in.

More compelling proof that the odds are stacked against the capital-growth-only brigade is gleaned from an analysis of the components of the total return figures. Let's go back to the total nominal return of 9.1% per annum and see how that was made up. We already know that 2.2% per annum came from inflation. Real capital growth (i.e. price movements net of inflation) added another 2.1% per annum. Where did the rest of the return come from? Wait for it, dividends – yes, boring dividends, slavishly reinvested year after year, contributed 4.7% per annum. This represents more than half the total return over time!

Still doubting the evidence? Have a look at the following chart:

And for good measure, here are the numbers summarized in table format.

Source: Plexus Asset Management (based on data from Prof Robert Shiller and I-Net Bridge)

In an environment characterized by increasingly shorter investment horizons, the concept of compounding sounds so yesteryear, but who can argue with the body of empirical market evidence? To coin a phrase often quoted, but seldom fully appreciated (or understood): It is time in the market, and not market timing that counts.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.