Proof US Economic Recovery Has Ended

Economics / Economic Recovery Aug 22, 2016 - 04:43 PM GMTBy: Michael_Pento

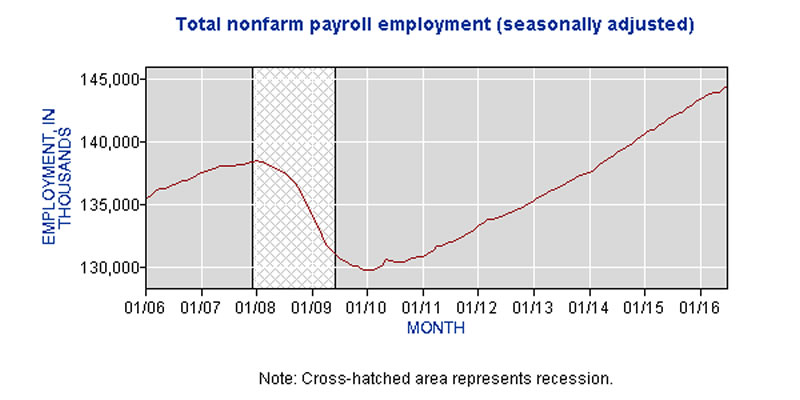

The primary data point that the perennial bulls on Wall Street claim as evidence for an improving economy is the monthly jobs number. The Non-farm Payroll Report claimed that 255,000 jobs were added in July on a seasonally adjusted bases. This number was well above the 12-month average of 190,000. And according to the Bureau of Labor Statistics (BLS), at total of 1.66 million additional people have been employed thus far in fiscal 2016, making this the one bright spot in the economy.

The primary data point that the perennial bulls on Wall Street claim as evidence for an improving economy is the monthly jobs number. The Non-farm Payroll Report claimed that 255,000 jobs were added in July on a seasonally adjusted bases. This number was well above the 12-month average of 190,000. And according to the Bureau of Labor Statistics (BLS), at total of 1.66 million additional people have been employed thus far in fiscal 2016, making this the one bright spot in the economy.

And with 1.66 million additional paychecks flooding the economy, one would assume the U.S. Treasury was flush with new tax receipts, which would assist in reducing the budget deficit. However, according to the Treasury Department, the deficit came in at $112.8 billion in July, the highest since February's $192.6 billion. For the first ten months of the fiscal year, which ends Oct. 1, the budget deficit was $513.7 billion, up from $465.5 billion a year earlier.

Obviously, the government runs a deficit when it spends more than it collects in taxes and other revenue, as is almost always the case. But this year the Congressional Budget Office (CBO) is predicting the 2016 deficit will total $590 billion, up more than 34% from last year's budget shortfall. Most importantly, this growing gap comes primarily because of lower-than-expected receipts to the Treasury.

A closer look at tax receipts over the past few years reveals that the growing number of employed has not had the effect on cash flows to the Treasury that you would expect. Receipts from the Federal Unemployment Tax Act (FUTA) have been falling steadily since 2012, according to the Office of Management and Budget, moving counter to the growing number of people employed. The FUTA tax is levied at 6% on the first $7,000 of an employee’s wage.

In 2012 receipts totaled $66.6 billion, in 2013 those receipts fell to $56.8b, in 2014 they were down to $54.9b, and in 2015 they dropped to $51.8b.

The decrease in the FUTA rate in July of 2011 from 6.2%, to 6.0% may explain some of the shortfalls, but FUTA has continued its decline since 2012 despite the steady rise in employed persons.

In the past fiscal year of 2015, FUTA also fell short of the US Treasury’s own estimate of $56.35 billion coming in at just $51.8 billion, creating an 8% shortfall.

In the fiscal year 2015, Social insurance and retirement receipts also came up short at $1,065.3 billion, $5.1 billion lower than the Mid-Session Review estimate.

This begs the salient question: If the employment condition is booming why are payroll taxes falling?

There are a couple of answers to that question and neither is favorable. The BLS numbers are either wrong or the quality of new jobs created must be very poor. The latter response seems the most credible; a combination of an increase in the proportion of part-time workers and full-time jobs that provide lower compensation. This would also explain the economy’s falling rate of productivity. After all, it’s hard to increase the output per hour of barmaids and waiters.

The true employment condition, as well as the quality of those jobs, can be found in the tax receipt story, which is more comprehensive than the BLS’s estimate. But it’s not just payroll taxes that have declined; corporate tax receipts have fallen 12.8% year-to-date, while individual taxes are down 0.4%.

Again, the only consistent outlier amongst all of the weak data is the monthly Non-Farm Payroll Report. But if the quality of those net new jobs created is extremely poor, then the headline BLS number can be easily reconciled with the economic data points that point towards recession.

The bottom line is that our standard of living cannot be improving when Productivity has been negative for 3 quarters in a row. The economy isn’t getting better while earnings on S&P 500 companies have been negative 5 quarters in a row, and are projected to come in negative for the 6th time. There can be no real growth when tax policy remains unchanged and receipts are falling. And finally, it’s hard to be upbeat regarding growth when nominal GDP is up just 2.4% year-over-year. The government’s own measurement claims Core Consumer Inflation is up 2.2% YoY. This means real economic growth is just 0.2%. But even that paltry growth rate quickly vanishes if you believe inflation is higher than what the Bureau of Labor Statistics reports.

The truth is the economy is most likely already in a recession and there never was a viable economic recovery. Just an anemic, ersatz and transitory bounce in GDP derived from artificial, record-low interest rates and asset bubbles. Investors need to keep their eyes open as equity prices march further into all-time high territory. And, most importantly, have a strategy to protect their portfolios once sanity returns to the market.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.