How Gold Bugs can Have their cake and eat it too by Embracing the trend

Commodities / Gold and Silver Stocks 2016 Sep 13, 2016 - 01:55 PM GMTBy: Sol_Palha

Executive ability is deciding quickly and getting somebody else to do the work.John G. Pollard

Executive ability is deciding quickly and getting somebody else to do the work.John G. Pollard

Many individuals sit back and look wistfully at the 1st stage of the Gold Bull Market they missed. It is interesting that people focus on what they lost but not what they might miss. Since Gold topped out in 2011, many sectors took off; one could have deployed a portion of one’s funds in any of these sectors and walked away with healthy gains. Instead, the classic Gold bug clung to Gold and let all these opportunities slide away.

Never live in regret, life is much too valuable for that. There is always another bull market, why focus on one market only. Many people fixate on the precious metals markets because many hard money experts continue to come out with gloom or doom scenarios. Never listen to anyone giving you a script that is painted with strokes of Panic. No one can function properly once he or she succumbs to panic; reason goes out the window, and nonsense takes over.

There is a way that Gold bugs and hard money experts can have their cake and their pie, but that would entail a change in perspective. If you can do this then, the process is rather simple. We will provide these details shortly; please bear with us.

Precious metals will trend higher one day but why fixate on that day only, what about today, and all the other opportunities you might be sacrificing because you have restricted your vision. If you cling to a particular outlook, you have reduced your line of sight by a significant margin. This is why Gold bugs openly state that they will not support “Fiat”, and they will rather embrace Gold and Silver than the stock market which is funded by worthless paper. To which we respond “oh really” well then what are these bugs doing when they buy Gold; are they not hoping that Gold soars in value and what will it rise in value, oh yes, worthless dollars.

If you cling to one perspective, you cannot see the full picture. How about looking at the picture from every angle. You are Gold bug or hard money fan; here is how you can have your cake and your pie

Why not embrace the equities bull, use the worthless money to get more cheap money and then use some of this paper to buy the Gold and Silver you crave; this perspective is lost to the on many because all they see is Gold and nothing else. Had they embraced this point of view, they would have been embraced the equities bull and multiplied the worthless paper (money) they had. Then, they could have used some of this worthless money to buy real money (Gold), and maybe then they would not be so obsessed with the Gold Markets. The Gold they obtained would technically be free as they used paper profits generated by embracing assets they typically would not; this extra paper was used to bankroll the purchase of new bullion. In effect, they would be pulling a page out of the central banker's books. A perception depends on the angle of observance; alter the angle and you modify the perception.

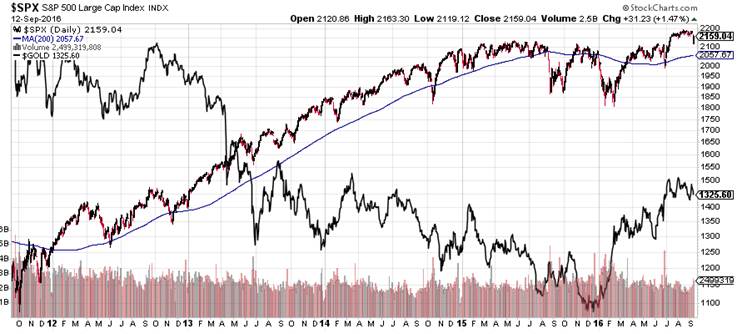

This chart illustrates how Gold performed vs. the SP500 over the past five years; in comparison, Gold has taken a beating and is now making a modest comeback. This took place in the face of the greatest money printing efforts from central bankers in the history of this planet. What happened to the hard money argument that Gold will rise as the money supply soared. Instead the opposite took place, the more money central bankers created, the more Gold fell.

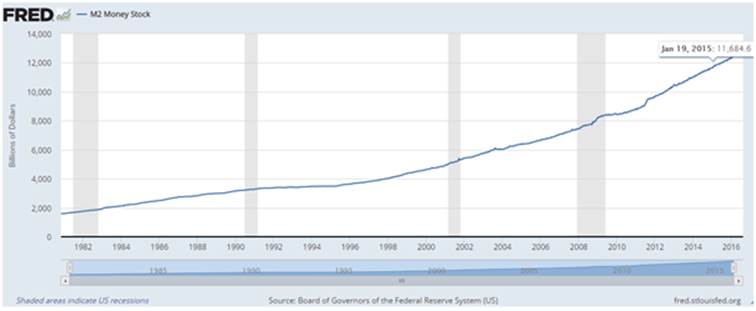

This chart clearly illustrates that since 1980, Gold has not fared as well as it should have. Look at how the money stock has increased. The price of Gold should have continued to trend upwards, and it should be north of $2500. Instead, it cannot even trade to $1400. There is a reason for this; central bankers have managed to recreate reality. By brainwashing the masses and creating new definitions for inflation, they have convinced the masses that Gold is an old relic not worth focusing on, but that is a story for another day.

This is why it is important not to be belong to any group and why it is more important to concentrate on the trend. Don’t fall in love with Gold; it is just another investment; it will trend up for some time, then pull back and correct firmly and then trend up again. Nothing trends up forever, well, stupidity being the only exception.

Once again, the point we are trying to make is that you should not live in regret; the 1st phase of the Gold bull is over, but the next phase will be even stronger. We have a high-end target of $5000 for Gold and to be honest with you, we hope it does not trade to $5000, and we are wrong. Inflation will be quite significant if Gold hits $5000, so those fools hoping for Gold $25,000 or $50,000 have no idea how terrible things would be if Gold traded to those targets. If, Gold ever trades to $50,000, the world as you know it will be over. Chaos will be the order of the day. We will be facing a situation that will be even worse than the Greate Depression. Luckily most of these guys are full of hot air, and it is more likely Central bankers will embrace Gold before Gold trades to those targets.

Conclusion

Forget the noise, focus on the trend. Experts are there to confuse and not enlighten one. We have never claimed to be experts, at most we will settle for the title of advanced students of the Market. The market is a complex beast, and there is always something new you can learn. Those that refuse to accept this are usually punished severely.

Moreover, don’t forget, you can have your cake and your pie. Use worthless paper to make more paper and then use some of this paper to buy (Real Money) Gold and or Silver bullion. In such crazy times, it would be prudent for everyone to have a portion of his or her funds in Gold and Silver bullion. If you have no position in bullion, use strong pullbacks to open new positions.

Ability is a poor man's wealth. M. Wren

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.