The Fed Destroyed US Boomers’ Retirement Dreams

Personal_Finance / Pensions & Retirement Oct 19, 2016 - 04:58 PM GMTBy: John_Mauldin

The more I think about where the “monetary policy community” of academic elites has brought us, the angrier I get. It’s been a long time since I’ve been this passionately upset about something.

The more I think about where the “monetary policy community” of academic elites has brought us, the angrier I get. It’s been a long time since I’ve been this passionately upset about something.

Almost everything the Fed did to us since 2008 falls into two broad categories: interest rate repression and quantitative easing.

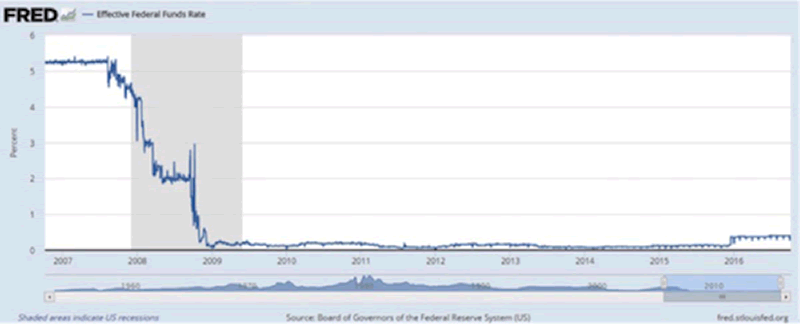

Here’s the federal funds rate from 2007 to 2016. The shaded area is what we now call the Great Recession.

The Federal Open Market Committee entered 2007 with the rate target at 5.25%. They started lowering it in August of that year—months before the economy went into recession. Why was that? Recession or not, many folks weren’t doing well. Even then, there was talk of banks having difficulty… though the worst was yet to come.

Look how fast rates fell. In July 2007, savers could buy Treasury bills, certificates of deposit, or other principal-protected savings instruments and enjoy a 5% or better risk-free yield. Longer-term fixed-income products offered even higher yields.

A year and a half later, the fed funds rate was bumping the zero bound, and savers could make nothing without taking on market risk. Very few wanted to do that at the time because iconic brands were blowing up everywhere.

The Fed ignored demographics

Here is the great irony and possibly the most harmful part of the Fed's monetary policy initiative. They wanted investors to move out on the risk curve. But did they bother to look at the demographics of this country?

We have a huge bulge of Boomers—retirees and near-retirees—who do not need to be moving out on the risk curve at this time in their lives. They need Steady-Eddie returns, and they need to be reducing their risk, not increasing it.

A sober look at the current economic environment reveals overvalued, overbought, and illiquid markets everywhere. Ultra-low and negative interest rates have created an environment of risk that is looking more and more like a bubble in search of a pin.

By reducing the incomes of retirees and terrifying near-retirees, the Fed successfully reduced economic activity. Hopefully, that was not their intent, but that is what happened.

If and when the economy bursts, it will take the retirement dreams of millions of Americans with it.

This policy error will affect hundreds of millions of people

From the Fed’s viewpoint, super-low interest rates were economic stimulus. With borrowing costs so low, we were all supposed to race out and buy stuff.

What did happen was the opposite of stimulus, at least for those who were not the direct beneficiaries of quantitative easing. That would be the people who actually wanted to be prudent and save and put money in fixed-income and certificates of deposits.

Remember when you could invest in a CD at 5% to 6%? What a quaint notion.

Companies should have expanded and hired more workers. Homebuilders should have been incentivized to build more McMansions in the suburbs, knowing that qualified buyers would appear like magic. What was supposed to happen was a normal recovery. What we got was the weakest recovery on record.

Not only that, the Fed destroyed the retirement hopes and dreams of tens of millions of my fellow US Boomers. When we include the effects of the destructive policies of the rest of the world’s central banks, the number becomes hundreds of millions.

The secure and protected world our central bankers live in is far removed from that of the American or European middle class retiree. The purity of their theory and the clarity of their economic thought is clearly far more important to them than people’s wellbeing.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.