Goldman Sachs Is Big Winner In Trump Election Victory

Companies / Banksters Dec 06, 2016 - 02:35 AM GMTBy: Jeff_Berwick

During the Democratic primary, Bernie Sanders demanded that Hillary Clinton release transcripts of speeches she made to Wall Street’s top banks, including Goldman Sachs.

During the Democratic primary, Bernie Sanders demanded that Hillary Clinton release transcripts of speeches she made to Wall Street’s top banks, including Goldman Sachs.

Her detractors claimed that a Clinton nomination as the democratic presidential candidate would be a win for Wall Street.

While Donald Trump was campaigning he promised to “drain the swamp” in Washington, District of Criminals (DC) – by avoiding placing either lobbyists or Wall Street pros in positions of political power.

Boy, how time flies! Yesterday’s certainties are certainly not today’s realities. Trump’s cabinet appointments are nestled firmly in the conservative wing of the Republican Party.

The Wall Street connections Hillary was previously derided for, have now become Trump’s intimate acquaintances and in some cases his professional political colleagues, at his request.

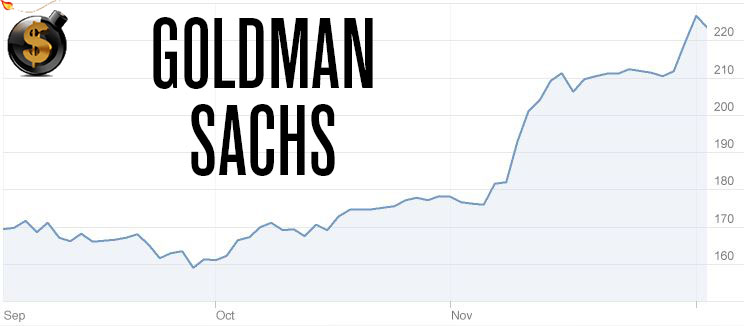

The past several weeks have been a boon, particularly for Wall Street’s most controversial and powerful firm, Goldman Sachs. Since the election on November 8th, Goldman’s stock has risen a stunning 22%!

When the President-elect chose former Goldman Sachs partner Steven Mnuchin (he worked there for nearly two decades) for Treasury Secretary, the investment bank’s share price increased 4%, closing at its highest level since December 2007.

Mnunchin, a man who has produced Hollywood films, will oversee the national debt, the IRS, banking regulations and sanctions. In other words, Wall Street will control all of these things. The Treasury Secretary is also fifth in line to succeed the president.

The duo has stated that they would like to roll back the Dodd-Frank Act which was put into place after the financial crisis to ban banks from using client’s deposits to back their bets.

Goldman Sachs’ Gary Cohn met with Trump on Tuesday at Trump Tower. Mr. Cohn is vice president and chief operating officer, second only to CEO Lloyd Blankfein. Cohn, 56, has been with the investment bank for 26 years. He started in Goldman’s commodity unit.

Bloomberg reports Cohn oversaw Goldman’s mortgage unit by 2000, a market which gained attention thanks to the 2008 financial crisis and the popular 2015 film “The Big Short.” The Chief operating officer could also be in line to take over as CEO for the bank.

CNN Money has reported that Trump may choose Anthony Scaramucci (two-time Goldman Sachs employee) for a cabinet post. Scaramucci helped to lead the billionaire’s finance committee during his presidential campaign and serves on the Trump transition team.

Other Wall Street insiders who have been tapped or are being considered include:

- Chief strategist Steve Bannon: Goldman Sachs.

- Transition adviser Anthony Scaramucci: Goldman Sachs.

- Commerce secretary nominee Wilbur Ross: Rothschild & Co.

- Possible budget director Gary Cohn: Goldman Sachs.

- Potential secretary of state Mitt Romney: Bain Capital.

In other words, say hello to the new boss who is no different than the old.

On the campaign trail, Trump claimed Goldman Sachs enjoyed “total, total control” over Hillary Clinton and other rivals, such as Ted Cruz. In regards to the speeches, Mr. Trump said Ms. Clinton meets “in secret with international banks to plot the destruction of U.S. sovereignty.” This is a classic example of Donald speaking out of both sides of his mouth.

On Netflix, account holders can watch the film “The Bank that Runs the World” about Goldman Sachs, who sponsors the political campaigns of politicians from both sides of the political aisle.

As the Washington Post writes, Goldman Sachs has made it back into D.C’s “inner circle.” (to be more accurate, they’ve never left DC’s inner circle, judging by how much they donated to Barack Obama’s presidential bids)

“The Goldman gang has always been able to make sure they are close to power; they are very good at cultivating and maintaining relationships,” said Christopher Whalen, head of research for Kroll Bond Rating Agency.

When it comes to the financial power structure, nothing is going to change. Goldman Sachs’ stock skyrocketing after the election is all the proof you need of that.

And, because of that, we expect many of our investments to continue to do well in 2017. Bitcoin has been one of the best performing assets in 2016 and has surpassed $750 to hit new highs not seen since 2014. Gold and silver have pulled back from their big gains earlier in the year, as have the mining stocks, but we expect them to begin to fly again soon.

To receive all our investment analysis and recommendations, subscribe to The Dollar Vigilante newsletter here. And, to receive a complimentary copy of our book, Getting Your Gold Out Of Dodge, click here.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.