4 Investing Legends Predict Change In 2017

Stock-Markets / Financial Markets 2017 Jan 27, 2017 - 05:58 PM GMTBy: John_Mauldin

Forecasting the New Year is a curious tradition. Much evidence suggests that no one does it both accurately and consistently, yet everyone keeps trying. Just as no war plan survives contact with the enemy, no investment plan survives contact with February.

Forecasting the New Year is a curious tradition. Much evidence suggests that no one does it both accurately and consistently, yet everyone keeps trying. Just as no war plan survives contact with the enemy, no investment plan survives contact with February.

But the real value of an annual forecast is strategic. It helps you set priorities, define important issues, and think about what you should anticipate and what you can safely ignore. That’s a good exercise to go through periodically, and January is as good a time as any.

I gave you my own thoughts last week (see “Skeptically Optimistic” and subscribe to my free publication, Thoughts from the Frontline).

Today, we’ll review several other forecasts from people who deserve your attention. Of necessity, I must leave out some good ones, but I think the ones I cover will give you plenty of useful information.

Gavekal has a spectrum of views

The Gavekal team—led by co-founders Charles Gave, Louis-Vincent Gave, and Anatole Kaletsky—have a knack for asking the right questions.

It all depends on what happens to return on invested capital. Whether the US dollar rises or falls will be the primary driver of performance for almost any asset class in 2017. And behind that question of the dollar lies the broader outlook for the US economy; specifically, can President Trump manage to raise ROIC in the US? The answer to that question sets up the following decision tree:

If no, then the dollar falls back, US equities underperform, and emerging market debt outperforms big-time.

If yes, then we have to ask why US ROIC is rising:

- Is it at the expense of ROIC outside the US (i.e. protectionism)?

- Is it through tax cuts and deregulation?

David Rosenberg predicts a return to disinflation

Rosie doesn’t think inflation is coming back or that the economy is ready to soar, notwithstanding the new management in Washington. He thinks the widespread optimism among investors and business owners is no reason to change your plans:

The economy isn’t that strong, and anyone who thinks one man can reverse, on his own, the structural forces that led to the multi-year disinflation trend—and I’m talking about excessive debt, globalization, aging demographics, and technology—needs to go back to economics school right away.

I think it is very dangerous to be basing investment decisions on expectations of government policy. What is done and when it is done is far too uncertain, and uncertainty is inherently difficult to price.

Rosenberg is right that the structural forces favoring disinflation/deflation haven’t changed. A different trade policy is not going to restore all the jobs our Rust Belt states lost.

Christopher Wood discusses inflection points

Here’s Chris:

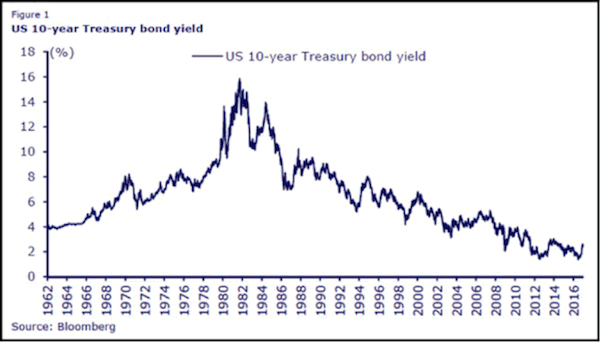

An inflection point may have been reached in world financial markets, or at least such is what market participants began to think in the final weeks of 2016.

This possible inflection point in bond yields, if that’s what it is, would seem to be the result of another inflection point: the impending Trump presidency. Chris is not convinced. Chris again:

It is, of course, this perceived inflection point in policy—and the related hopes for the return of animal spirits to the American economy—which has been the key trigger for the dramatic sell-off in the American bond market and almost equally dramatic rally in the US dollar since Donald Trump’s victory. But from a Federal Reserve perspective, these market moves have already served to tighten financial conditions significantly.

While GREED & fear will be the first to admit that tax cuts and deregulation are clearly positive triggers for animal spirits and growth, extreme skepticism is warranted on the hopes currently being invested in the powers of fiscal easing and related infrastructure spending even if it is assumed that a Republican-controlled Congress, containing many fiscal conservatives, is really willing to sign up to The Donald’s spending plans.

Chris goes on to discuss potential trade policy changes:

GREED & fear’s view is that the most-substantive proposal out there is the draft legislation currently before the House of Representatives discussed here in some detail last month…

There is apparently huge lobbying currently going on against this legislation by corporate America.

No CEO wants to be the subject of a Trump tweet. I expect such tweets to slow and eventually stop as corporate leaders refocus their expansion plans on domestic production.

Bank Credit Analyst says trade has little impact

BCA says:

Looming shifts in fiscal policy will be positive for global growth in the next couple of years, but are unlikely to be game changers.

On trade, BCA sees little risk of a trade war and notes that trade actually ceased to be a net contributor to world growth several years ago: global export volumes have been growing more slowly than GDP. That’s mainly a result of China’s growing domestic production.

Inflation will hit the Fed’s target but not get much higher.

As for the stock market, BCA sees reasons for caution but not an imminent crash. They make a good point about wages affecting corporate profit margins.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.