French Elections and Gold Price

Commodities / Gold and Silver 2017 Apr 21, 2017 - 12:31 PM GMTBy: Arkadiusz_Sieron

In the previous edition of the Market Overview, we analyzed the potential impact of the European elections on the gold market. As the Dutch elections are behind us, let's see how the Wilders' defeat affected the markets and the political outlook for France, where people will vote for the president on April 23.

In the previous edition of the Market Overview, we analyzed the potential impact of the European elections on the gold market. As the Dutch elections are behind us, let's see how the Wilders' defeat affected the markets and the political outlook for France, where people will vote for the president on April 23.

Investors reacted positively to the outcome of the Dutch election, relieved that populists did not win. European stocks and the euro rose, while the France-Germany 10-year bond yield spread declined after the elections. This is because Wilders' failure is considered to indicate that “the wrong kind of populism” is losing momentum.

Although Wilders lost, it does not mean that all risks vanished and the threat of protectionism has gone. Actually, the triumphant party won fewer seats in the last parliament, while Wilders got more than the last time (the same applies to Marine Le Pen, who is much more popular than her father, the founder of the National Front). And Dutch voters are still flirting with populism – they are just more dispersed, as people also voted for other right-wing parties. Moreover, other parties, including the ruling People's Party for Freedom and Democracy, adopted a more right-wing tone during the campaign, as the prime minister's decisive approach toward Turkish diplomats showed. Let's face it: Wilders is the second force in the country now, so he would definitely influence the domestic politics. In a sense, a populist party did not win, but populist ideas were pushed to the mainstream political agenda instead.

Therefore, it is too early to state that Le Pen is set to fail. Importantly, her odds of winning in the run-off increased after the Dutch elections. As a reminder, according to the polls conducted before the presidential television debate, she will win in the first round of voting, but lose in the run-off. Her odds of winning in the second round are 40 percent with Macron and 45 percent with Fillon, but as Emmanuel Macron is believed to have won the debate, the chances of Le Pen fell slightly. The French election is a different kettle of fish, as there are only few candidates (the run-off is between the two contenders who get the most votes in the first round of the elections), while the parliamentary election in the Netherlands was between 28 parties. If the political scene in the Netherlands was not so fragmented, Wilders could win. Another issue is that French economy is performing worse than the Dutch (the unemployment rate is twice as high, while the GDP growth is half of the Netherlands). Hence, although the probability of Le Pen's victory is not high (in the second round, voters are likely to build a coalition against her), we believe that her chances did not change significantly after the outcome of the Dutch elections. In other words, investors should not extrapolate trends between the Netherlands and France. The presidential election in the latter remains one of the major risks for the euro area.

Thus, investors are nervous ahead of the French elections, and we could see a short-term volatility in European assets and the euro; we could also observe some inflows into gold, the ultimate safe-haven asset. For example, the euro was up 0.6 percent to a six-week high after the French presidential debate, while the French interest rate premium over Germany declined. According to the polls, centrist Emmanuel Macron won the debate, which eased the political risks to the EU from Le Pen. The price of gold rose together with the euro. It shows that investors started to take into account the political uncertainty in Europe after trading solely on expectations of the Fed's and Trump's actions. It also indicates that the exchange rate channel is more important for the yellow metal than the uncertainty channel.

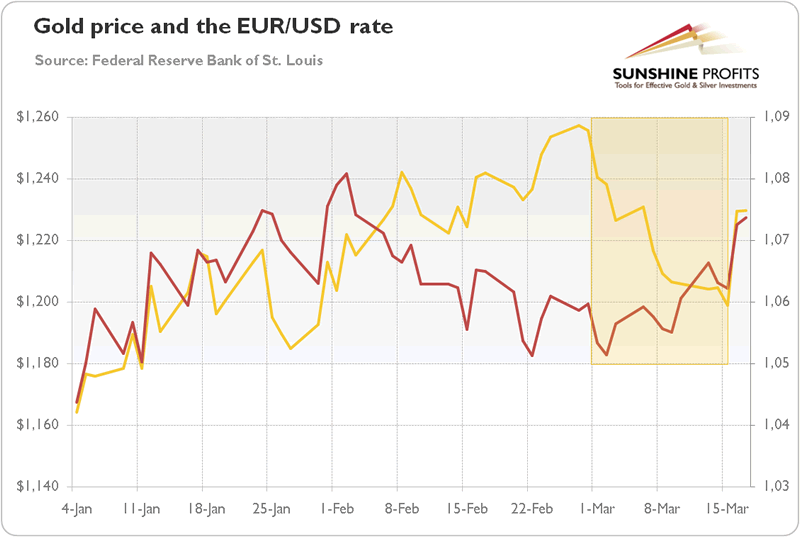

However, long-term investors should not overstate the impact of that election on the gold market. As the chart below shows, the price of gold actually declined before the Dutch elections, while the euro gained against the U.S. dollar.

Chart 1: The price of gold and the EUR/USD exchange rate in 2017.

It implies that macroeconomic factors and central banks' actions may be more important drivers for the currency exchange rates and the price of gold in the long-term. Surely, the French election is much more important than the Dutch, given the size of the French economy and the key role of the country in the EU, but even the surprising and really disrupting Brexit vote caused only a short-term rally in gold prices. Hence, the EUR/USD exchange rate and the price of gold may be strongly affected by the prospects of the election in the short-run, but their impact may not be long lasting.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.