What Investors Can Learn From the Japanese Art of Kintsukuroi

Commodities / Gold and Silver 2017 Aug 01, 2017 - 11:08 PM GMTBy: GoldCore

– What investors can learn from the Japanese art of Kintsukuroi or Kintsugi – art of repairing broken pottery with gold

– What investors can learn from the Japanese art of Kintsukuroi or Kintsugi – art of repairing broken pottery with gold

– Investors and savers can protect their savings with gold

– Savers and investors are being punished by negative to low interest rates

– Global debt levels, stock bubbles and reduced liquidity will lead to crisis

– Reinforce cracks with gold prior to money pot shatters

Source: Wikimedia

Editor: Mark O’Byrne

Kintsukuroi or Kintsugi is the Japanese art of repairing broken pottery with gold and silver.

The Japanese like to consider it a way of not only repairing the item but also transforming it into something new which is pristine and has a new potential.

For the philosphers in the art world they like to ask how can something of such beauty be created from a shattered vase or bowl?

Our politics, markets and economy are broken. With each passing day we see more evidence of a globalised, interconnected world that is also increasingly politically and financially fragmented.

In turn this is raising tensions between and within countries. Especially between the ‘haves’ and ‘have nots.’

We have seen this before, many times in history, when the greed of mankind and his belief in infallibility leads us to believe we can perform unprecedented financial experiments. The more we push on with the experiments, rather than learning from history, the bigger the cracks and damage.

Jim Rogers recently expressed his disgust at banks’s claims that had they not acted as they had in response to the financial crisis then things would be worse.

Rogers disagrees, all they have done is papered over and widened the cracks… “propping up zombie banks and dead companies is not the way the world is supposed to work. … It’s been nine years and we have nothing to show for it [economically] except staggering amounts of debt.”

In order for Kintsugi to transpire the artist must ‘see’ a cracked pot differently. A new perspective has to be taken. The pot is not broken, it is not useless instead it is something which has potential to become stronger and better.

We must begin to look at our economy in a similar light. Our savings are not useless, in the same way our economic system is not useless.

But they are weak in their current state, they should be made stronger rather than forced to take on more pressure.

The art of seeing differently

Last week, came the news that global debt levels were 327% of world gross domestic product (GDP), at $217 trillion in the first quarter of 2017. We have added over $120 trillion since the financial crisis.

In the weeks before the world’s top money managers had rung the warning bell that this pot was ready to crumble. Marc Faber told CNBC that ‘everything’ is in a bubble with the risk that:

“One day this bubble will end,” and as a result people will lose 50% of their wealth.

Mohammed El Erian, part of the global financial elite but someone who we should all listen to, has also expressed similar concerns to Faber.

He wrote on Bloomberg that because of reduced liquidity resulting from simultaneous policy tightening by central banks, he has some serious doubts about the sustainability of the current overextended bull market in stocks.

Meanwhile Bill Gross believes markets in the US are at their highest risk levels post-2008 as investors are paying a high price for taking chances.

The low (and negative) interest rates of central banks are artificially driving up asset prices. This is creating little growth in the real economy and as a result is punishing individual savers and businesses.

Even those who are generally more concerned with individual wellbeing rather than the health of the global economy are now getting involved in firing warning shots.

Life guru Tony Robbins has warned that ‘the crash is coming’ both in a book and on a regular podcast.

He recently pointed to the falsehoods that we are all being told about the system, “We are in a really artificial situation. There is a new high, on average, every month. Feds around the world have been printing money.”

But, this is the world we live in. Should we wait and see how it plays out? Bury our heads in the sand?

Or, should we instead think about what we can do differently. How we can look at his situation and take a new perspective, give it some potential and extended future?

Like the art of kintsukuroi we may be able to give it a second chance, with gold.

Gold is for everyone: Some are already filling the cracks with gold

“The world breaks everyone, then some become strong at the broken places.” Ernest Hemingway

Countries around the world (including large nations such as Russia and China) are acquiring gold at an accelerated rate in order to diversify their reserve positions. When you consider the already substantial reserves in the US, Germany and the IMF, we may already be moving quietly towards a default gold standard.

There is a reason these countries and organisations are accumulating and/or holding onto gold. They know that when things take the inevitable turn for the worst, gold will alleviate the financial and monetary damage.

They know this because whilst their economic policies might not reflect any knowledge of history, history including the recent crisis shows them that gold has survived history because of it’s ability to hold value and act as a safe haven.

Unfortunately the chances of the majority of the world’s leaders realising how they can fix the cracks before they become breaks, are low.

But that doesn’t mean investors can’t embrace gold to fix the cracks that their finances and investments are exposed to.

As with the broken pots, gold just needs to be a small part of your portfolio.

A small allocation confers stability and insurance. Jim Rickards argues that the solution to the risks we are all exposed to is to allocate 10% of your portfolio to physical gold or silver:

‘That will be your insurance when the time comes.’

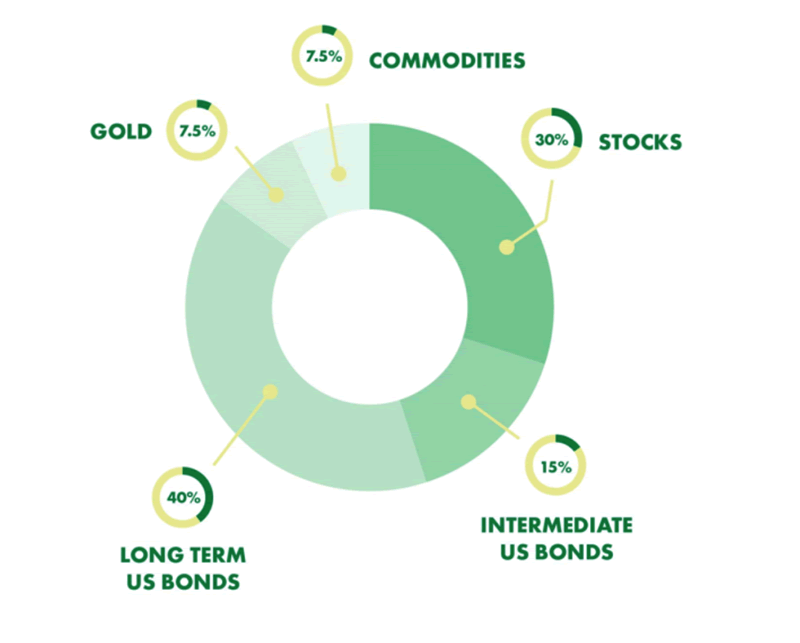

Whether it is 5%, 10% or 50%, gold should play a part in your portfolio to give it strength in the tough times that are no doubt ahead. Just one look at the table below (from guru Tony Robbins) and you can see how little an amount needs to go in, in order to fill the cracks and reduce volatility and enhance returns in a portfolio.

All Seasons strategy via Ray Dalio via Tony Robbins

You might ask why isn’t there a rush to gold if it’s the way to secure our portfolios? Only the smart money is diversifying into gold now – as was the case before the first financial crisis. Martin Armstrong of Armstrong Economics recently said:

‘Gold and the stock market will take off when people realize that government is in trouble. When they lose confidence, that is when they will start to pour into tangible assets.’

Conclusion – Reinforce the financial cracks with gold

Really kintsukuroi is about highlighting imperfections. Many reading this might ask why on earth one would want to highlight the imperfections in the banking system and the global financial system rather than just starting from scratch.

We don’t need to go so far as to lose our wealth in order to realise how we can protect ourselves.

There is no changing the damage that has been done. We cannot erase the past, only learn from it.

How do you learn from things? By remembering what has happened and by incorporating those lessons into every day life.

We can do that with gold. We can learn from the past mistakes and bring gold into our portfolios to protect and grow our wealth.

Gold has consistently proven itself in times of economic distress. Those who have benefited the most from this are the ones who bought their insurance and reinforced the cracks prior to the shattering crash.

Gold Prices (LBMA AM)

01 Aug: USD 1,267.05, GBP 957.76 & EUR 1,072.30 per ounce

31 Jul: USD 1,266.35, GBP 965.59 & EUR 1,079.06 per ounce

28 Jul: USD 1,259.60, GBP 961.96 & EUR 1,075.45 per ounce

27 Jul: USD 1,262.05, GBP 960.29 & EUR 1,076.53 per ounce

26 Jul: USD 1,245.40, GBP 956.72 & EUR 1,071.29 per ounce

25 Jul: USD 1,252.00, GBP 960.78 & EUR 1,074.59 per ounce

24 Jul: USD 1,255.85, GBP 962.99 & EUR 1,077.64 per ounce

Silver Prices (LBMA)

01 Aug: USD 16.74, GBP 12.67 & EUR 14.17 per ounce

31 Jul: USD 16.76, GBP 12.77 & EUR 14.29 per ounce

28 Jul: USD 16.56, GBP 12.66 & EUR 14.15 per ounce

27 Jul: USD 16.79, GBP 12.77 & EUR 14.34 per ounce

26 Jul: USD 16.37, GBP 12.54 & EUR 14.06 per ounce

25 Jul: USD 16.31, GBP 12.52 & EUR 14.00 per ounce

24 Jul: USD 16.50, GBP 12.66 & EUR 14.17 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.