This Just Changed Everything: Marijuana Green Profits Are Being Unleashed

Commodities / Cannabis Aug 04, 2017 - 02:22 PM GMTBy: The_Gold_Report

Kenneth Ameduri, founder of Crush the Street, discusses why he believes now is a good time to take advantage of cannabis investing opportunities.

Kenneth Ameduri, founder of Crush the Street, discusses why he believes now is a good time to take advantage of cannabis investing opportunities.

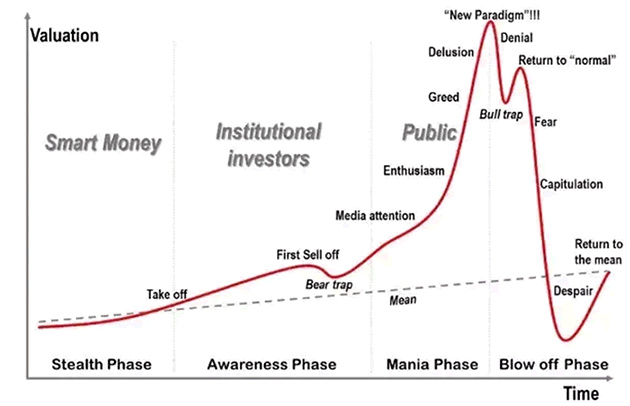

There is nothing wrong with being part of bubbles. It's the formation and expansion of a bubble that you want to be positioned in.

The problem that most people have with bubbles is that most people enter in the greed, delusion and denial phases of the bubble.

Most people completely miss the stealth phase because of ignorance. Few people are awakened in this phase of the cycle, which also explains why market participation is very weak. The highest dollar volume comes near the peak of markets, when everyone is conditioned to assume blue sky profits.

I want to be part of the bubble, but positioning myself during the stealth and aware phases of the cycle.

Prohibition of the 21st Century: Green Profits Being Unleashed

In the early 1990s, cannabis was a long way from being widely accepted, but a world of scientific research has silenced all the prejudice.

This industry is drastically changing, and growing by the minute.

To give you an idea of what we're currently looking at, here are the facts:

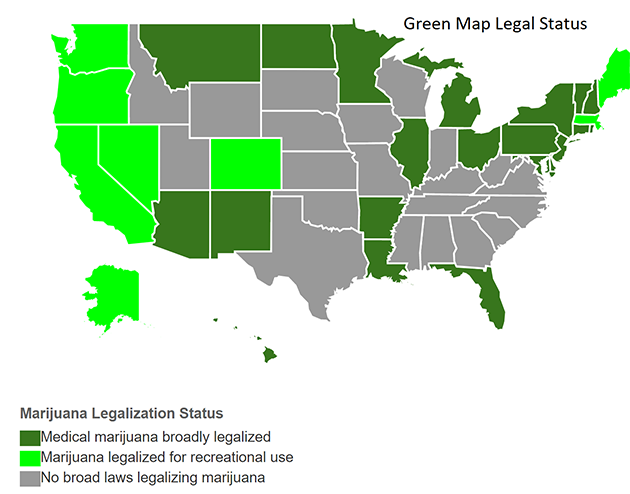

Twenty-nine states have legalized some form of marijuana.

On November 6, 2012, Colorado and Washington became the first states to legalize the sale and possession of cannabis for recreational use.

Seven states and the District of Columbia have adopted the most expansive laws, legalizing marijuana for recreational use. Most recently, California, Massachusetts, Maine, and Nevada all passed measures in November legalizing recreational marijuana.

Mainstream television is Cali-based, and we all know it will have an effect over not only the U.S., but the entire world.

California will set the tone—it's the queen of cannabis culture and will influence the political landscape and speed of legalization nationwide. With California’s implementation of recreational marijuana use, the floodgates will fling open.

California is a state of 39 million people. It's not just that California is the fifth largest economy in the world—this state has 250 million people a year that come and visit.

Florida is number two in terms of yearly visitors, and they only get about 113 million—less than half as many as California.

On January 1, 2018, recreational use of cannabis is fair game. Keep in mind that this is still federally illegal. I fully expect cannabis legalization to go into effect federally in less than 10 years.

China, the world's largest country, still has some of the strictest laws in the world. It’s banned for sale, possession, transportation, and cultivation. The effect the slightest bit of loosening of laws in a population of 1.4 billion people will have on an industry cannot be overstated.

Here, I am getting excited about California's 39 million people. There is a tsunami of buyers that will enter the space as the world widely accepts cannabis.

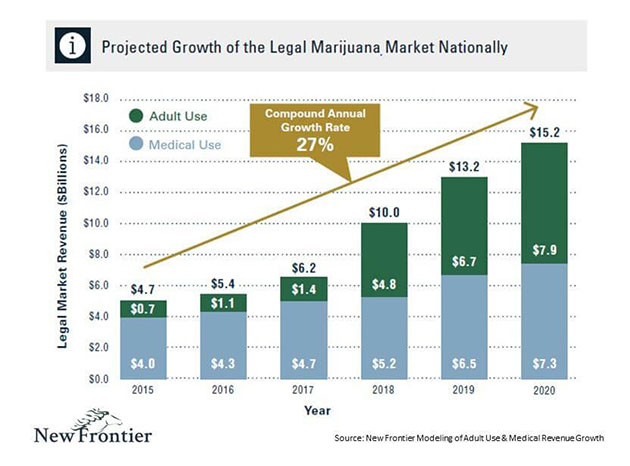

As it is in the U.S., expected growth is exciting:

Early Stages of Gushing Profits

Just to give you an idea of how small this industry is, the largest cannabis player right now is a company that has a market cap of $3 billion. In fact, it's the only company in the cannabis space worth over a billion.

This will not be the case for long. From recreational uses to the laundry lists of industrial capabilities, marijuana companies are going to rocket higher.

From an investment standpoint, the winds are at our back, and I am diligently seeking the right opportunities in the cannabis space.

I am currently in talks with some of the greatest movers and shakers in the cannabis space right now, drilling down on who we can partner with and have the best position to be able to fully experience this trend before we go into the enthusiasm and greed stages of the bubble cycle.

Bubbles don't have to be a bad thing. Riding the wave up could turn profits in the 1,000%+ range.

Some of greatest tech companies rose from the ashes of the Dotcom bubble, including Amazon, Facebook, Google and Netflix.

North American sales are projected to top $20.2 billion by 2021, assuming a compound annual growth rate of 25%.

There is only ONE company in the cannabis space right now worth over $1 billion. This is incredible early stage.

The THC in marijuana has medicinal uses, while the plant fibers in hemp have countless uses in manufacturing and industrial production. We could see the cannabis trend reaching over 20,000 various products—it's the perfect set-up.

Sign up for the free Crush The Street newsletter to get up-to-date and well-researched information to prepare yourself financially and get positioned to thrive in the hottest trends.

Kenneth Ameduri is the chief editor and cofounder of financial publication letter CrushTheStreet.com. He was a founder in Future Money Trends and Wealth Research Group, which have gone on to be vital sources of education and wealth for hundreds of thousands of readers. In his 20s, Ameduri has founded multiple businesses that have gone on to be worth millions of dollars. Ameduri was also a founder of FMT Advisory, which successfully manages millions of dollars in client funds. He is an ardent student of Austrian economics and anticipating market trends as he has successfully invested and built companies for more than 15 years.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Kenneth Ameduri and not of Streetwise Reports or its officers. Kenneth Ameduri is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Kenneth Ameduri was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of the author

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.