These Two Articles Debunk The Biggest Financial Nonsense I See In The Media

Stock-Markets / Financial Markets 2017 Sep 18, 2017 - 03:23 PM GMTBy: John_Mauldin

For this week’s Outside the Box (subscribe here for free), we have a two-parter of short essays. They are unrelated but equally important. First, in “Time to Drain the Fed Swamp,” Brian Wesbury and colleagues at First Trust make the case that it was the private sector, not the federal government or the Fed, that saved the economy after the panic of 2008.

For this week’s Outside the Box (subscribe here for free), we have a two-parter of short essays. They are unrelated but equally important. First, in “Time to Drain the Fed Swamp,” Brian Wesbury and colleagues at First Trust make the case that it was the private sector, not the federal government or the Fed, that saved the economy after the panic of 2008.

The Fed has outgrown its britches, they argue, and it’s time to fill the Board of Governors chair and vice-chair positions with people who will hold the Fed to account for its mistakes. They conclude with this trenchant line:

We need a government that is willing to support the private sector and stop acting as if the “swamp” itself creates wealth.

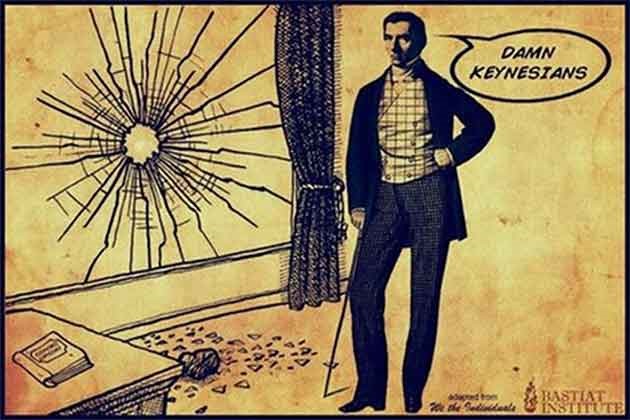

Then, in “Don’t Buy Into ‘The Broken Window Fallacy,’” good friend Doug Kass shares Frederic Bastiat’s parable of a broken window to demonstrate why destruction à la Harvey and Irma is not a net positive for the economy in the longer term.

I keep reading nonsense economics by people who say this is going to boost the economy; and in the seriously weird way that we measure GDP, maybe it will, however slightly; but it is a definite drain on the wealth of the country.

Time to Drain the Fed Swamp

By Brian S. Wesbury, Robert Stein, and Strider Elass

The panic of 2008 was damaging in more ways than people think. Yes, there were dramatic losses for investors and homeowners, but these markets have recovered. What hasn’t gone back to normal is the size and scope of Washington DC, especially the Federal Reserve. It’s time for that to change.

DC institutions got away with blaming the crisis on the private sector and used this narrative to grow their influence, budgets, and size. They also created the narrative that government saved the US economy, but that is highly questionable.

Without going too much in depth, one thing no one talks about is that Fannie Mae and Freddie Mac, at the direction of HUD, were forced to buy subprime loans in order to meet politically-driven, social policy objectives. In 2007, they owned 76% of all subprime paper (See Peter Wallison: Hidden in Plain Sight).

At the same time, the real reason the crisis spread so rapidly and expanded so greatly was not derivatives, but mark-to-market accounting.

It wasn’t government that saved the economy. Quantitative Easing was started in September 2008. TARP was passed on October 3, 2008. Yet for the next five months, markets continued to implode, the economy plummeted, and private money did not flow to private banks.

On March 9, 2009, with the announcement that insanely rigid mark-to-market accounting rules would be changed, the markets stopped falling, the economy turned toward growth, and private investors started investing in banks. All this happened immediately when the accounting rule was changed. No longer could these crazy rules wipe out bank capital by marking down asset values despite little to no change in cash flows. Changing this rule was the key to recovery, not QE, TARP, or “stress tests.”

The Fed, and supporters of government intervention, ignore all these facts. They never address them. Why? First, institutions protect themselves even if it’s at the expense of the truth. Second, human nature doesn’t like to admit mistakes. Third, Washington DC always uses crises to grow. Admitting that their policies haven’t worked would lead to a smaller government with less power.

The Fed has become massive. Its balance sheet is nearly 25% of GDP. Never before has it been this large. And yet, the economy has grown relatively slowly. Back in the 1980s and 1990s, with a much smaller Fed balance sheet, the economy grew far more rapidly.

So how do you drain the Fed? By not appointing anyone that is already waiting in DC’s revolving door of career elites. We need someone willing to challenge Fed and DC orthodoxy. If we had our pick to fill the chair and vice chair positions (with Stanley Fischer announcing his departure) we would be focused on the likes of John Taylor, Peter Wallison, or Bill Isaac.

They would bring new blood to the Fed and hold it to account for its mistakes. It’s time for the Fed to own up and stop defending the nonsensical story that government, and not entrepreneurs, saved the US economy. Ben Bernanke and Janet Yellen have never fracked a well or written an App. We need a government that is willing to support the private sector and stop acting as if the “swamp” itself creates wealth.

Don’t Buy Into “The Broken Window Fallacy”

By Doug Kass

September 12, 2017

The broken window fallacy was first expressed by the great French economist, Frederic Bastiat. Bastiat used the parable of a broken window to point out why destruction doesn’t benefit the economy.

In Bastiat’s tale, a man’s son breaks a pane of glass, meaning the man will have to pay to replace it. The onlookers consider the situation and decide that the boy has actually done the community a service because his father will have to pay the glazier (window repair man) to replace the broken pane. The glazier will then presumably spend the extra money on something else, jump-starting the local economy…

The onlookers come to believe that breaking windows stimulates the economy, but Bastiat points out that further analysis exposes the fallacy. By breaking the window, the man’s son has reduced his father’s disposable income, meaning his father will not be able purchase new shoes or some other luxury good. Thus, the broken window might help the glazier, but at the same time, it robs other industries and reduces the amount being spent on other goods. Moreover, replacing something that has already been purchased is a maintenance cost, rather than a purchase of truly new goods, and maintenance doesn’t stimulate production. In short, Bastiat suggests that destruction—and its costs—don’t pay in an economic sense.

The broken window fallacy is often used to discredit the idea that going to war stimulates a country’s economy. As with the broken window, war causes resources and capital to be funneled out of industries that produce goods to industries that destroy things, leading to even more costs. According to this line of reasoning, the rebuilding that occurs after war is primarily maintenance costs, meaning that countries would be much better off not fighting at all.

The broken window fallacy also demonstrates the faulty conclusions of the onlookers; by only taking into consideration the man with the broken window and the glazier who must replace it, the crowd forgets about the missing third party (such as the shoe maker). In this sense, the fallacy comes from making a decision by looking only at the parties directly involved in the short term, rather than looking at all parties (directly and indirectly) involved in the short and long term.

– Investopedia, “The Broken Window Fallacy”

Yesterday many—including Jim “El Capitan” Cramer—emphasized that the dual hurricanes in Florida and Texas were net economic positives as they would stem the peaking already apparent in autos and housing.

As Jim wrote:

It’s simple. When you get flooding like we had in Texas, you are going to have perhaps hundreds of thousands of people shopping for new cars, all at once. If you get storms that destroy houses with wind and rain, as is the case in Florida, you get checks to fix them up almost instantly.

–Jim Cramer, “Hurricanes Will Break the Decline of the Auto and Housing Industries”

While it is clear that the need to replace destroyed autos will reduce car inventories temporarily and assist in the sale of homes, the benefit—as described above in The Broken Window Fallacy—is not likely to be long lasting or stem the peaks in car production and housing sales. Those who are looking at a net benefit are restricting their observations to only the parties directly involved in the short term, rather than looking at all the parties directly and indirectly involved in the short and long term:

* A rebuild of what you already had in Florida and Texas is restorative and does not increase an economy’s productivity or capacity.

* By contrast, the infrastructure build discussed by the administration is incremental; it increases productivity and makes the American economy better and stronger. As many of you know (see “The Orange Swan Returns with a Vengeance“), my view is that Trump’s infrastructure bill, as well as tax reform and other legislation, are unlikely to be passed on a timely and non-diluted basis. It may be argued now that the Florida and Texas rebuilds may be another excuse for non-passage.

* The rebuilds from Hurricanes Harvey and Irma will increase the deficit due to the direct expenses and loss of tax revenues created by a business slowdown over the next two quarters from the storm’s damage. That deficit has now eclipsed $20 trillion.

* The rebuilds also may extend the already-stretched affordability issue facing housing, as it will increase building material prices and inflation, serving to increase the prices of homes.

* There is not an infinite supply of labor. The construction workers who will be moving to Houston and Tampa to rebuild are being taken away from other markets.

* Finally, in the local areas involved in the path of the worst destruction, there is often a net loss as people leave and don’t come back. New Orleans’ population is about 80% today of what it was before Katrina. This is at best a zero sum, but in reality, probably is a net loss because many people are uninsured and can’t afford to rebuild or buy again. In addition, there is a human toll on health, etc.

The Markets

We either are in one of the greatest bull markets of all time, fueled by eight years of more monetary cow bell, or our markets—as in 2000 and 2007—likely are ignoring numerous uncertainties, extended valuations and other headwinds—as I say, rationalizing the irrational.

As an example, the markets rose modestly last Friday, anticipating a huge storm—and subsequent replenishment and rebuild—that could have resulted in more than $150 billion of damages.

Yesterday, the markets ramped up by more than 25 S&P handles on light volume after never really going down because the hurricane’s wrath and impact was far less than initially anticipated.

To many it was a Goldilocks just-right outcome, as some thought the damage of the natural disasters was still enough to restrain the Fed’s tightening yet enough to halt the peaking of the automobile and housing industries. The former, autos, was suffering from too much inventory relative to sales, the need to expand incentives (a threat to auto industry profitability), lower used-car prices and a deterioration in subprime auto paper delinquencies. The later, housing, was threatened by stretched affordability and stagnating incomes.

To some, this contradiction is natural, but it is not natural to me.

Bottom Line

The hurricanes experienced over the last two weeks will result in a restoration and not in an incrementally improved and more productive US economy.

Think “The Broken Window Fallacy.” Destruction does not benefit an economy.

I remain bearish on both stocks and bonds.

Get Varying Expert Opinions in One Publication with John Mauldin’s Outside the Box

Every week, celebrated economic commentator John Mauldin highlights a well-researched, controversial essay from a fellow economic expert. Whether you find them inspiring, upsetting, or outrageous… they’ll all make you think Outside the Box. Get the newsletter free in your inbox every Wednesday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.