Blockchain Tech: Don't Say You Didn't Know

Currencies / BlockChain Sep 19, 2017 - 03:06 PM GMTBy: The_Gold_Report

Lior Gantz, founder of Wealth Research Group, discusses blockchain technology and one company that is harnessing its power.

Lior Gantz, founder of Wealth Research Group, discusses blockchain technology and one company that is harnessing its power.

"You can't stop things like the blockchain. It will be everywhere, and the world will have to readjust. World governments will have to readjust" – John McAfee, Founder of McAfee

As you're aware by now, the world's largest corporations and most governments are already testing the incredible potential of it.

- Australia, Japan, and Germany are all prototyping blockchains for their stock exchanges.

- NASDAQ is also running test trials, and the TMX is already using blockchain tech for oil and gas contract trading.

- The U.S. Department of Defense is now integrating blockchain tech for secure chat-based platforms—they hold it in high regard when it comes to security.

- The Ethereum Alliance is basically composed of Fortune 500 companies that are seed investors in the cryptocurrency that HIVE is going to mine soon.

I was fortunate enough to learn about Bitcoin in the summer of 2012. To give an idea of how Bitcoin looked back then, examine the chart below:

This chart starts with the first trading session of Bitcoin for the price of $0.05 and ends with Sept. 11, 2017.

All in all, from $0.05, Bitcoin had reached over $4,700.

Mining is the backbone of cryptocurrencies because it is miners who allow transactions between the community participants to be validated.

As said, I learned about it in July of 2012, when it was $8.75. I bought it personally in November of 2012 and then more of it beginning January of 2013. I began exiting at $119, all the way to $420 in late 2015.

The newsletter I founded is Wealth Research Group, and in November of 2016 and February of 2017, when the price of Ethereum was $10.35 and $12.80, respectively, we alerted members of the free newsletter to consider owning this particular coin.

From $12.80 in February of this year, it reached roughly $400 by Sept. 1, and as of Sept. 11, 2017, it trades for $294, a 2,300% gain from our suggestion alert.

Today, I want to make sure you know about a company that starts trading on the Sept. 18, the date of this article's release.

It's the connecting bridge between the immense stock market investor pool and the tiny cryptocurrency sector.

My goal for months was to find a way for tech-reluctant investors to get involved because it is the future of financial services. This means those who do not wish to buy cryptocurrencies on their own, store them in a wallet and handle the technological aspect of it all can still get maximum exposure to blockchain technology.

As I see it, we are on the cusp of entering a phase similar to the 1990s, where ordinary investors made millions by investing early with companies that became the dominators of the Web, and a new wave of companies are about to reap the rewards from the explosion of blockchain technology.

The only company Wealth Research Group has been able to fully vet and conduct thorough due diligence on, which has no holes for us to poke at, is HIVE Blockchain Technologies Ltd. (HIVE:TSX.V; PRELF:OTC).

HIVE Blockchain Technologies is emulating Steve Jobs' genius approach by opening up the cryptocurrency and blockchain world to the trillions of dollars in investor funds sitting on the sidelines because they don't want to own unregulated, newly formed cryptocurrencies, but they understand the significant growth potential of blockchain technology itself.

Fiore Corporation wisely partnered with the largest cryptocurrency mining company in the world: Genesis Mining.

The model and partnership are simple as HIVE Technologies:

- Is acquiring one facility purchased from Genesis Mining, with the option to purchase more.

- Plans to generate profit from mining the most profitable coin using state-of-the-art computing power and algorithms.

- Next, it intends to allocate profits to cover all operational costs and grow the business rapidly by reinvesting it to consolidate competition and rule the blockchain industry.

- Lastly, it looks to hoard a strategic quantity of the mined coins for maximum leverage to rising prices.

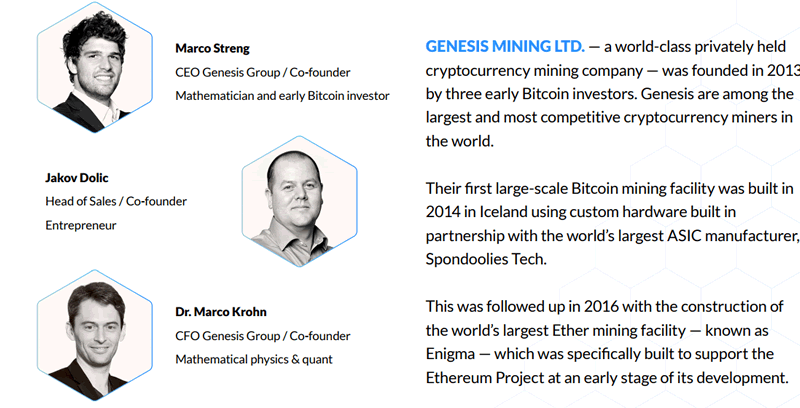

The brains behind Genesis are three of Bitcoin's earliest adopters.

You might have seen Marco Streng on numerous interviews and lectures, as he is considered the smartest man in blockchain technology worldwide.

These three are the operational experts who will navigate the technological aspect of HIVE and propel the growth engine towards the ultimate use of shareholders' funds.

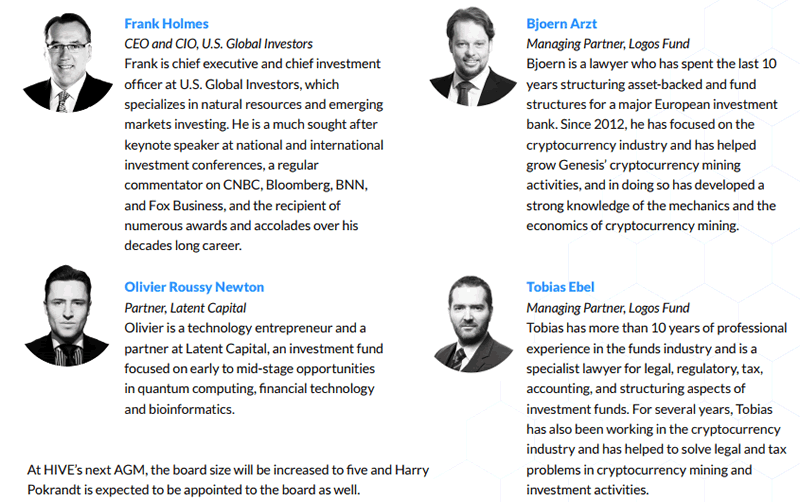

Now, the management team has fund manager superstar Frank Holmes, who is a multimillionaire and one of the seed investors in Goldcorp, one of the world's biggest gold miners, so he knows exactly how to build a business into a monster and over-deliver for shareholders.

In my numerous conversations and face-to-face meetings with Fiore Management and Frank Holmes, along with the company's CEO, Harry Pokrandt, I have the impression that they know they're onto something unique and their timing is perfect.

This is the only blockchain stock I plan to suggest—HIVE Blockchain Technologies (HIVE:TSX-V & PRELF:OTC).

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Lior Gantz: I, or members of my immediate household or family, own shares of the following companies or cryptocurrencies referred to in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: None.

HIVE Technologies has a marketing agreement with Wealth Research Group. My company has a financial relationship with the following companies referred to in this article: HIVE Technologies. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.