The Magnitude of Job Loss We Will See in the Next 20 Years Is Staggering

Economics / Employment Nov 02, 2017 - 12:54 PM GMTBy: John_Mauldin

In the next 20 years, we will see more change and improvement than we’ve seen in the last hundred. Think where we were 100 years ago and how much has changed since then. That much and more is going to happen in the next two decades.

In the next 20 years, we will see more change and improvement than we’ve seen in the last hundred. Think where we were 100 years ago and how much has changed since then. That much and more is going to happen in the next two decades.

Global society really is going to transform that fast.

Let’s Start with Some Good News

In 1820, about 94% of the world’s population lived in extreme poverty. By 1990, the figure was 35%, and in 2015, it was just 9.6%.

Research shows that, on a global basis, the poor are getting richer faster than any other group. However, if you look around the US or Europe, that is not the conclusion you come to. But Africa or Asia? Absolutely.

Let’s be clear: The Industrial Age and free-market capitalism, for all of its bumps and warts, has lifted more people out of poverty and extended more lives than has any other single development.

Because of where the emerging-market economies are in the development cycle, they have the potential for vast, rapid improvement in the lives of their people.

But most of you do not live in the emerging markets. We live in the developed markets, and here, some of the outcomes of the coming transformation will not be so comfortable.

I’ll give you three examples that show the vast implications of the looming paradigm shift.

The Oilfield Industry Retransformed in Two Years

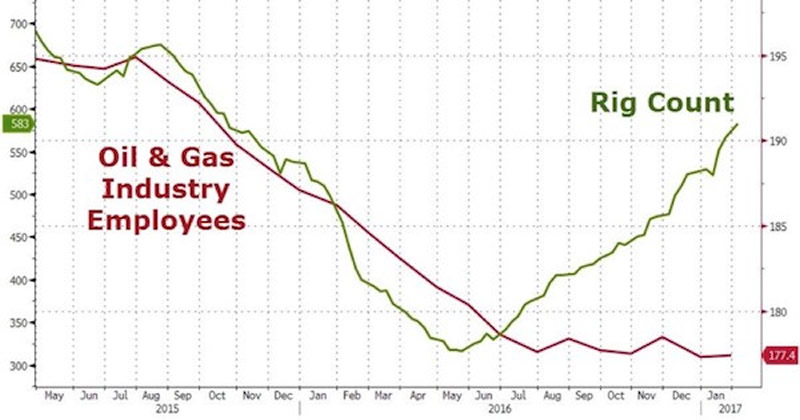

Let’s start with this chart (hat tip, Downtown Josh Brown).

Obviously, the rig count in US oilfields is rising rapidly—no surprise there. But distressingly, the number of oilfield workers is continuing to fall. How can this be?

The answer is a new robotic machine called an Iron Roughneck that reduces the human labor required to connect pipe from a crew of 20 down to a crew of five. And those jobs were quite high-paying.

Now look back at the chart. The amazing thing is that this transformation happened in two years; it didn't take a generation or even half a generation. You were an oilfield worker with what you thought was potentially a lifetime of steady, well-paying— if dangerous, nasty, and dirty—work. And then BOOM!

The jobs just simply disappeared. Your on-the-job experience doesn’t translate to any other industries very easily, and now you and your family are on the skids.

The Automation of Driving

RethinkX, in a 77-page report, concludes that 90% of all driving in the US will be TaaS (transportation as a service) by 2030, although that will utilize only 60% of the cars.

The report projects that the adoption of TaaS will come about in typical technological adoption fashion: slowly and then seemingly all at once. The authors talk about the end of individual car ownership.

And it is not just the six million taxi and truck driver jobs that are threatened. Automated driving will save some 30,000 lives per year just in the US, which is something to be applauded. But it will also dramatically decrease the number of people going to emergency rooms from automobile wrecks, reducing the need for healthcare workers.

Since cars won’t be in wrecks, the number of people required to repair them will be radically reduced. There are 228,000 auto repair shops in the country, employing some 647,000 workers (at a minimum – data from BLS).

If driving is TaaS, then automobile dealerships are in trouble, as are most car salesmen and the 66,000 people who work in automotive parts and accessories stores. What about auto insurance salesmen? And all the gas stations that will not be needed? (When an automated car gets low on electricity, it will simply pull into a spot and replug – automatically, of course, aided by robotics.)

The US auto industry employs 1.25 million people directly and another 7.25 million indirectly. Not all driving jobs will be lost, but the authors estimate that around 5 million will be, with a reduction in national income of $200 billion.

And if we need fewer cars? That shift would put a lot of automotive manufacturing companies and their workers under severe strain.

The End of Cancer and Many Careers

I was talking with my friend Dr. Ray Takigiku, chief executive and chief scientist of Bexion Pharmaceuticals. The company is now 15 months into a phase I trial to determine the safety of a drug called BXQ-350, which is basically a full-on silver bullet for mass-tumor cancers.

It has so far been a small trial in four medical research universities, with a limited but growing number of patients who have pancreatic cancer and brain tumors. The results have been very promising.

Full disclosure: I was a first-round investor in Bexion, and so I have a strong home-field bias in wanting BXQ-350 to succeed, but the reality is that its success will be extraordinarily good for humanity.

But let’s think for a minute about the impact of the success of a drug of this type beyond the many lives that will be saved and the significant reduction of pain and suffering. I couldn’t determine the number of healthcare workers specifically associated with the treatment of cancer, but it has to be in the hundreds of thousands, and they have relatively high-paying jobs.

Then there are all the hospital beds filled by cancer patients – easily many tens of thousands. Plus all the ancillary workers that are associated with the care and welfare of cancer patients.

Kyle Bass gave me the estimate that at least $500 billion of market cap in big Pharma will be destroyed by a cure for cancer.

The Clock Is Ticking

So there are just three examples of major disruptions to employment that will be caused by near-future technological change. We haven’t even gotten into the brick-and-mortar retail jobs that online sales firms like Amazon are taking away. And warehouse workers?

The list could go on and on of whole job classifications that are endangered species. These changes are going to disrupt our lives and the social cohesion of our country. And of course these shifts are coming not just in the US, but in the entire developed world.

And even technology centers in the developing world are going to find themselves at risk of employment dislocations.

Just so that I don’t appear to be a total Gloomy Gus, let me quickly note that the very technologies that are destroying jobs are also going to result in tens of millions of new and in many cases better jobs. Many of them will be high-paying, more life-fulfilling, and far less dangerous than the occupations they replace.

The glib answer to the question, “Where will the jobs come from?” has always been “I don’t know, but they will.” That is what has always happened in the past. We went from 80% of laborers working on the farm in the 1800s at barely subsistence-level incomes to 2% producing far more food today.

But that transition took place over 200+ years—10 generations. There was time for people to adjust and for markets to adapt. Even when whole industries appeared and then disappeared again, it happened over generations.

The transformations I am talking about are going to happen in one half a generation, or at the most a full generation. That is not much time for adjustment, especially for a country like the United States, where 69% of families have less than $1,000 in savings. (I have seen the figure quoted that 47% have less than $400.)

Join hundreds of thousands of other readers of Thoughts from the Frontline

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.