PetroYuan Can Accelerate the De-Dollarization

Currencies / China Currency Yuan Nov 15, 2017 - 03:36 PM GMTBy: Submissions

The move away from Petrodollar

The move away from Petrodollar

In 1974, US President Richard Nixon and King Faisal from Saudi Arabia struck a deal. This deal gave birth to the petrodollar system which still lasts until this day. The deal involves Saudi Arabia selling oil to its largest buyer back then, the U.S. In turn, the U.S. provides Saudi Arabia with money, military aid, and political support. The Saudis then reinvest billions of their petrodollar revenue back in U.S. Treasury bonds.

Since that seminal deal, Oil has traded in U.S. dollars almost exclusively, even when the buyers and producers are not American. The consequence of the dollar-for-oil trade is massive. It creates a huge demand for dollars, therefore establishing US Dollar’s hegemony in world trade. The arrangement has also allowed the U.S. to run a huge deficit and borrow money at very low interest rates to finance the U.S. spending and growth for the next 4 decades.

In recent years however, several nations have tried to abandon petrodollar. The incentives come from the increasingly used tactic of economic sanctions by the Western nations. Washington for example has targeted the Russian economy and imposed an economic burden to force Moscow into submission. In response, Russia has gradually moved away from the reliance to U.S. dollar. Russia worked with China to create alternative to the SWIFT payment system which is not controlled by Western interest. China and Russia have also agreed to use yuan and ruble for bilateral oil trading. A non-dollar trading system will allow countries to bypass and counter the impact of the sanctions. This move away from petrodollar has lessened the US ability to use the dollar as a weapon.

The Alternative of Petroyuan

Today, China is replacing the U.S. position as the top oil importer. From China’s point of view, it makes sense to use Yuan to price the world’s most important commodity. Just as petrodollar creates more demand for US dollar and support U.S. economy in the past 4 decades, petroyuan can also stimulate demand for things in China, whether goods and services, Panda bonds (yuan-denominated bonds), or securities.

To this end, Beijing is said to introduce oil futures benchmark denominated in Yuan in coming months. In July, the Shanghai INE (International Energy Exchange) has completed four-step trial in crude oil futures denominated in yuan. The INE would try to launch it by the end of the year. In the bid to establish petroyuan, in recent years China has also been actively courting the biggest oil producer, Saudi Arabia, to accept Yuan as the currency for oil trade. Many believe that as soon as Saudi Arabia moves to accept Yuan for oil trade, the rest of the oil players may follow suit. The issue however is China’s closed capital market and the inability to move Chinese currency out of the country. To alleviate this fear, China is said to provide an option for the oil producers to convert the Yuan to physical gold in Shanghai / Hong Kong exchange.

For sure, it won’t be easy to replace the dollar and there are still challenges as China needs to convince major countries to participate. In addition, Saudi Arabia can meet a blowback from their long-term ally the U.S. Recent development however suggests Saudi Arabia’s relationship with China is getting warmer. In May this year, King Salman oversaw the signing of deals with China worth $65 billion. King Salman also publicly said he hoped China can play a greater role in Middle East affairs. Then in August this year, China and Saudi Arabia inked another $70 billion of new deals. The deal includes investment, trade, energy, postal service, communications, and media.

Although U.S Dollar may not lose its status as the world reserve currency overnight, the launching of Yuan-denominated crude oil benchmark can mark a new beginning of the end of Petrodollar.

What happens to dollar and Oil with the introduction of Petroyuan?

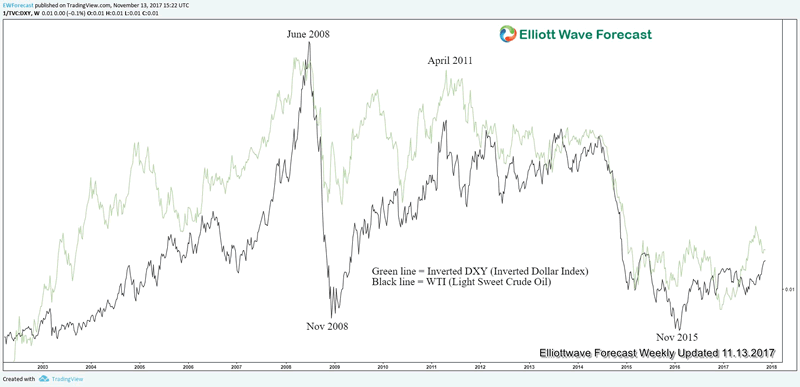

An overlay of weekly chart between Oil (CL_F) and inverted DXY (Inverted US. Dollar) above shows a strong positive correlation between the two. When Oil prices go up, the inverted DXY chart also goes up which means that US dollar declines. They also have the same major tops and bottoms in 2008, 2011, and 2015.

The introduction of Yuan-denominated oil futures benchmark by China in coming months may represent a big shift in the global order. It could potentially start the progressive decline in US Dollar. To start, there will be lesser demand for U.S. securities across the board. Secondly, Carl Weinberg, chief economist at High Frequency Economics estimates it will take away between $600 billion and $800 billion worth of transactions out of the dollar.

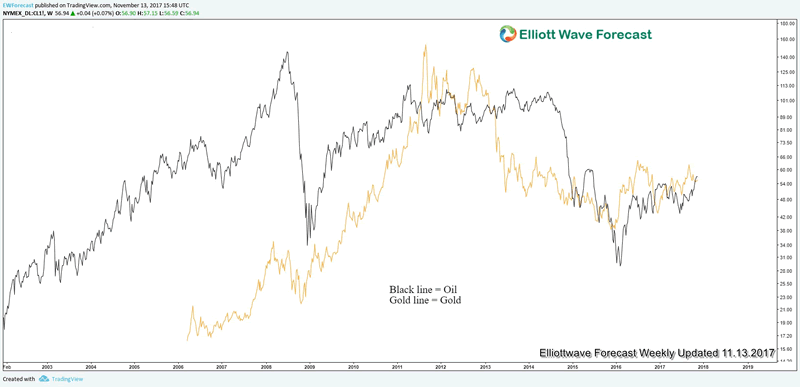

Based on the correlation chart above, we should also see Oil priced in dollar starting to rise as the U.S. dollar lose its value. Not only that, we should also see Gold and other commodity’s price rallying in dollar’s term. The chart below shows an overlay between Gold and Oil which also shows a positive correlation

If you enjoy this article, check our work and join Free 14 days Trial to see Elliott Wave Forecast in 78 instrument, including Oil, Gold, and Dollar Index (DXY) as well as getting access to Live Trading Room, Live Session, and more

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.