Bitcoin Smashes Through $18k… and Now $19k As Insane Jim Cramer’s “Kibosh” Threat All Hot Air

Currencies / Bitcoin Dec 17, 2017 - 03:34 PM GMTBy: Jeff_Berwick

Many people thought that once bitcoin futures began trading on the CBOE that it would allow Wall Street to smash the price of bitcoin lower.

Many people thought that once bitcoin futures began trading on the CBOE that it would allow Wall Street to smash the price of bitcoin lower.

Or, as Jim Cramer said, “kibosh” bitcoin.

Of course, if you listen to anything Jim Cramer has to say, well chances are you’ve lost a lot of money.

As you can see, he said that bitcoin was going to get “kiboshed” when it was below $15,000.

And, bitcoin has soared since.

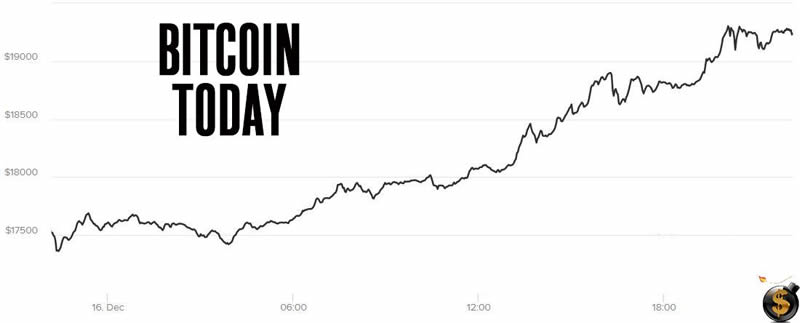

It surpassed $18,000 at 7:00am and 7 hours laters it flew past $19,000!

It looks more like Jim Cramer is getting kiboshed than bitcoin is.

But, then again, it was only six months ago that Cramer said bitcoin was going to $1 million because people needed bitcoin to pay blackmail.

He’s clearly insane.

As far as market capitalizations go, bitcoin now has a higher cap than Bank of America, Wells Fargo, Walmart, and Visa.

Perhaps the most satisfying milestone for bitcoin will be when its market cap surpasses that of JP Morgan’s at $368 Billion. As of today, bitcoin sits at a $323 Billion market cap which now puts it within spitting distance of JP Morgan at just $45 million dollars shy.

It probably irks Jamie Demon that he wasn’t able to pick up more bitcoin while it was cheaper.

In our last issue of the TDV newsletter, this past weekend, Senior Analyst Ed Bugos put to rest a lot of the myths that bitcoin futures trading on Wall Street meant the globalists could crash bitcoin.

In fact, with a massive new pool of capital having access to bitcoin exposure it is more likely that it will send bitcoin rising higher… which is what we have seen so far.

Sure, at some point, bitcoin will crash again. But a major crash likely isn’t going to happen until everything else, including the stock market, crashes as well.

That’s because everything is in a bubble now, caused by more than eight years of central bank money printing. And, when it does pop, as it last did on the Shemitah end day in 2008, it’ll take most things down dramatically with it… including possibly bitcoin.

Stanley Druckenmiller agreed with us this week when he said that until the "everything bubble" bursts, bitcoin will be safe.

In the meantime, Jim Cramer has done what all mainstream analysts do and hedged his bets. If bitcoin goes to $1 million he can say he was right. And, if bitcoin crashes along with everything else in the next central bank created crash he can say he told us it was going to get “kiboshed”.

And, if you keep watching CNBC you’ll eventually lose all your money.

Stick with us here at The Dollar Vigilante where we have held steadfast to our buy recommendation on bitcoin since it was $3 in 2011… which is now over a 600,000% gain for TDV subscribers (you can subscribe HERE).

And join us this February for Anarchapulco, Cryptopulco and the TDV Summit which will be the epicenter of the cryptocurrency space for that entire week.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.