Gold Stocks Bull Market and Crash Analysis

Commodities / Gold & Silver Sep 04, 2008 - 10:48 AM GMTBy: Neil_Charnock

This is Part 2 - Big Bang – big bang for your buck – isn't that what investors want? Yes we all want the ten bagger or better. But where is one going to come from next. As I said in the first article – Big Bang Part 1. “Haven't the easy pickings already been taken this far into the PM Bull? After all the low hanging fruit has been taken hasn't it? You can see that from the charts on the HUI and the XAU can't you? That is not to say these magnificent indices will not go higher but I am talking about the easy pickings and leverage.”

This is Part 2 - Big Bang – big bang for your buck – isn't that what investors want? Yes we all want the ten bagger or better. But where is one going to come from next. As I said in the first article – Big Bang Part 1. “Haven't the easy pickings already been taken this far into the PM Bull? After all the low hanging fruit has been taken hasn't it? You can see that from the charts on the HUI and the XAU can't you? That is not to say these magnificent indices will not go higher but I am talking about the easy pickings and leverage.”

Let's take a more careful look at some investments that have the potential to deliver this kind of return over the medium term and some which may return solid 2-3 and 400% returns even over the next several months. The sector I want to examine closely here has to launch and break free of the heavy and exaggerated down trend it has suffered over the last 10 months – it has to confirm or bets are off. There is a compelling thesis that this is a fair probability however and this is therefore worth examining. The magnitude of the fall can be explained yet it is not due to the company fundamentals or the price of gold. So to examine this carefully we have to take a close look at this magnitude in addition to other factors.

Buying patterns have changed the past few weeks and this may indicate things may be about to reverse. Some stocks which have looked dead and buried (price wise) are still showing signs of life as the selling abates and some tentative buying emerges. The lack of volume in the selling may be alluding to sell side exhaustion and now the buying we are seeing is a strategic and carefully planned mop up operation. I have observed stealth like buying with bids emerging only when offers are placed – and even then the entire parcel is not usually taken. This leaves the ask at the same price until another parcel is offered allowing for greater volumes to be consumed without pushing up the price. Once these savvy players are set and gold heads back up and confidence again returns the up move will accelerate.

For other illiquid stocks sitting at bargain levels I have also seen a quick push up in price spurred by a hefty purchase or two. This dislodges shares from relieved weaker hands, relieved that the price has actually moved counter trend and gone up a little. There is blood every where in the smaller and emerging producers yet gold is still at $950 in AUD terms thanks to a recent fall in the Aussie Dollar.

This is a time to buy – when nobody wants these unloved companies and there are some gems amongst them. These are the obvious targets and the focus of my growing interest. Growing operations set to expand and develop healthy balance sheets – stocks that do not have to borrow and that are making a profit even before they progress their production to higher levels and greater economies of scale. Before I launch into further analysis it is worthwhile examining the story so far so let me take you through some recent action – a recap of the Bull to date.

The Story So Far

The gold stocks Down Under started late in this 7 year gold rally (currently 7 years – so far) due to Aussie Dollar factors – much like the Euro and some other currencies. Back in 2001 we were picking up larger cap stocks at bargain prices and enjoyed easy pickings. Most of the smaller cap gold sector failed to move much however because the Aussie Dollar strengthened against the USD based price of gold diminishing gold's price rise in Aussie Dollar terms.

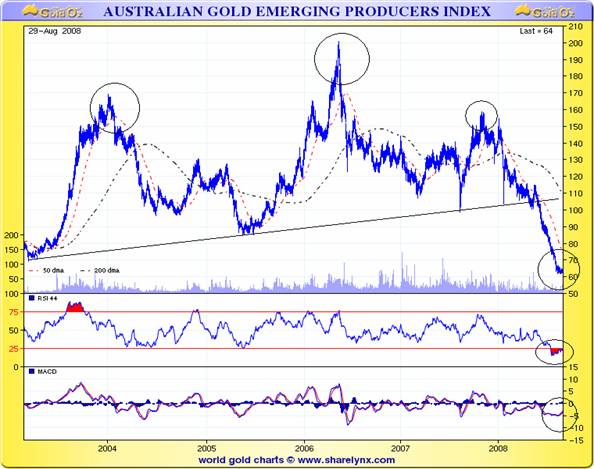

During 2003 however we saw a magnificent initial rally in the Juniors and Emerging Producers at that time from July 03 to the end of December 03 which is the top left hand circle on the chart below. Of note we have just reached the 5 year anniversary of the beginning of that rally seen at the far left hand side of the chart. A savage drawn out 16 month correction then followed from that end of 2003 high. We had to wait four quarters for the second quarter of 2005 for the next run to begin however - and the rally that followed lasted almost into the gold peak of May 2006 (second top circle). The larger stocks and higher growth stocks took off even before the end of the financial year at June 30 and the bulk of them followed for the rest of the year.

During this phase of the Bull the stocks diverged as their price surge stalled late in the gold price rally - and then began to fall as gold briefly went on and finished its rise to the $730 level. At that time the Australian dollar hovered under the US80c level so gold in AUD terms was actually around $930 at the top of the market. This was significant because the AUD gold price had only broken the $AUD580 level in mid 2005 – the run up to $930 was a cracker.

The drop that followed was sharp in gold and the gold stocks, gains were quickly wiped out for those that had not taken profits and stepped aside. Gold staged a long sideways consolidation for 16 months and the gold stocks continued to head lower in stages giving only brief purchase opportunities but these opportunities were there for traders – not longer term investors. This was completed by August 2007 just as the Sub Prime debacle struck and the gold stocks had begun a rally of sorts a few months earlier.

The August correction was sharp and pushed the stocks down to the base support trend line shown in my chart. Yet our S&P300 Metals and Mining Index (XMM) rallied higher into November where I have placed my third top circle. Gold had reached $US800 by November however the smaller gold producers had not responded well with only relatively meager rises for most companies. This was the end of that gold stock rally as you can plainly see even though gold went up for a further 4 months and by over 20% to the top.

During 2007 most of this group of companies made highs that were to be set above the highs of 2008 despite gold's strong run to March this year - equities (even gold ones) were out of favor. It is interesting to note that even though these stocks made higher highs in 2007 as gold shot forward initially – they then fell as gold continued forward into new price territory. This was long before the actual high in the gold and silver prices. This is not totally unusual and is actually normal on a smaller scale at the end of rallies. Gold stocks sell off and the metals finish their top formations – par for the course. But the scale was of note this time because many of us thought that gold was profitable to mine at these levels and the stocks diverged very early – in fact months before the top of the gold price.

Recent History – The Crash

The problem was that the institutions and leveraged investors were “too long”. Apparently everybody who wanted to get long was already in and as fear built the liquidity disappeared. There were no buyers and plenty of sellers and they had to take what ever price they could get to meet margin calls.

As the credit crisis spread and leveraged investors were getting creamed (we warned about this practice – not a big fan) a large broker bit the dust – one that specialized in margin buying. A big bank was also in deep and sustained losses and had to liquidate in the illiquid conditions and down came the gold stocks in the face of record gold prices. As gold went higher and higher the shares just kept diving.

The smaller less liquid stocks were hit hardest of all and I have now pointed to the emerging producers as the best investment I have seen in years. They are at their deepest – over sold level on the whole chart below at a time when they have made great progress with their operations. Here is a chart of a special index that Nick Laird from Sharelynx has prepared for my website – it is made up of 20 emerging producers and is not weighted so it is not distorted by the largest of the stocks included.

Notice the first two gold up-legs and the lack luster third rally which failed as equities fell out of favor – all marked by the upper circles. The third peak came in the October to November period just as gold neared its historic 1980 high of $850 and ran up straight out of the initial sub prime disaster smack down. This third top was over 4 months before and $180 below the eventual POG top providing a stark illustration of the beginning of the dislocation that has occurred between the physical gold price and the companies that produce the king of the metals.

Note the break down through the up-sloping support line earlier in the year. This was a major break down and signaled the last keep clear warning. Also notice the lower indicators – RSI and MACD both turned up now from oversold levels. The RSI indicator reached a multi year and a new gold bull low to date low at well under the 25 level. We now have the potential to launch another gold price and PM stock rally and the timing becomes the only question.

With the price of gold strong in historic terms and currently oversold, having held the fierce correction to the 20 month moving average (which has held every other deep correction in the last 7 years) we have a high probability of a base somewhere down here too. Falling production and increasing demand from Asia is highly likely to assist it to hold healthy price levels – the COT position now looks positive too. Other fundamentals are in place to support the price and drive it back once this correction has run its course. These are difficult financial times when gold is at its most attractive as an asset class.

Now we come to the buying season and gold is set to rebound as it is heavily oversold on at least a short term basis. We are approaching the five year anniversary of the beginning of the 2003 rally and I am carefully watching to see if we are going to base out for a time or begin a sharp rally. The fundamentals for gold have not changed. The Australian dollar has sold off heavily so the risk of converting from other currencies to purchase here has largely diminished.

I have just finished construction of a gold stock producer quotes page in my web site – a free feature (this is not a plug) – and have included links to each producer so off shore visitors and Aussies can get access to up to date quotes for this whole sector on one page. All gold producers together on one page seemed like a good way to group it all for my own use as well. I included the 2008 high for each stock in a separate column and also marked the lows for each.

To mathematically illustrate how oversold the larger and smaller producers actually are I compared the high of this year for each stock to the low for each stock – lows mostly made a few weeks back. I then calculated the percentage fall for each. The worst hit stocks have been hammered over 80% and there were three of them. I have included 44 companies and our ETF code ASX-GOLD. So 6.6% of these producers made lows at minimum 80% below their high for this year which remember – was lower than the highs of last year when gold made $US800+ for the first time in 27 years.

Ten stocks fell between 70 and 79.9% which makes 22.7% of them in total. Thirteen or 29.5% of these companies fell by 60 – 69.9% and eleven or 25% fell by 50 – 59.9%. Only six companies (13.6%) fell between 40 and 49.9%. A cross listed major NEM only fell 28.2% and the ETF only fell by 20.63% because it is linked directly to the Aussie dollar price of gold. This mauling would look worse if I took the 12 months highs back into late 2007. Only one stock made a recent new high and promptly sold off again but that was significant.

Investors that pick off the cream of these stocks now and in the near future – and all of these stocks have their time in the sun when their operations flourish and grow rapidly – will reap the kinds of returns I speak of at the beginning of this article. Pick the ones that have enough cash and an operational plant and are at a point where they will expand production significantly and you will reap the rewards. For those that buy now and wait patiently for the other end of the cycle when euphoria is high and gold stocks are in the media – you will then be able to bag those awesome returns investors all dream of.

Good trading / investing.

Regards,

Neil Charnock

GoldOz is currently developing a Member area and has added further resources for free access. We have stepped up our research and stand by to assist investors from all walks of life. We sell an updating PDF service on ASX gold stocks from only $AUD35 for 3 months – the feedback is grateful and enthusiastic because we are highlighting companies that have growth potential and offering professional coverage of the sector. GoldOz web site is a growing dynamic resource for investors interested in PGE, silver and gold companies listed in Australia , brokers, bullion dealers and other services.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are his current opinion only, further more conditions may cause these opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.