The “Free Lunch Trade” Market Bubble Has Burst… What’s Next?

Stock-Markets / Financial Markets 2018 Feb 07, 2018 - 06:50 AM GMTBy: Graham_Summers

The markets just changed.

The markets just changed.

Few understand what happened to the financial system after 2008. What happened was that the debt based financial system began to implode as debt deflation took hold. The scary thing is that it wasn’t even a large amount of debt deflation.

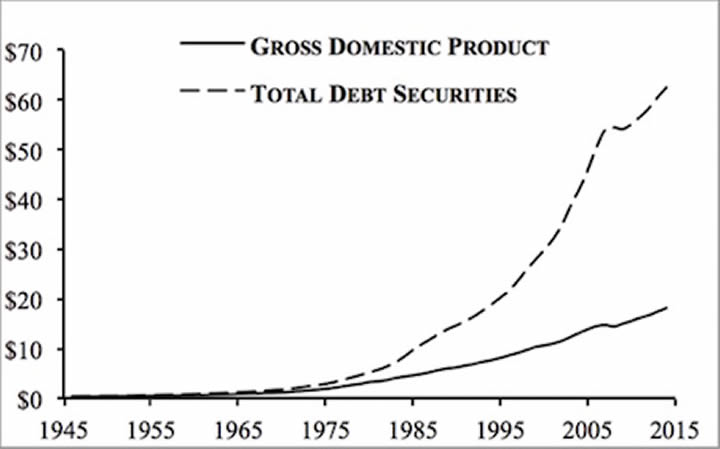

Remember the 2008 Crisis? That time when everyone thought the world was literally going to end? It’s that small dip in the dotted line below:

US Gross Domestic Product vs. US Total Debt Securities, Trillions US Dollars (1945-2016).

Note: Data adapted from Federal Reserve Bank of St. Louis (2017).

To stop a full-scale collapse, Central Banks attempted to corner the sovereign bond market via interest rates and QE programs. I realize that many will fail to grasp the significance of this so let me explain.

In our current financial system, in which no major currency is backed by Gold or any other finite asset, sovereign bonds represent the bedrock for the system. They are the “risk-free” rate of return or the standard against which all risk assets are valued.

Put simply, Central Banks attempted to corner ALL risk by controlling the baseline against which it was valued.

This created bubbles in literally EVERYTHING: corporate bonds, state bonds, stocks, commodities, real estate, and even tertiary items like passive investing and shorting volatility.

Those who went “all in” on “free money” trades like shorting volatility or risk-parity funds, were in fact simply investing in a derivative of The Everything Bubble: a tertiary bubble in the idea that investing came without pain and was the equivalent of a free lunch.

Here’s the breakdown:

1) Central Banks created a bubble in the risk-free rate or sovereign bonds, which lead to…

2) A bubble in stocks as money was forced into risk to find higher returns (the “There Is No Alternative” or TINA) bubble, which lead to…

3) A bubble in passive investing and shorting volatility… two sides of the same “stocks are never going to fall thanks to Centrals Banks” coin.

Yesterday, two these tertiary bubbles (the passive investing in risk-parity fund bubble and the short volatility bubble) blew up.

This is the beginning of a major market change.

I’m not saying that The Everything Bubble burst yesterday, I’m saying that volatility is back and that the tertiary bubble in passive investing and shorting volatility is over.

We now have to see how the secondary bubble in stocks holds up.

The time to prepare your portfolio is NOW before things really get ugly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.