Best 7 Worst U.S. Population Change

Politics / Demographics Mar 09, 2018 - 12:45 PM GMTBy: Harry_Dent

The Dems shut down government because of the ongoing immigration impasse.

The Dems shut down government because of the ongoing immigration impasse.

Only for a couple of days, sure.

But it’s THAT big of an issue across the political spectrum right now.

Trump wants a wall.

Trump wants the Dreamers out.

Trump even wants to put an end to legal family immigration practices, where new U.S. citizens get to sponsor green card applications for their family.

Trump’s an idiot. (Hey, you may not like to hear me say that, but we’re all entitled to our opinions.)

He’s oblivious to the negative impacts his isolationist tactics could have on future growth and prosperity in the U.S.

Of course, he’s the President, and he’s fighting a battle he believes his followers want him to fight. The question is, can the U.S. afford to curb immigration? To answer that question, we first have to look at our own population and migration patterns.

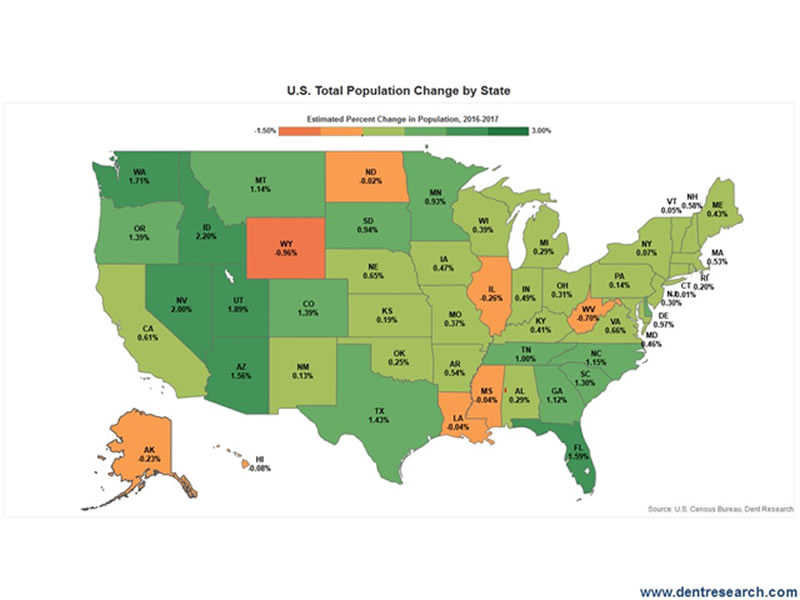

Although the U.S. population grew 2.2 million in 2017, or about 0.7% (a number that will decline ahead), the population growth is very different across the 50 states.

Look at this map. It shows the natural population growth by births over deaths per 1,000 residents to see which states are doing the best.

This indicator is the best for showing longer term growth beyond immigration and migration trends, which can change (something I’ll talk about another day).

The shades of green show higher growth while the shades of orange show lower growth or even a decline in a few states.

Guess who comes in first with the highest birth rates?

Utah, with its Mormons! It’s population growth rate is at 11.5%. Utah is the youngest state in the U.S., which bodes well for its future growth demographically.

The large state with the highest long-term growth rates is Texas (7.5%), with its mix of higher births, high immigration, and high migration from other states – it hits on all cylinders!

California is the other large state with high natural growth rates due to foreign immigration.

Then comes Georgia, Washington State, and Virginia.

But Florida is the surprising loser here at a mere 1.1% growth. That’s not surprising. It’s the retirement capital of America and has a lot of older people, despite strong migration and immigration trends.

The northeastern states are losing the most, like Maine (-0.90%), Vermont, Maine, New Hampshire, and Pennsylvania. The worst, of course, is West Virginia (-1.70%).

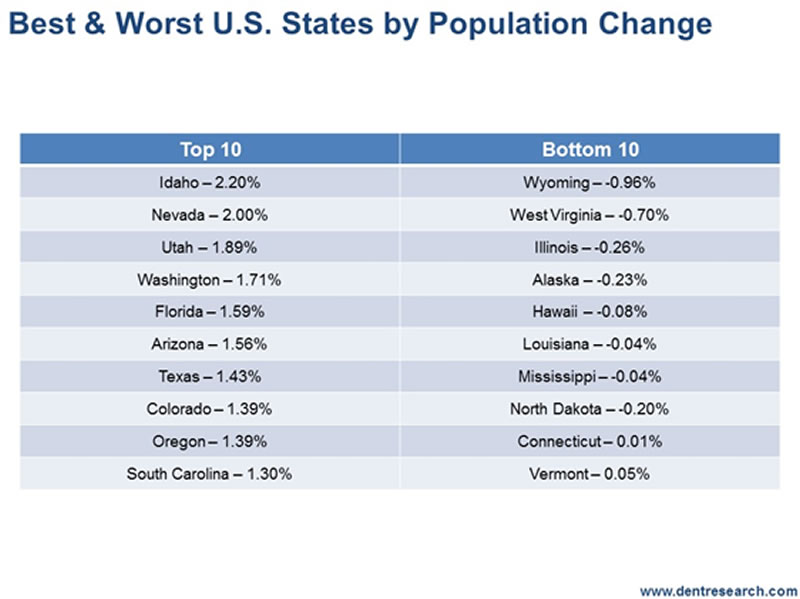

This table shows the top 10 and bottom 10 stats on natural population growth from births over death rates.

Where do you want to live or do business?

My vote is for Texas, which has four major cities with different lifestyles (my favorite is Austin where our next Irrational Economic Summit will take place in October). It’s has a zero state-income tax to boot!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.