Respite for Bitcoin Traders Might Be Deceptive

Currencies / Bitcoin Jun 06, 2018 - 12:10 PM GMTBy: Mike_McAra

There seems to be some respite for Bitcoin traders. It might be tempting to take this breather as a sign of the tide turning. We highlight the reasons why you probably shouldn’t.

There seems to be some respite for Bitcoin traders. It might be tempting to take this breather as a sign of the tide turning. We highlight the reasons why you probably shouldn’t.

In the last couple of days, Bitcoin has gone up a bit. This has brought questions if the current move is only a correction within a decline or already an important sign of a shift in the market. In an article on CoinDesk, we read:

Bitcoin looks primed for a move to $8,000, but low trading volumes point to the risk of a bull trap.

The cryptocurrency broke through a key descending trendline (drawn through the May 6 high to the May 21 high) on Sunday, adding credence to last Tuesday's bullish outside-day candle and signaling a short-term bearish-to-bullish trend change.

However, at the same time, daily trading volume fell 1.77 percent to $4.85 billion, according to CoinMarketCap. Further, rolling 24-hour trading volume currently stands at $4.95 billion – down 22.5 percent from the current quarterly average of $6.38 billion.

Low volume is a cause for concern for the bulls, as it is widely considered a sign that the market is approaching a peak; that is, the rally will be short-lived.

We have a slightly different take on whether Bitcoin is set to move above $8,000 – the currency might shoot up above this level but we haven’t really seen enough signs that this is the case just yet. Other than than, we generally support the conclusions of the cited couple of paragraphs.

Bitcoin is up and it went above the declining resistance line but this line might have just turned out to stop the appreciation. The declining volume seems to be a classic bearish indication. And we might see a daily close below this line today, which would be bearish as well. We still think that a move up can’t be ruled out but the move down we’ve seen today weakens the recent bullish signs.

Any Important Bullish Implications?

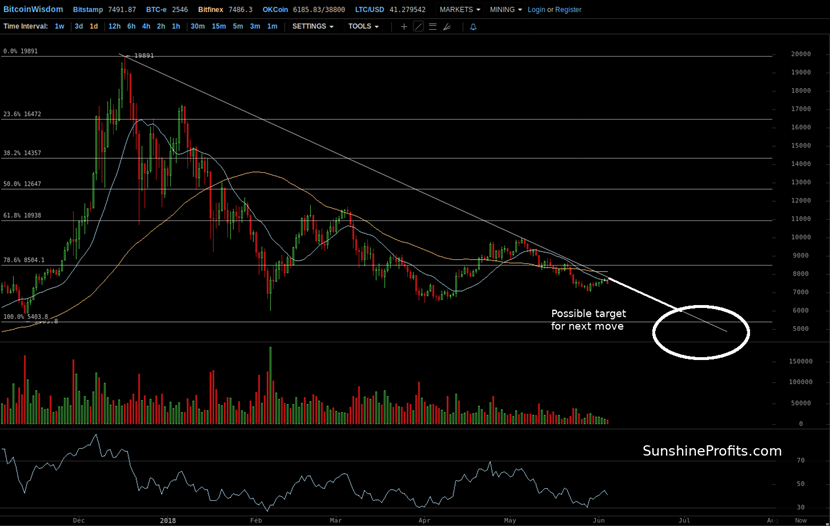

On BitStamp, we see the recent move up and the depreciation of today. The appreciation of the last couple of days brought Bitcoin above the 78.6% Fibonacci retracement level and this is a slightly bullish indication. Only slightly, because this particular level is not an extremely important one.

A more bullish indication is the breakout above the declining resistance line based on recent tops. This indicates that the move up might be stronger than the preceding ones but the fact that Bitcoin turned South today and is now closer to this level weakens the bullish implications slightly.

Have we seen very important bullish indications, though? Not really. Bitcoin is still below the 61.8% Fibonacci retracement level and the action hasn’t really changed the short-term outlook. And this is only for the short term, without really considering the bigger picture into account.

Verification in Disguise

On the long-term Bitfinex chart, we see the depreciation from $10,000 and the recent appreciation in perspective. In particular, the recent move up does seem like a correction within a larger decline. This is further reinforced by the long-term declining trend line. It might be the case that today’s move down is a bounce back down off this line.

Additionally, we see that in spite of the recent move up, we haven’t really seen a move above the 78.6% retracement level based on the rally to the all-time high around $20,000/ Actually, it rather seems that we might have seen a verification of the breakdown below this level. This is a bearish indication, at least for the longer term.

The current situation is quite curious in terms of the price action. We are seeing a move up on relatively low volume followed by one day of depreciation and the current environment looks like the late stage of a short-term correction within a long-term decline. This means that, in our opinion, the situation is still bearish and we might see a stronger move to the downside in the next couple of weeks.

Summing up, the decline might resume and become even deeper.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.