Is This a Big Sign of a Big Stock Market Turn?

Stock-Markets / Stock Markets 2018 Jun 15, 2018 - 03:15 AM GMTBy: EWI

Financial legislation might mean something different than most investors believes it means

A stock market warning has just developed for those who are bullish.

Here's what I'm talking about (CNBC, May 22):

The House voted May 22 to pass the biggest rollback of financial regulations since the global financial crisis.

In a nutshell, lawmakers want to get rid of onerous rules that have been placed on small and medium banks as part of Dodd-Frank, the law that was passed in 2010 to prevent another financial meltdown.

One might ask, "Why should bullish investors see this as a red flag? Isn't the loosening of financial regulations a positive for the stock market?"

Well, EWI has, indeed, observed a correlation between financial legislation and the stock market, but it's probably not what most investors expect.

Financial history shows that financial legislation tends to follow the stock market, not the other way around. Put another way, financial regulators implement reforms after busts and later turn optimistic and repeal or relax financial regulations after booms.

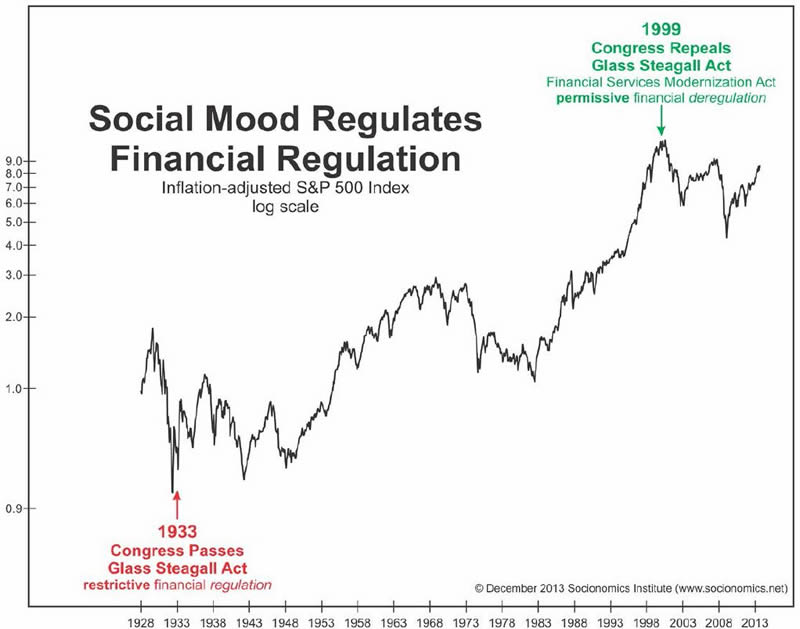

Besides Dodd-Frank, a historic example is Glass-Steagall, the first major federal legislation to separate commercial and investment banking. This law was enacted after the bottom of the 1929-1932 stock market crash.

The December 2013 issue of the monthly publication, The Socionomist, showed this chart and said:

In 1933, Congress passed laws designed to prevent the crash that had already happened. In 1999, Congress passed laws designed to encourage the rally that had already happened.

Notably, the stock market rallied after Glass-Steagall passed, and then some 66-years later, plummeted shortly after the law was repealed.

Yes, the government is usually the last group to act on a trend. If technical indicators are also pointing to a reversal, investors would do well to position their portfolios accordingly.

So happens, EWI's analysts are saying that many of the market's technical indicators are suggesting a major acceleration in the DJIA's current Elliott wave price pattern.

We just released this new, free report, 5 'Tells' that the Markets Are About to Reverse, that reveals many false indicators – a.k.a. "head fakes" -- investors see every day. The report helps readers separate themselves from the herd and survive (and thrive) in volatile markets. Read the free report now.

This article was syndicated by Elliott Wave International and was originally published under the headline Is This a Big Sign of a Big Stock Market Turn?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.