UK Interest-only Mortgage Prodcuts Double but Approvals Fall

Housing-Market / Mortgages May 08, 2019 - 09:41 AM GMTBy: MoneyFacts

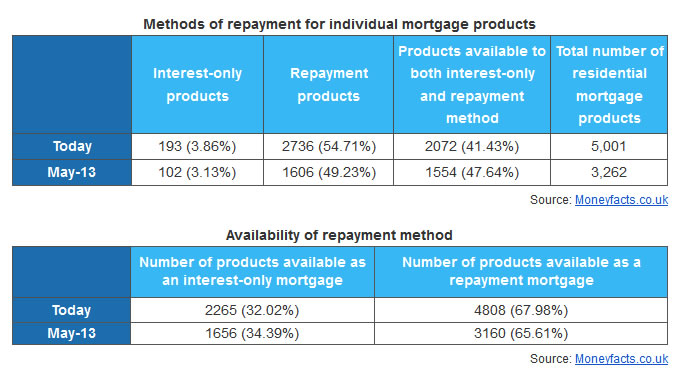

The latest research from Moneyfacts.co.uk shows that the number of interest-only mortgage products has almost doubled over the past six years, rising from 102 products in May 2013 to 193 products today. However, this increase in products has not led to a greater number of approvals of this type of product.

Figures released by the Financial Conduct Authority (FCA) and the Bank of England show that approvals for interest-only mortgages have fallen from 26,592 in Q1 2013 to 24,148 in Q4 2018*. This decrease comes despite overall residential mortgage approvals nearly doubling over the same period, from 183,900 to 323,700.

Darren Cook, Finance Expert at Moneyfacts.co.uk, said:

“These figures suggest that although borrowers are still able to locate potential suitable interest-only mortgage products – with around a third (32.02%) of all residential mortgage products offering interest-only as a repayment method – tighter rules and stricter lending criteria following the aftermath of the financial crisis may be leading to a lack of appetite for this sector.

“Apart from passing stricter lending criteria, it is essential that a borrower looking to apply for an interest-only mortgage first develops a strong and viable repayment action plan before approaching a potential interest-only provider. It is likely that the mortgage provider will request and scrutinise this plan early in the application process before proceeding further with the application.

“For those borrowers who may have reached retirement age while on an interest-only mortgage, the FCA has loosened the regulations on retirement interest-only mortgages. As a result, mature borrowers will now be able to find a much greater choice of retirement interest-only products that allow them to only pay their monthly interest on their mortgage until they die or go into long-term care when the property is sold to repay the mortgage capital.

“In fact, there are 193 residential mortgages currently available that have interest-only as the only repayment method, of which 44 products are retirement interest-only products.”

*FCA and BoE, MLAR Statistics, March 2019.

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.