Gold Miners and Inflation

Commodities / Gold & Silver 2020 Aug 28, 2020 - 10:13 AM GMTBy: Gary_Tanashian

I want to try to answer a subscriber’s question as clearly as I can because it really does seem to be more confusing than it actually is. It’s always made sense to me but I understand there is a promotion machine out there selling viewpoints and in the gold sector especially, it is often wrong-headed, lazy analysis using tired assumptions.

“I do have a couple of questions that relate to gold/gold miner stocks that I can’t seem to get my head around. No hurry on an answer, just when you get time: From time to time, you have mentioned that inflation would send the gold bugs scurrying for cover. I had always thought that gold would rise during inflationary periods so I can’t seem to get why inflation would not be good for gold. And on the middle ground; how would gold likely act if we experience a prolonged period of stagflation?”

Gold has utility against inflation. But depending on the cyclical backdrop other assets can have better utility than gold against inflation. Where gold really shines is on the counter-cyclical phases when things are falling apart. Then it is unique, as money and as a haven.

I try hard to make the point that the gold miners often rise during inflation but if/as gold under-performs cyclical commodities and assets their bottom line fundamentals are affected because in theory at least, their cost inputs are rising faster than the price of their product. So I am not bearish on gold miners during inflation. I am bearish on their fundamentals. Big difference. Some of the biggest gains in HUI have been during times that the fundamentals were degrading. That’s because the inflationist bugs are on board.

Conversely, some of the worst selling events happen while the fundamentals are screaming higher. Look no further than Armageddon ’08, the Q4 2008 deflationary crash in everything, as gold declined but it sky rocketed vs. everything but the US dollar and Treasury bonds. That was fuel to gold mining bottom lines and an epic buying opportunity. I equate this to inflationists giving up the ship when the inflation fails.

Unfortunately, a gold stock promoter will generally not look at these dynamics because they are a nuisance to the perma-bullish view. Similarly, perma-bears will not look at them either. Gold stock bears often point to the lack of inflation as a reason to be bearish on gold stocks. Wrong Way Corrigans, the whole lot of them. Which is why I came up with a little cartoon indicating the best macro fundamental conditions for the miners [generally, the larger the planet the more important the consideration].

It is also why I tell you that the moment things turn against the sector we will be aware of it and take action against it. Frankly, I don’t much like being a gold bug because it means I am not feeling good about the world’s situation, especially its financial and economic situation. And I don’t like being seen as a gold bug (I label myself that, but work with me here) because of some of the company I keep, by definition.

Everybody’s got an opinion on gold, a metal that stirs up peoples’ emotions like no other asset. Its value proposition is grounded in monetary honesty vs. a world of assets ginned up on printed leverage. But that’s a low bar. Gold is a rock. It is a pretty rock that has been seen as money for centuries. It is relevant in times – like now – of incredible monetary chicanery. It is for the long-term as we unwind this Keynesian experiment.

But gold miners are simply companies that dig the stuff out of the ground and they do it at cost. The cost rises and falls just as the price of their product rises and falls. But when costs rise better than the product, as often happens during cyclical inflation (look no further than 2003-2008) the investment value proposition in the miners fades.

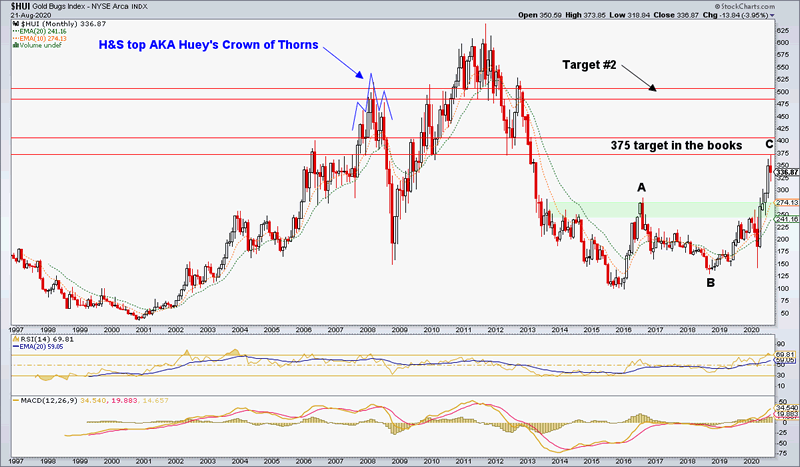

I used to call it the Crown of Thorns as the H&S top formed after years of inflationary markets. That was because the fundamentals had been flatlining or degrading for half a decade while the index rose. The fundamentals were good from 2001 to 2003 and that move was similar to what we’ve seen since 2018. The fundamentals tend to launch the sector. But then it becomes a cacophony of loud voices and wrong-headed rationale. So, our target is in the books and the next target awaits. But I would rather see the fundamentals stay intact or else as often noted, this becomes just another (inflated) sector.

NFTRH 617 then went on to fully cover and update the situation in gold, silver and the miners (including 28 charts of quality senior and junior miners, exploration and royalty companies) in a report that fully covered US and global stock markets, internals, sentiment, commodities, currencies and well, the whole shootin’ match. Check out an NFTRH subscription before the price increases on September 1st.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.