Markets Chop & Grind: Gold, Stocks & Commodities

Commodities / Gold & Silver 2020 Oct 06, 2020 - 02:02 PM GMTBy: Gary_Tanashian

Whether the market is foreign or domestic, equity, commodity or metal the grind is on. Speaking of grind, the one in gold has been expected as the metal builds out its big picture Handle to the bullish Cup with an objective that is much higher. Let’s take a look at a few NFTRH charts to gauge the grind in several markets and by extension, the grind many feel on their nerves these days. It’s not a time to make money. It’s a time to preserve gains and patiently position.

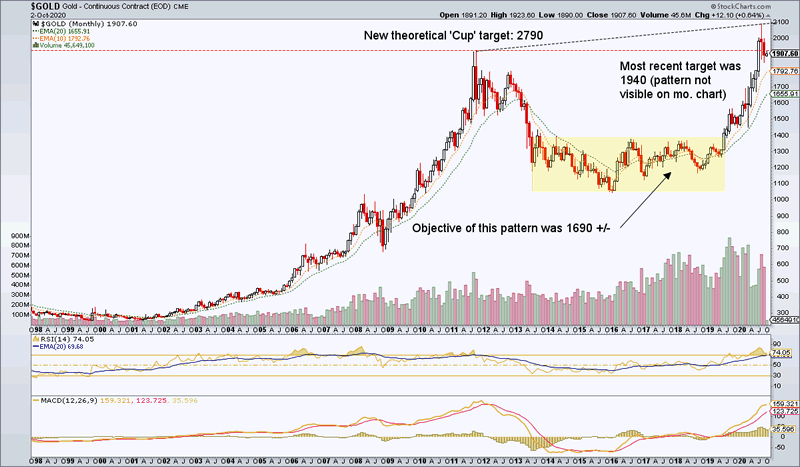

For gold the grind would be the making of a Handle after the Cup’s key higher high to the 2011 high.

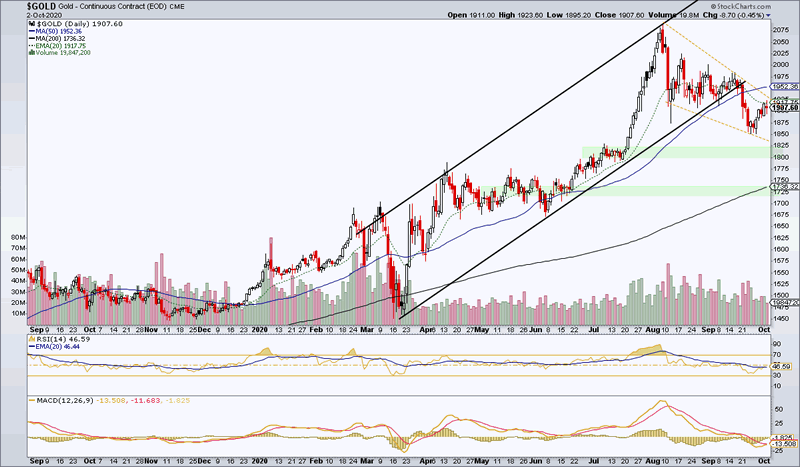

The daily chart below shows the form it is taking; a falling wedge toward the first support area just above 1800. If the monthly chart above is to make a substantial Handle the gold price correction could extend to a test of the rising 200 day average. RSI and MACD are negative.

Easy now, it’s not a prediction, but don’t let the perma-pompoms tell you it is not doable. Let’s keep it muted ladies.

With the SMA 200 trend firmly up, this is all indicated to be healthy bull market activity. The 2790 target is locked and loaded, perhaps in the second half of 2021 or early 2022.

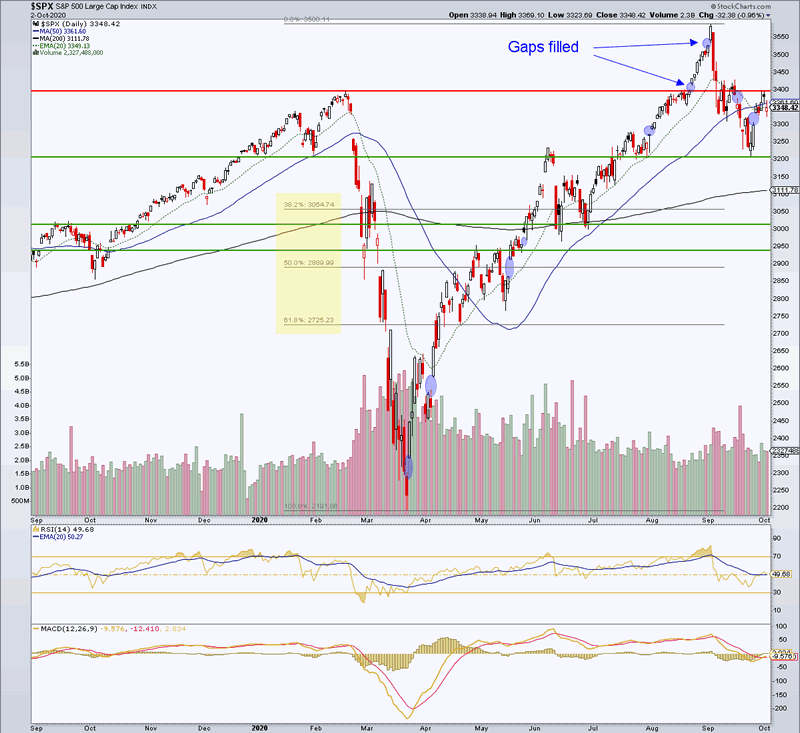

Moving on to the US stock market, the gap fest known as the daily S&P 500 (it’s companion headline indexes are gap infested as well) bounced this week, right to the lost ‘blue sky breakout’ point at 3400 and halted on a Friday featuring weaker than expected payrolls and a president infected with COVID-19. Usually inflammatory and negative market events out of the blue resolve bullish after a quick shakeout. But there are more elements in play than Trump’s health.

Frankly, I had been favoring a deeper correction to at least the 38% Fib retrace level and a test of the 200 day moving average. 3200 was our first, but not best correction target. Until this is resolved, the grind continues in stocks as well. RSI and MACD are negative.

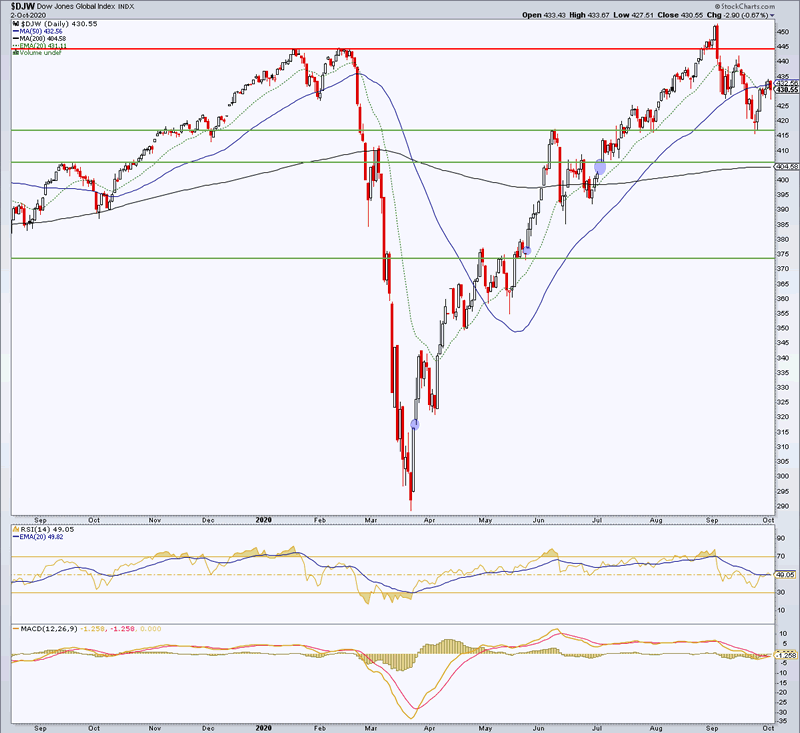

The Global index (daily) has some gaps of its own to think about after also losing blue sky. On Friday the 50 day moving average provided short-term resistance. RSI and MACD have gone negative.

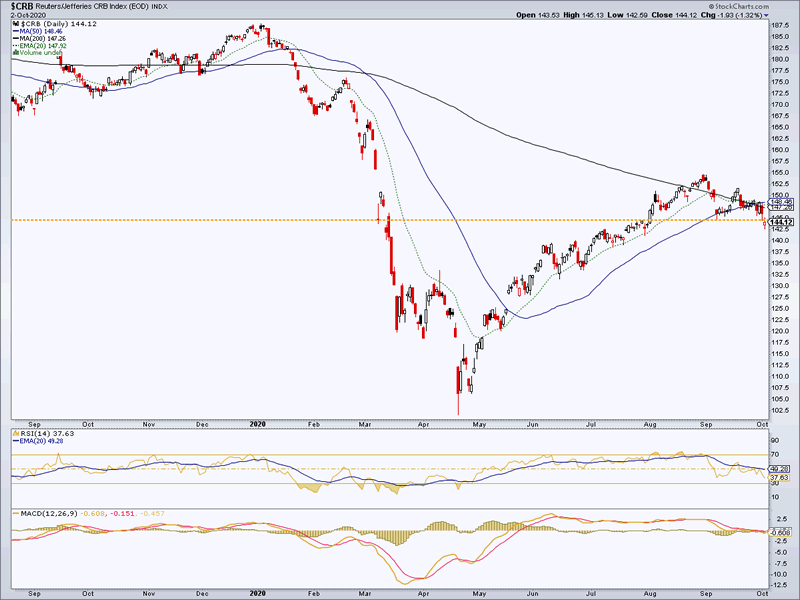

Over in the commodity patch, the daily CRB index looks disgusting as it fails the moving averages after grinding them for the last several weeks. The chart speaks for itself. You don’t need me to add words.

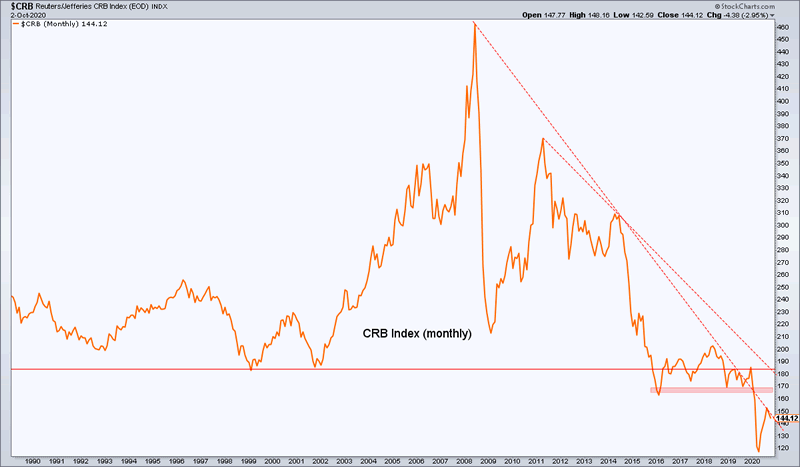

But I will add another chart, the monthly big picture chart we view every week in NFTRH just to make sure we future inflationists don’t get carried away until it is time. This is and has been an even more disgusting picture than the above, with not a single bullish thing going on.

Bottom Line

It was relatively easy to make money in 2020 until various markets topped and began to grind, signaling the need to play defense as opposed to offense.

- Gold is grinding out the Handle to a bullish Cup and the job of that Handle is grind at peoples’ nerves. Patience is needed, but odds are good that a big bull move lay out in the future. That’s what a healthy correction does; it bleeds ’em out and causes doubt among the clingers-on from a previous bull phase. Just today I noted on Twitter…

- US and Global stock markets followed gold’s top with a top of their own a few weeks later. Since then it has been a mild correction. This week the stock market made a move to break the correction before Friday’s pullback. It’s still up in the air as to whether the grind has ended but I am giving a slight edge to the bull case. [edit] The work in this weekend’s report (NFTRH 623) calls that view into question. It’s why I do the damn work.

- Commodities, which would be a prime investment area in a cyclical inflation phase are a technical dumpster fire as the CRB index appears to have ground out a short-term top. Worse still, the bigger picture never did register even the slightest positive technical reading.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.