Is Gold the Only US Election Winner?

Commodities / Gold & Silver 2020 Nov 05, 2020 - 04:29 PM GMTBy: Arkadiusz_Sieron

The elections are behind us. However, the official results are still not definite. What does it mean for gold prices?

Ladies and Gentlemen, the new President of the United States is… still unknown! The election results are not available, as some states are still counting the votes. The race is very balanced, with few states remaining too close to call. At the moment of writing this report, Joe Biden leads the White House race with 253 electoral votes, while Donald Trump has 213 electoral votes. So, Biden is more likely to become the new POTUS . However, with those few states officially still undecided, Trump could still win. Hopefully, we will get some of the results later today, but it might even take several days to count the ballots in some locations.

One thing is sure: Trump over-performed polls and expectations in the presidential election, again. What a shame, pollsters! We warned our Readers several times against trusting polls:

“although mainstream pollsters have corrected some of the mistakes they made in 2016, it’s safe to assume that Trump has better chances of reelection than it is widely believed and reflected in the mainstream polls”.

Moreover, Republicans also performed much better than expected in elections to Congress . We don’t know all the results yet, but as for the moment, both Democrats and Republicans have 48 seats in the Senate. So, yes, Republicans could still lose the Senate, but that is less likely now than before the elections. They are also on track to pick up a few seats in the House of Representatives. So, while all the focus is on presidential election results, investors shouldn’t underestimate the surprising strength of the Republicans in Congress.

Implications for Gold

What does it all imply for the gold market? Well, it’s not easy to determine since we still don’t know the results. However, the most likely scenario is Biden to enter the White House, Democrats ruling in the House, and Republicans maintaining a majority in the Senate, which is actually relatively bad news for gold.

I mean, the Blue Wave was considered to be the best scenario for the yellow metal. If controlling both the White House and Congress, Democrats could do whatever they want. So, they could boost government spending and public debt and raise taxes, supporting the gold prices. However, if Republicans keep control over the Senate, they will block the worst ideas of Democrats. Thus, the divided power would be better for the economy but worse for the shiny metal.

However, the probable lack of a blue wave shouldn’t plunge the price of gold. Yes, there will still be gridlock and higher uncertainty, and gold prices may be under brief pressure in the short-term, but the fiscal stimulus will eventually arrive. Therefore, no matter who ultimately wins, gold’s long-term fundamental outlook remains bullish . The coronavirus pandemic will continue to affect the US economy negatively, so both the White House and the Fed will provide more stimulus. The monetary policy will stay ultra-dovish, and the real interest rates will remain in the negative territory.

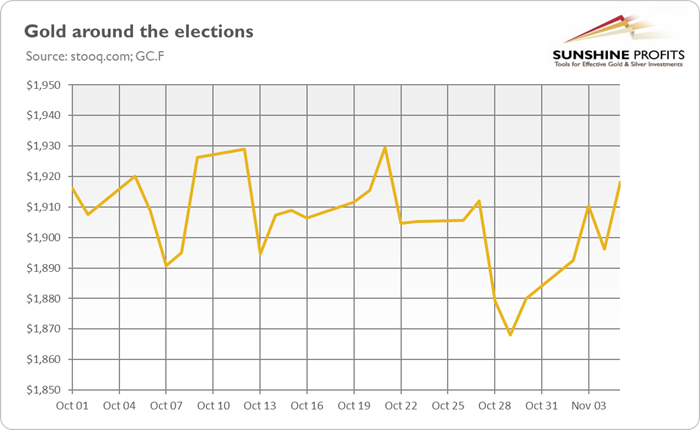

Moreover, when the dust settles after the elections, and the uncertainty will become lower, gold may continue its rally . As the chart below shows, the gold price has already increased (after an initial drop). So, maybe the actual winner of the elections is gold?

Of course, it’s too early to assess with certainty the medium-term impact of elections on the gold market. The volatility could stay with us for quite some time, and the dashed prospects of significant fiscal stimulus could negatively affect the gold market in the short-term.

However, one thing remains interesting. In contrast to the 2016 presidential election, the gold market swings were much smaller this time . It seems to be bullish news, but, hey, don’t count your chickens before they hatch. So, stay tuned. Hopefully, we will know the more complete election results soon and the new FOMC statement, which will enable us to describe the gold’s outlook with more certainty!

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.