This Isn’t Your Father’s Overvalued Stock Market

Stock-Markets / Stock Market 2021 Mar 09, 2021 - 02:35 PM GMTBy: John_Mauldin

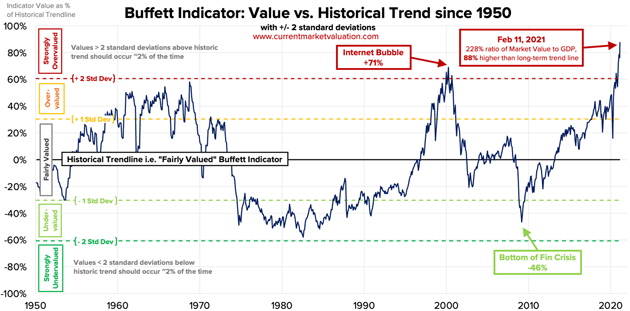

Many analysts contend that current stock valuations resemble the dot-com era. You can see it visually at CurrentMarketValuation.com. Some highlights…

The classic “Buffett Indicator” certainly seems to be in nosebleed territory. Notice that the valuations in 1966, the beginning of a long-term bear market, were also high.

Source: CurrentMarketValuation.com

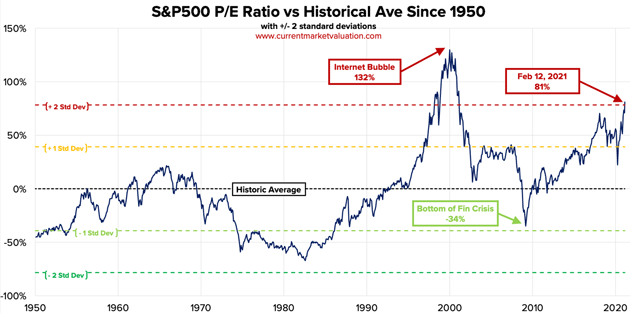

Then there is the ever-popular price-to-earnings ratio. Notice by this measure that valuations were not all that stretched in 1966. Yet there still followed a 17-year bear market, as measured from the peak back to where it started.

Source: CurrentMarketValuation.com

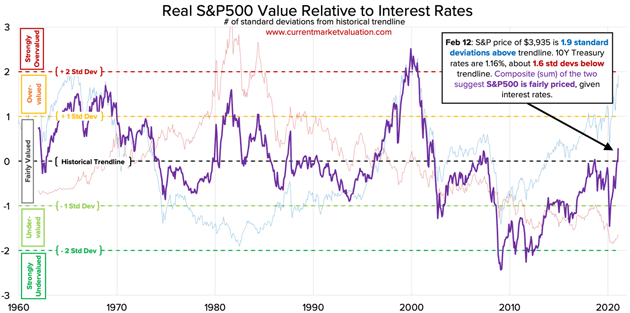

This next one is unusual: valuation as measured by mean reversion. Mean reversion is the fairly unsophisticated concept that "what goes up must come down."

While the market’s day-to-day movements are chaotic, long-term stock market returns tend to follow somewhat predictable upward trends. But they can also deviate from the trend for years or even decades.

This isn’t a trading strategy. But it's still a useful indicator of overall market valuation relative to the past.

What's Different Now

This is not your father’s or your grandfather’s (if he was alive in 1929) overvalued market.

There are two major differences…

First, in the dot-com era, the Federal Reserve had let loose the dogs of easy monetary policy going into the Y2K event. That was appropriate given the uncertainty, but it clearly helped send already overvalued markets to extremes.

We had day traders piling into anything that looked like an internet stock, speculations, really easy money, and so forth. Then after January 1 passed uneventfully, Greenspan appropriately reversed the Fed’s monetary policy. Oops.

And now we have enormous federal government stimulus, soon to be about 25% of GDP in less than a year. That money ends up somewhere, but its impact is still unclear. There is no historical parallel to consider.

Overvalued… but Perhaps Not Overpriced

Jerome Powell is not Alan Greenspan.

Powell and his colleagues have made it very clear they will keep monetary policy loose and rates low for a very long time. Inflation is well down their worry list. Their top concern is unemployment, which is indeed a real problem.

The Fed is telling us it will let inflation get to 3% or more. They are looking at the average inflation over time, which means they can justify doing anything they want.

What they want is low rates, even if it overheats the economy, until unemployment returns to where it was before the pandemic.

If they really mean that, then we are going to have low rates for a very long time, as unemployment is a bigger problem than most people think.

It also means, maybe not coincidentally, the US Treasury will find it easier to refinance an ever-increasing federal deficit.

But persistent low rates might mean stock market valuations are actually in the fair value range.

Look at this chart showing S&P 500 value relative to interest rates. Interest rates are 1.6 standard deviations below the trendline.

That suggests that the S&P 500 may not be so overpriced.

While valuations tell us nothing about short-term market moves, they are actually pretty good at longer-term returns.

That being said, some smart people I follow see pockets of undervaluation (at least relative to the US) in more than a few places. If you're looking for value, you might want to start there.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.