AI Stocks Portfolio Buying and Selling Levels Going Into Market Correction

Companies / Tech Stocks Oct 11, 2021 - 01:16 PM GMTBy: Nadeem_Walayat

The US stock market has been content to rally to new highs with many stocks going to the Moon including most of our AI tech giants, a rally that I have been distributing into to the extent that I have now sold 80% of my holdings in the Top 6 AI stocks in my portfolio some of which I have been accumulating for over a decade (Microsoft). The primary objective of this analysis is the determine where we stand in terms of THE TOP, after all, all bull markets eventually do top either ending with a CRASH (1987) or a bear market (2000 and 2007). So what to hold and what to sell is the question I am asking myself, with a view to riding out a potential bear market / crash, where this analysis deploys a new automated metric of individual stock SELLING LEVELs so that one better knows where one stands in terms of ones portfolio, all in just one table. After all the risk we all fear is that of a 2000 style collapse that sends stocks lower for the next 20 years! Remember that bear market bottomed with a 85% collapse for tech stocks! Yes, one could say the likes of Amazon, Microsoft, Apple had become dirt cheap, but that would have been a very painful and prolonged discounting event. So a case of balancing the risks of letting some stocks ride whilst cashing in those that will pay a heavy price for their over exuberance all whilst being aware of the AI mega-trend trundling along in the background.

This is part 2 of 2 of my extensive analysis comparing the bubble valuations of 2021 vs 2000 as the likes of Nvidia, Face, and AMD were going to the moon just as 21 years ago the likes of Cisco and Intel were (Part 1 - Tech Stocks Bubble Valuations 2000 vs 2021).

Content:

- Stock Market Bubble Valuations 2000 vs 2021

- Microsoft to the Moon - OUCH!

- CISCO to the Moon - OUCH!

- INTEL to the Moon - OUCH!

- Tech Stocks in a Bubble today?

- China / US Stock Markets Divergence

- AI Stocks Portfolio Buying and SELLING Levels

- AI Stocks Portfolio Buy / Sell Table Update

- High Risk Stocks

- Market Oracle AI Coin Mothballed

- Global Warming Code RED

However the whole of this extensive analysis (AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021) was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is set to increase to $4 per month for new Patrons THIS WEEK, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

China / US Stock Markets Divergence

After having tracked each another quite closely since the pandemic low, Chinese stocks started to diverge during March 2021. The mania infected investors in US markets look to strong US GDP growth of +6.3% and strong earnings growth of 49% as reasons to ignore the lofty price earnings multiples, crazy valuations for trillion dollar corporations and even more for the mid cap tech stocks that are the darlings of the likes of ARK Invest, trading on bubble valuations that are literally straight out of the dot com bubble era where just as was the case then many don't even make a profit and a large percentage of which never will!

Yes +6% GDP and +50% earnings growth is fantastic, but China's GDP for the same period is +18% GDP and earnings +84%! Many are fixating on the risk of regulation as the CCP appears to be stamping down hard on its tech giants thus prompting the exodus of foreign and domestic investors as they suddenly perceive the CCP is about to kill off the likes of Baidu, Alibaba and Tencent which has prompted many stock youtubers even those who should know better to get sucked into the all prevailing doom and gloom/

The reason why I mention this because when it is a actually a good time to buy stocks you get this kind of fear mongering that scares the poop out of investors from actually buying. I am immune but the reaction in the comments to my analysis of several weeks ago suggests that many are not and do get influenced by 'social' media following the likes of clueless Cathy Wood' who's funds apparently bought chinese stocks at their highs and then sold at their recent lows!

So a recap of what my analysis concluded in that chinese stocks had crashed to levels where I would start buying with initial buying levels for Alibaba at $203 or better, Baidu at $182 or better and Tencent at $57 or better, and in the week following my analysis all of those buying levels were achieved and so I bought and I am seeking to buy more as the stocks fall with price limits and alerts for Alibaba at $183 and $158, Baidu at $147 and $130. Though these will be on the Hong Kong exchange so I cannot just leave limit orders as ii.co.uk only allow 1 day limits on HK orders. Whilst I won't be adding to my Tencent buy. Remember folks I consider these HIGH RISK stocks for the fact that we are dealing with CHINESE stocks and the CCP, so we have to assume that there are many significant potentially negative variables at work that we are unaware of.

So as things stand should Alibaba and Baidu continue to tumble then I WILL buy more, and I am especially heartened by the fact that most investors by virtue of a clueless media are too fearful to buy, which means this should be a good time to buy stocks at fair valuations.

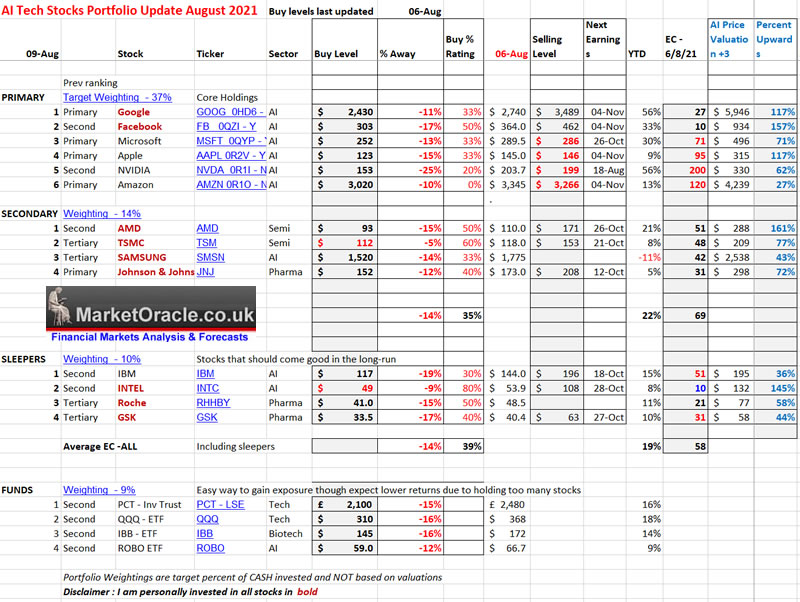

AI Stocks Portfolio Buying and SELLING Levels

Here I will be updating the current state of my stocks portfolio that now incorporates a new metric - SELLING LEVELS, beyond which I would consider selling / de-risking my holdings, but first an explanation of what buying and selling levels are so that we are all reading from the same page.

Buying Levels

Are based on chart technical levels and stock fundamentals where the key input is the EC ratio, a construct of 15 metrics that is updated following each earnings report. The buying levels are where I would consider the stocks to be fairly valued and if inclined to do so look to accumulate more holdings. In practice the buying levels don't tend to change often i.e. can remain in force for a good 6 months or more so more sensitive to trend then earnings reports.

Selling Levels

This is in response to my gradual process of disinvesting from the primary AI stocks that I had been invested in and accumulating for a some years. Selling levels are wholly based on fundamentals with no technical input so need to be updated on release of each earnings report.

The purpose of selling levels -

1. Firstly it is to tell me that I should at least consider selling a stock that is trading BEYOND its selling level where the fundamentals paint a picture of the stock having become overvalued and thus the downside risks far out weigh the upside risk at least until the next earnings report.

2. That it lets me know which stocks NOT to sell i.e. those trading well below their selling levels as they might not be fair value to buy, but neither do the stock fundamentals justify selling even if the stock has had a strong bull run.

3. That they are not a sell signals, they are a valuation level beyond which to contemplate selling as they are not technically generated i.e. Amazon's selling level is $3266, but the stock chart suggests a trading with highs typically between $3490 to $3560. Therefore as the stock trades through the selling level then I would and have sold at above $3500. So I don't take the Selling levels as a rule that I must sell at x price but rather look for a high probability price area that the stock looks set to trade to, i.e. selling into an uptrend. Whilst if the stock is trending lower after passing through the Selling Level earlier then that is confirmation that one should sell at the market.

The key point is that Selling levels are generated from earnings reports so they have an expiry date which is the next earnings report following which they will need to be updated, hence the table includes the date of the next earnings report which acts as an expiry date for the Selling level.

Buy / Selling Levels are Not Black and White

A stock with tight buying levels and selling levels is effectively range bound. i.e Apple Sell $146, buy $123. So I can only say what I would do at a particular point in time i.e. at one time I would ignore the selling level and just hold with a view to buying at the buying level should it occur, at another time (NOW) I would SELL Apple at $146 and seek to buy at $123. Whilst I doubt I would sell ALL of my Facebook and Google stock even if they traded well beyond their Selling levels as I do not want to be completely disinvest from the AI mega-trend.

So Buying and Selling levels are a GUIDE and NOT a RULE, something that acts as an alert to take notice of to investigate further and then determine ones course of action. So yes for some stocks it will mean SELLING, for other stocks it will mean NOT selling that I will elaborate on at each update of what I am personally doing.

So remember where investing is concerned things are rarely black and white but usually shades of grey and so should the Buying AND Selling levels be viewed.

AI Stocks Portfolio Buy / Sell Table Update

As I flagged ahead of time in my previous articles and in the Patreon comments , and as illustrated in the updated table above, I have now completely sold out of Amazon, Microsoft, Apple and Nvidia. Whilst my holdings of Google are down to 50% and Facebook 30% and the the rest of my portfolio remains untouched.

GOOGLE Buy <= $2430 Sell > $3489 - Clearly remains PRIMARY! If one could construct the perfect stock then Google would that stock! It's as though Google is being run by a super human intelligence AI!

FACEBOOK Buy <=$303 Sell > $462 - Has marched up the table to sit next to the King of AI stocks. Surely Facebook is also being run by a super human intelligence?

MICROSOFT Buy <=$252 Sell > $286 - I SOLD ALL as mow we move from the freaks of Google and Facebook to more of a regular high growth stock trading on a high EC of 71.

APPLE Buy <=$123, Sell > $146 - I Sold ALL and await a buying opportunity. The stock is over valued and trading at it's selling level.

NVIDIA Buy <=$153, Sell > $199 - SOLD ALL as I see this stock along the lines of how people saw Cisco at the peak of the dot com bubble, though note earnings report is due 18th August so the selling levels at least will change in response to a changed fundamentals.

AMAZON Buy <=$3020, Sell >$3266 - I Sold All, the stock has been over valued for some time, though despite that did manage to break to a high of $3700 before succumbing to gravity. Amazon is the weakest stock on my list with buying pressure of just 27%! Of all the stocks this has the greatest potential to stagnate for several years. Whilst the buying level is at $3020, I personally would only buy at $2933, as I am increasingly becoming skeptical about Amazons long-term growth prospects. How much bigger can a $2 trillion corp get? For instance if it grabbed all of Wal-Mart customers that would perhaps only add $500 billion to it's market cap. Though of course that's not going to happen.

AMD Buy <=$93, Sell > $171! TO THE MOON!

I did say I expected AMD and Nvidia to meet somewhere in the middle and that is exactly what appears to be taking place. I would only consider selling AMD if it traded on a crazy valuations on par with that of Nvidia which would price the stock well above $200!. And despite the price surge AMD's latest earnings has the stock with the highest upwards pressure of 161%.

Whilst patrons have had a good 7 months from my analysis of November 23rd 2020 right through up until my revision of May 10th to accumulate AMD at below $78! Unfortunately that ship has now sailed and if we get lucky we will see $93 to accumulate more, and before one thinks $93 is too high just do the math $200 divided by $93 if we get such an opportunity. And remember folks AMD only has a market cap of $133bn which means it has plenty of scope to X2, X3 and more!

Every silver lining has a cloud and so it is with AMD for they do like printing new shares! And they will be doing a hell of a lot of printing later this year where I estimate they will print 420 million new shares against the current total of 1.21 billion to pay $36 billion for a chinese semi-conductor company called Xilinx which probably will create a lot of volatility around the AMD share price. Though even in a worse case scenario I still think AMD is a good stock to be invested in. So I will be looking to buy AMD on volatility surrounding the takeover of Xilinx and of course in response to general market volatility

TSMC - Buy <=$112, Sell > $153 - Another potential rocket ship to the moon stock that is also only 5% distant from its buying level.

IBM - Buy <= $117, Sell > $196 - The stock remains a range bound, I sold all at the top with a view to buying towards the bottom. Whilst it's EC of 51 is far from being at fair value, the stock definitely fits its label of being a sleeping giant.

Intel - Buy <=49, Sell >$108 - The Intel rocket ship is being fueled ready for launch with 145% upwards pressure, an EC of just 10, the stock is primed to join it's chip making brethren to the moon!

Summary

Stocks trading at or beyond their selling levels are - Microsoft, Apple, Nvidia and Amazon.

Stock at or below buying levels - None

Stocks nearest buying levels are - TSMC and Intel.

What will I be doing?

I am primed to buy more Intel and TSMC, whilst I am reluctant to buy Amazon even if it fell well below it's $3020 buying level. I just get the impression Amazon could be the next Cisco in terms of future prospects.

Whilst I look forward to a general stock market correction to buy more Google, Facebook and AMD and get back into Microsoft. Whilst I am not too fussed about buying the others right now.

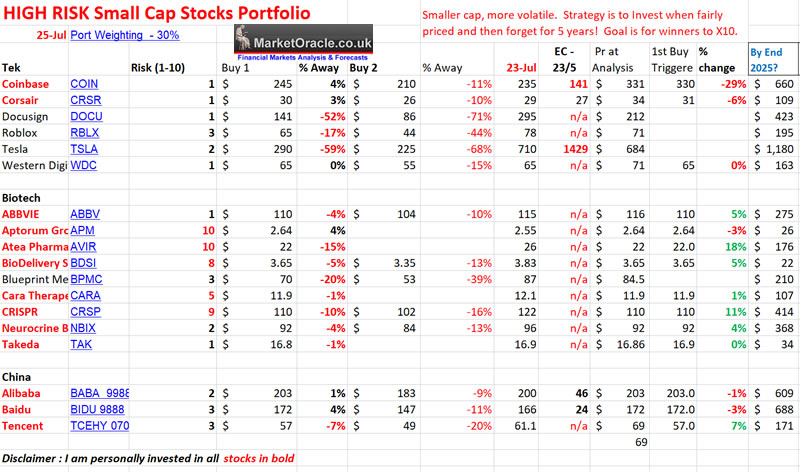

High Risk Stocks

I had planned on including another high risk stock that triggered one of my price alerts but have run out of time and so will include in my next article. In the meantime here is the high risk stocks table which now includes rough price targets of where stocks could trade to during the next 4.5 years as a guide of how I rate each stocks potential future prospects. As ever these are HIGH risk stocks which means there will be several that won't make it thus take the price targets as a very rough guide rather than a forecast.

DISCLAIMER - Investing in small cap higher risk stocks is VERY HIGH RISK. This analysis is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept any responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities.

What am I doing?

I am looking to buy more Corsair given that it is is dirt cheap, my limit order at $26 came within a whisker of being filled as Corsair dropped to a low of $26.4. Some patrons commented that they were front running my limit orders by buying a little higher :). Current price is $28, I've revised my limit order to $26.40 and will let it ride, if it gets filled I will double my position, if not there are plenty more opps out there.

Some patrons asked my view on the Robin Hood IPO, we'll I got my fingers a little burnt on the COINBASE IPO where I did not follow my own advice and overpaid as in my analysis before the IPO I had penciled in a fair buying price of between $144 to $192, instead like a newb I bought it for $330. Thus I am steering clear of IPO's and definitely consider the likes of Robin Hood a much bigger gamble than Coinbase, at least Coinbase generates a growing profit unlike Robin hood which booked a $1.4 billion loss in Q1 on revenues of $522mln ???? I suppose the millennials will still buy it regardless just because of it's name and many use the platform but I am skeptical of this stocks future prospects.

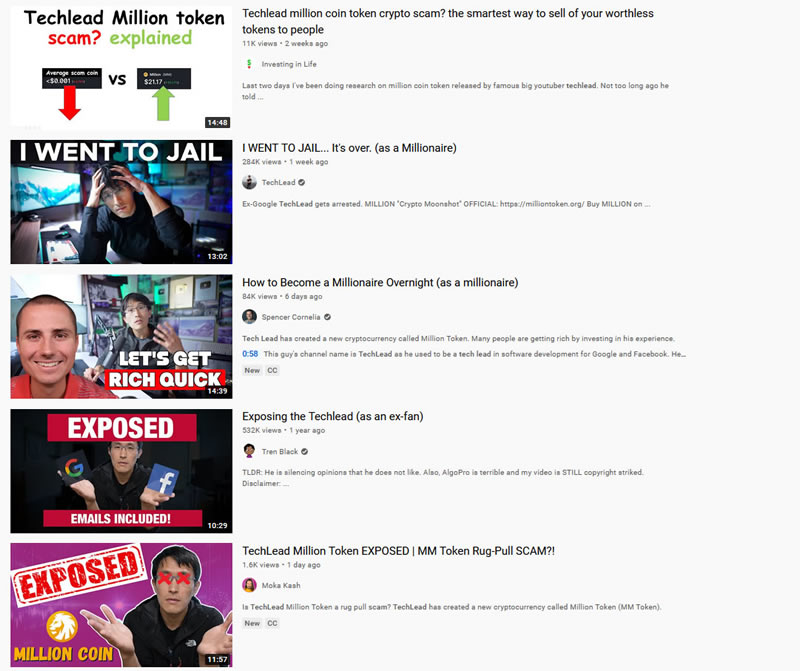

Market Oracle AI Coin Mothballed

When one game plays the process of developing and unleashing a crypto coin on the market then one soon comes up against the market liquidly brick wall where for one to SELL these newly minted AI coins then would need someone to BUY said coins i.e. provide liquidity, daily volume. Which is why most of the alt coins are really are just Shit coins because without significant volume of trading then the market caps are pure fiction! Virtually ALL ALT coins with a market cap of less than $100 million are worthless, and Most Alt coins between $100mln to $500mln are also probably worth little! All waiting for the greater fool to come along and buy so that the founders can sell into.

And that is the PROBLEM!

If I launched MO AI coin then what would be my primary objective?

It would be to create liquidity, to get people to buy the tokens so that there is volume to sell into.

It's pointless having 1 million tokens if one cannot SELL a single token without sending the price and market cap instantly to ZERO!

What would need to happen is that I would need to buy and sell the coins between myself to create a market, create volume.

And then what?

Then I would have to encourage people to buy the coin which will take me down the dark path of becoming a crypto Alt coin pumper where in the initial phase my attempts to create interest would be level headed but with each iteration would become more and more promotional painting a picture of blue sky's ahead, X10, X100, easy money as many who have gone down this path have done! Turning themselves into crypto Alt Shit coin pumper's, border line scam artists such as the guy called Tech Lead, a tech toobers with over 1 million subscribers who has now burned his reputation by becoming a Alt shit coin pumper for his 1 Million shit coin token that has no purpose which he has been pumping for several months since launch with BS videos painting picture of a coin with a market cap of $100 million, when in reality the picture painted is fictional, with his whole focus on pumping his shit coin to the gullible viewers of his channel so that he can sell to!

Allegedly engaging in fraudulent activity by creating artificial liquidity by buying and selling the coins between himself to give the illusion of investors having made a profit which he then states in videos, that x person bought so many coins and made x hundreds of thousands of dollars, where in reality he is likely buying and selling the coins between himself and thus attempting to trap investors into providing liquidity. A SCAM! And so it is being revealed as people look into who is doing the buying and selling on the tokens ECR-20 block chain, hence many videos exposing the scam.

We'll you can now see why I have decided to mothball the MO AI coin,as I don't want to go down this ever darkening path of becoming an Alt coin pumper.

Global Warming Code RED

Apparently today scientists from around the world declared global warming Code Red, as far as I'm concerned we already passed the code red point of no return a good 20 years ago. Global warming is now baked in, oceans will continue warming and the glaciers will melt and storms and fires will get worse with each passing year. It's done, best to look to how to profit from global warming which I will schedule for a future article.

It is highly probable that my next analysis will be on the housing markets, UK in-depth, US update and a quick look at Canada.

This analysis was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is set to increase to $4 per month for new Patrons THIS WEEK, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive stock market analysis on the prospects for the Dow into Mid 2022 - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

And - Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- What if I am Wrong and There is No Correction?

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

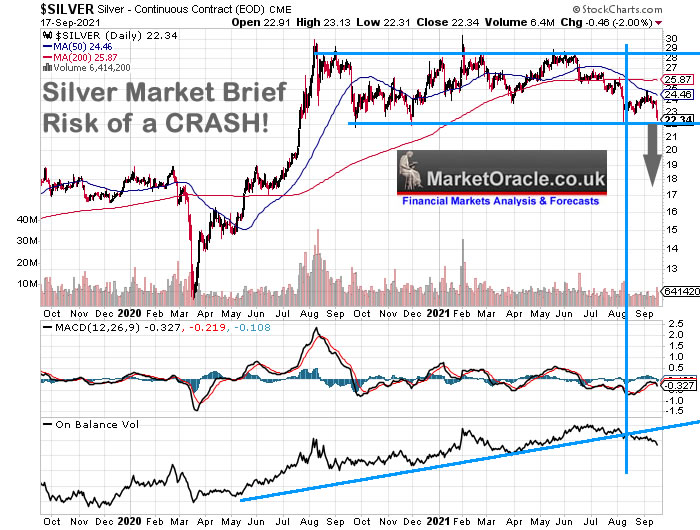

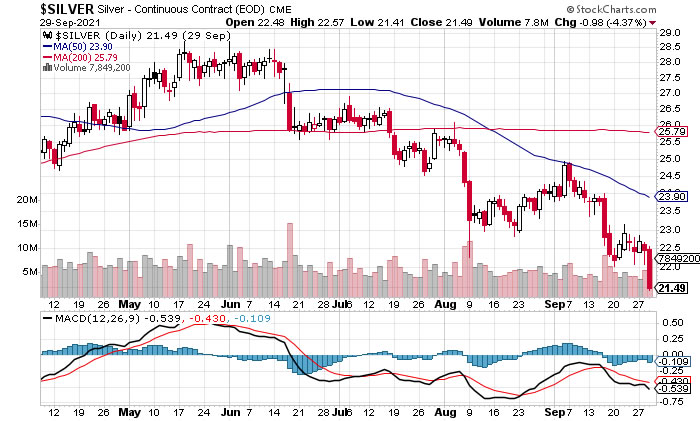

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

It has been a while since my last in-depth analysis of Silver as the commodity is not on my investing or trading radar with my primary focus on AI stocks, the stock market in general ahead of an expected significant correction and even the possibility of a market panic event to capitalise upon (Dow Trend Forecast Sept 2021 to May 2022). Nevertheless early in the course of this analysis I did post a quick technical take in market briefs that warned of a possible 20% crash in the silver price that this analysis seeks to expand on to conclude in a detailed trend forecast into mid 2022.

19th Sept 2021 - Silver Price Possible 20% CRASH Imminent

In advance of my Silver in-depth analysis here is a brief early warning of a possible 20% crash in the Silver price due to repeated failures to breakout higher, currently trading $22.34, just above support at $22 that it is revisiting for the fourth time a break of which risks a Crash of at least 20% to below $18 that could be imminent.

The silver price currently stands at $22.54 after having briefly dipped below $22 thus triggering the 20% crash sell signal.

Contents:

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 20% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Your de-risked along the highs analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.