Shocking Numbers Show Government Crowding Out Real Economy

Economics / US Economy Oct 20, 2021 - 02:22 PM GMTBy: MoneyMetals

The stampede of dollars into the gold and silver markets has not yet begun. There is record demand for coins, rounds, and bars, but institutional money is still ignoring precious metals, for the most part.

Anyone wondering why, can find a clue in the current makeup of the U.S. economy.

The large majority of the nation’s spending, and wealth, is handled by people who don’t have much in common with gold bugs – at least not yet.

Let’s start with some data.

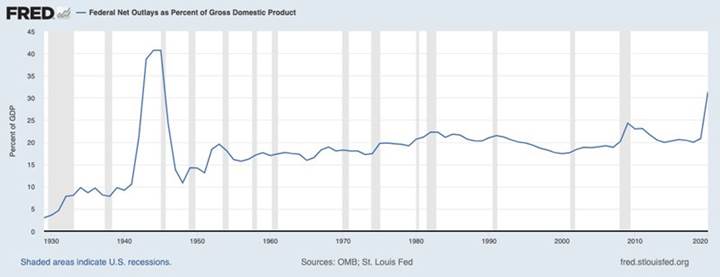

Federal outlays are now 31.35% of the GDP. That percentage was just under 21% in 2019.

State and local governments spent $3.2 trillion according to the latest report. Total GDP is at $21 trillion, so this spending represents 15.2%.

The Finance, Insurance, and Real Estate (FIRE) sector added 22.3% in 2020 and will likely capture a higher percentage of GDP this year.

To summarize the concentration of these three sectors in total GDP:

31.35% - Federal Government

15.2% - State and Local Government

+ 22.3% - Finance, Insurance, Real Estate

68.85% - Total

Government, banks, real estate, and insurance now comprise nearly 70% of our economy. Government sectors alone are approaching 50% (HALF!) of GDP.

This sort of information should make Americans seriously concerned about the direction of the country. They don’t even have to know GDP statistics to understand the economy is very sick and that it isn’t working for a majority of Americans.

Most of us know instinctively it is not sustainable for half of all spending to be done by people who produce nothing. Politicians tax productive people and borrow the rest. And they take care of their friends on Wall Street.

When this travesty is the “business model” underpinning so much of our economy, it makes sense to buy guns and gold.

However, lots of the people with an oversized stake in GDP have a different take. Their share of the pie has grown dramatically. They invest accordingly.

They love conventional assets. Why leave the equity markets, or the bond markets, when they know Jerome Powell has their back?

The past decade was a bonanza in terms of their personal net worth.

Many hope it can continue forever. They won’t spend too much time parsing the unsettling GDP data.

Instead, they listen attentively when Powell says inflation is transitory and the U.S. economy is fundamentally sound.

We shouldn’t expect this crowd to allocate any assets to precious metals until, perhaps suddenly, they discover Powell (or his replacement) is wrong.

By Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, perhaps the nation's fastest-growing dealer of low-premium precious metals coins, rounds, and bars. Siegner, a graduate of Linfield College in Oregon, puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

© 2021 Clint Siegner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.