Why Most Stocks May Go Nowhere for the Next 10 Years!

Stock-Markets / Stock Market 2021 Nov 04, 2021 - 01:35 PM GMTBy: Nadeem_Walayat

Dear Reader

This is part 2 of my extensive analysis that maps out the stock markets trend into Mid 2022 w- Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Part 1 - Stock Market FOMO Going into Crash Season

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

The whole of which was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my recent highly timely analysis on why it is time to get onboard the crypto gravy train heading for millennial FOMO 2022 -

Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

Contents:

- Bitcoin & Ethereum 2021 Trend

- Crypto Portfolio Current State

- The BITCOIN NEW ALL TIME HIGH Changes EVERYTHING!

- Ravencoin to the MOON!

- What am I doing?

- How to Invest in Crypto's

- Bitcoin 2022 Price Target

- Ethereum 2022 Price Target

- Ravencoin 2022 Price Target

- Cardano (ADA) 2022 Price Target

- Chainlink 2022 Price Target

- Pokadot 2022 Price Target

- Solano 2022 Price Target

- Litecoin 2022 Price Target

- Arweave 2022 Price Target

- Stellar Lumens - XLM 2022 Price Target

- Eth Classic 2022 Price Target

- Vechain 2022 Price Target

- EOS 2022 Price Target

- Earnings Noise Delivers INTEL And IBM Buy Opps

- Facebook and Google Could CRASH 10% Post Earnings Day

- High Risk Stocks Swings and Roundabouts

And here's a sneak peak of in my following video -

For trading cryptos at probably the worlds safest exchange see Coinbase (affiliate links).

For one of the best crypto trading platforms see Binance for 10% discount on trading fees - Discount Code LZ728VLZ

For mining with your GPU check out Nicehash.

As well as access to why inflation will be far from transitory, batten down the hatches for what's to come-

Protect Your Wealth From PERMANENT Transitory Inflation

- Best Real Terms Asset Price Growth Countries for the Next 10 Years

- Worst Real Terms Asset Price Growth Countries for the Next 10 Years

- The INFLATION MEGA-TREND

- Ripples of Deflation on an Ocean of Inflation!

- Stock Market Trend Forecast Current State

- US Dollar - Stocks Correlation

- US Dollar vs Yields vs Dow

- Stock Market Conclusion

- 34th Anniversary of the Greatest Crash in Stock Market History - 1987

- Key Lesson - How to REALLY Trade Markets

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Can US Save Taiwan From China?

And my extensive analysis of Silver concluding in a trend forecast into Mid 2022.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month,https://www.patreon.com/Nadeem_Walayat.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

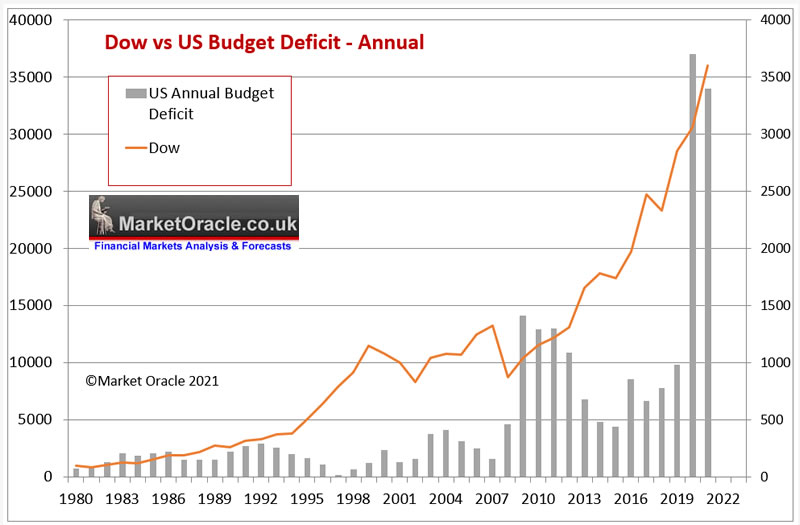

US Economy and Stock Market Addicted to Deficit Spending

What to know what's driving the stock market into the stratosphere? US Deficit Spending! (actually twin deficits including Trade).

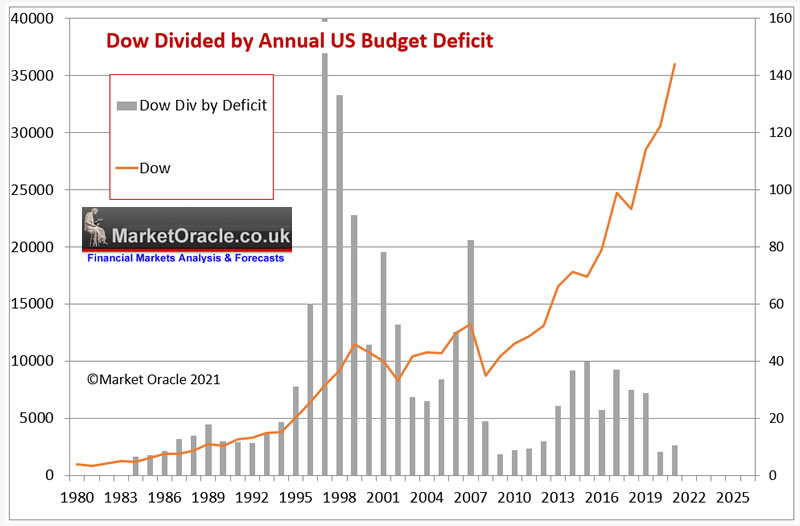

Here's the Dow divided by the annual US budget deficit. Usually the lower the reading the better the prospects for the stock market because the stocks are being fuelled by rampant money printing deficit spending that is being monetized by he central bank on an epic scale/

No this does not mean we are about to go off to the races as deficits given the huge expansion in the budget deficit has sent the multiple towards bear market lows, because we are not in a bear market, instead we are on the fast track towards the German Weimar republic!

The US government has dug itself into a hole that it cannot recover from. Why? Because most of the spending that's going on is for consumption and NOT investment, or a one off such as for a war, so it CANNOT STOP without triggering severe economic contraction!

What's the price for rampant money printing.

INFLATION!

REAL INFLATON and not the BS statistics that the likes of the Fed and Bank of England vomit every month, fake inflation statistics watered down over decades to hide the stealth theft of wealth and purchasing power of wages and savings..

I have been calculating my my own inflation measure for the UK for a couple of decades now which computes to the UK inflation rate currently being at about 16% per annum! In fact it has been in a range of 15% to 20% for over a year! Since the lockdown's, when people were paid to sit at home and do nothing much productive.

As for the United States, shadow stats does a good job of calculating the real rate of inflation which ia based on the US governments own 1980 formable that resolves to 13.5% vs 5.3%.

US Economy Has Been in an Economic Depression Since 2008

Wait things are even worse than that! You know the US GDP growth rate we are all bombarded with to illustrate the strength or weakness of the US economy, we'll it is just as FAKE as that which vomits out of the likes of the CCP.

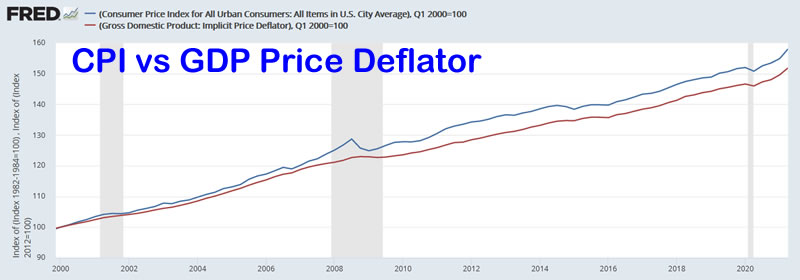

The Fed states US real GDP is currently +12% year on year . Now consider this, what inflation measure do you think the Fed is using to calculate these GDP figures? CPI? WRONG! GDP price deflator which tends to consistently under estimate inflation even against CPI as the following graph illustrates.

What's the difference? 158 divided by 151 which means that US GDP has been over reported by 4.5% since 2000.

What about against real shadow stats inflation? We'll if we used that measure than the US has been in an economic depression for the past 2 decades! What's most probable is that the truth lies somewhere between Shadow stats and CPI, at around the half way mark of US inflation currently being around 9.4%. That would still suggest that overall the US economy has stagnated since the dot com bust, with a growth rate that is about half that which has been posted and even worse performance since the Financial Crisis since which the probable real US growth rate has been ZERO!

So no wonder the Fed has been printing money on an ever escalating scale trying keep a dying economy ticking over, keeps kicking that day or reckoning can down the road for the next Fed President to deal with.

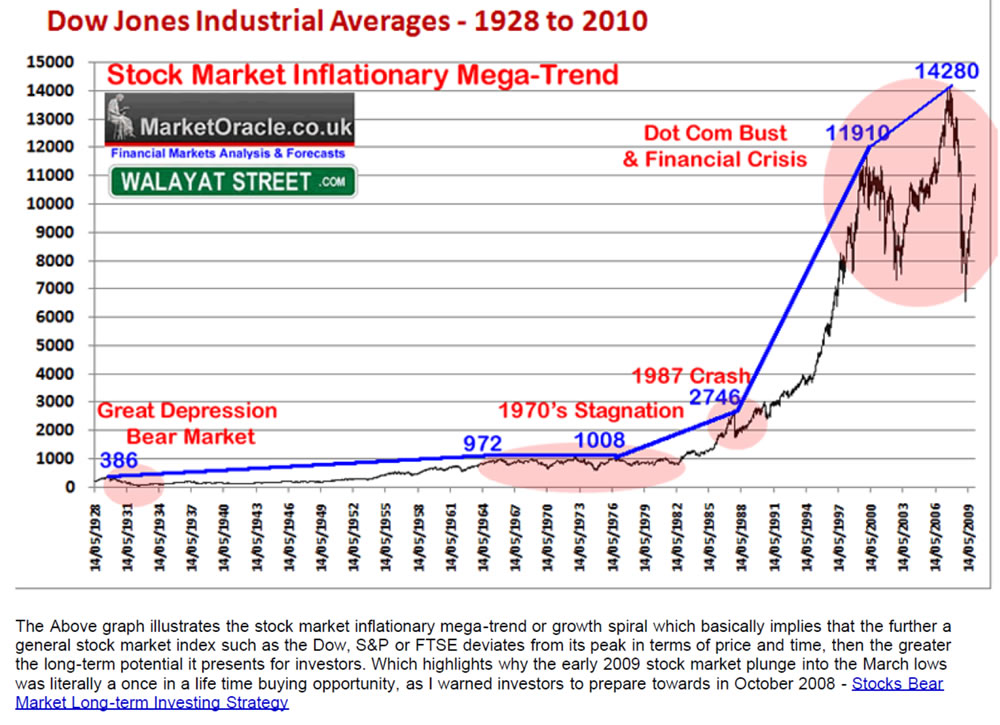

In terms of asset prices such as stocks and housing, the Fed cannot allow for any sustained drop in asset prices for it will literally bring the whole house of cards crashing down to reveal the true extent of the economic stagnation that the Fed has so far successfully masked by means of the inflation stealth tax. It's a case of printing money to infinity and beyond hence remain invested in assets that are LEVERAGED to INFLATION and why this stocks bull market will just keep chugging long until the point when the Fed loses control of the QE monster that it has created. This is why I have been banging the Inflation Mega-trend drum for OVER A DECADE! QE4-EVER, QUANTITATIVE INFLATION, because there IS NO FREE LUNCH! You cannot bail out the banking crime syndicate without paying a price and that is loss of purchasing power by means of REAL INFLATION. as illustrated by my January 2010 Inflation Mega-trend ebook (free download)

And a 12 year long mantra of buying the deviation from the high -

I have been monitoring this Inflation Train wreck for over a decade, and we are definitely heading for high inflation., How high is hard to say because it depends on the magnitude of the policy mistakes the Fed and US government and all of the other governments such as the UK will continue to make going forward as they desperately keep trying to kick the can down the road.

And you know what's funny, there are still the deflation fools out there that populate the mainstream press regurgitating their deflation thesis despite it having been wrong for DECADES! As we have always been on the path towards to real HIGH inflation! You only get deflation right at the very end when everything collapses into a debt deflationary black hole!

Which is why whilst most asset classes are likely to experience some pain over the coming years, as the Fed basically has fired most of it's bullets and so will be forced to adopt painful measures to correct the excesses (if it can), then yes asset prices can fall (temporarily), to what degree and for how long is uncertain but what is certain holding fiat currency is a going to be an even bigger loser than it has been for the past 10 years!

It's a case of trying to limit the damage done so that one can hold onto as much of ones wealth in real terms as possible.

We are in a difficult place right now, for I know stocks are over valued but I also well understand the path we are on requires us to be invested in assets that are leveraged to inflation else one is 100% guaranteed to see ones wealth destroyed as ever more desperate governments in act even more crazy MMT policies in attempts to keep the economies ticking over waiting for the AI God to emerge and save them.

So batten down the hatches folks, watch those multiples for that is where you will likely suffer the greatest investing pain i.e. 50X earnings for a 2 trillion dollar corp, that's asking for Financial PAIN!

Being investing in good stocks at or below a P/E of 20 is required to surf the Inflation mega-trend that we all ride.

At least ISA's and to a lesser extent SIPPs in the UK are tax free, but you never know governments in desperate times can do desperate things such as taxing the fake gains in asset prices courtesy of fake inflation.

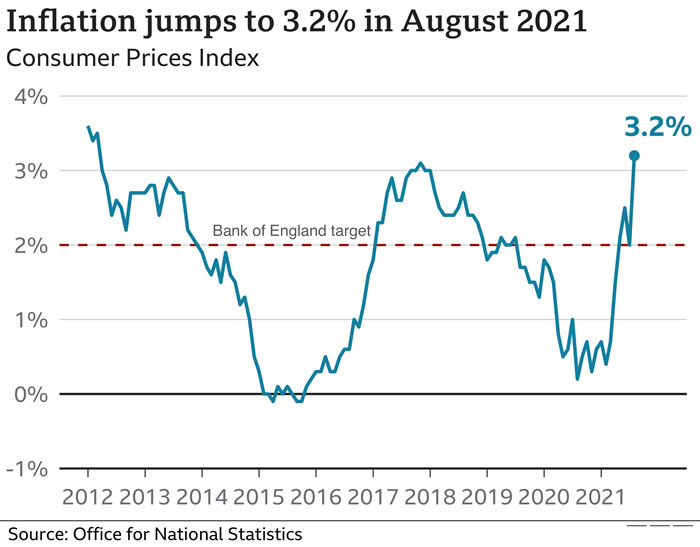

Meanwhile the UK just announced the largest jump in CPI inflation since records began (1998) all in the face of the mantra of temporary inflation that the clueless commentators state will soon fall back. INFLATION RISES ARE NEVER TEMPORARY THEY ARE CUMULATIVE AND EXPONENTIAL, HENCE THE INFLATION MEGA-TREND!

Inflation and the Crazy Crypto Markets

One of the reasons for investing in crypto's is INFLATION i.e. fiat currency is constantly being devalued whilst many crypto's are limited to print run such as Bitcoin. So whilst I have not bought any Bitcoin to date due to not meeting my price targets so far. However, going forward I will be retaining all mined bitcoin regardless of what happens to the price, roughly I mine about $300 worth of bitcoin per month across 2 desktops.

Meanwhile I have limit orders all over the place attempting to capitalise on the crazy crypto markets. For instance recently Litecoin first dropped to to $100 and then spiked to $300. Which triggered me long at $112 and $118, current price is $185. So I am seeking to capitalise on such highly volatility price moves in both directions due to immature trading platforms and low volume i.e. where Litecoin is concerned I have limit orders to buy at $146 and below with limit orders to sell at $280 and above.

My primary focus where crypto's are concerned is in accumulating the alt coins such as Ravencoin, Cardano, Pokadot, Chainlink etc as offering the most upside, where the strategy is to cover a dozen crypto's to increase the chances of limit order triggering spikes. For instance I also got triggered long on a similar crazy crypto price spike with XLM. So lots of wide limit orders across a dozen crypto's waiting for the spikes to do their work which even happens with the likes of Bitcoin as I illustrated in my recent video.

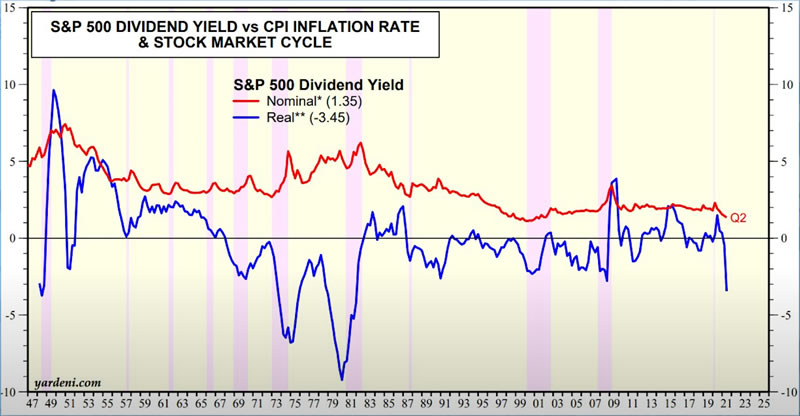

Consequences for the Stock Market

Here's another indicator to pile on top of a mountain of indicators that I have been covering over the past few months all flashing RED . The S&P real terms dividend yield is now LESS than at the dot com bubble peak! In fact one would need to go back to the depths of the early 1980s' inflationary depression to reach such poor returns.

Real terms dividend rate is another harbinger for lower stock prices or at least sustained stagnation. So whilst stocks do tend to be leveraged to inflation, however that is only if earnings and dividends are able to keep pace with inflation and as we have seen inflation is surging higher whilst dividend yields are not.

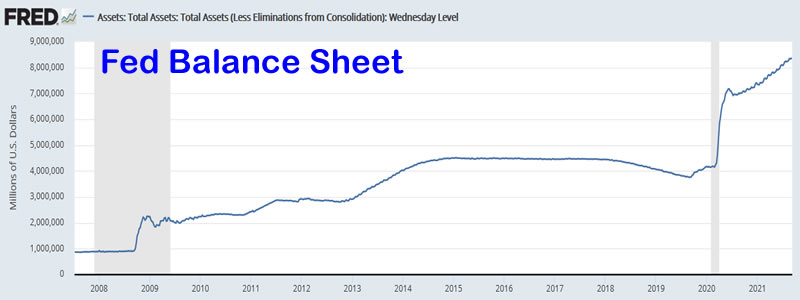

FED Balance Sheet

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices where up until recently the Fed had succeeded in hoodwinking the masses that US inflation was just 1%. Instead at that time I warned it was more like 6%! Now it's more like 10%. Anyway the money printing binge now totals $8.4 trillion, up from $4 trillion at the start of 2020.

The bottom line is forget what the bond market is implying because interest rates are manipulated, instead the real impact of money printing 'should' be seen in a falling Dollar, though every central bank is printing money, so it's going to be a bumpy ride. In the meantime if you think there is deflation compare the price of the stuff that you really want against what they were selling for a year ago! That's if you can get what you as illustrated by the tech market which tends to be OUT OF STOCK of GPU's, CPUs, and MEMORY! A market that is seeing price hikes on a near DAILY basis to typically DOUBLE MSRP! Hence my message for the duration of 2020 to buy your big ticket items now before the price hikes materialise which are now materialising, for instance in the UK even the price of 2nd hand cars has gone up in price by typically 18% compared to a year ago! Maybe a good time to get rid of my Land Rover and buy a Tesla?

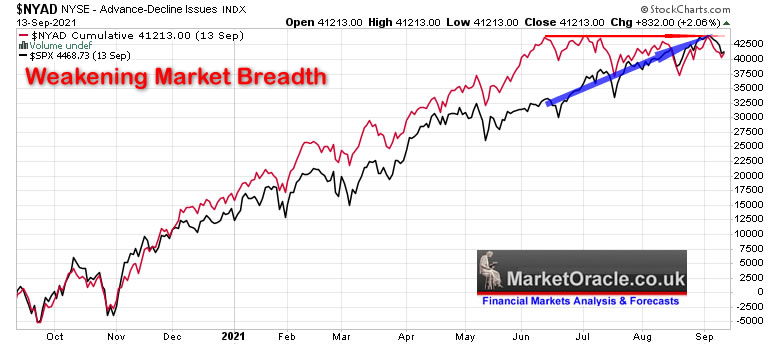

Weakening Stock Market Breadth

Cumulative NYSE Advancing - Declining issues have been warning all summer long of a divergence taking place between the general stock market indices such as the S&P and the overall health of the market as a literally a handful of over bid stocks have been sending the indices to new al time highs. For instance 8 stocks such as Apple, and Amazon comprise 27% of the S&P 500! S&P FIVE HUNDRED! What happens when these mega-corp stocks correct their overbought states?

(Charts courtesy of stockcharts.com)

The NYAD is usually a reliable leading indicator, especially for market tops and thus this divergence acts to confirm my expectations for a significant stock market correction over the coming month, which may include a crash of sorts.

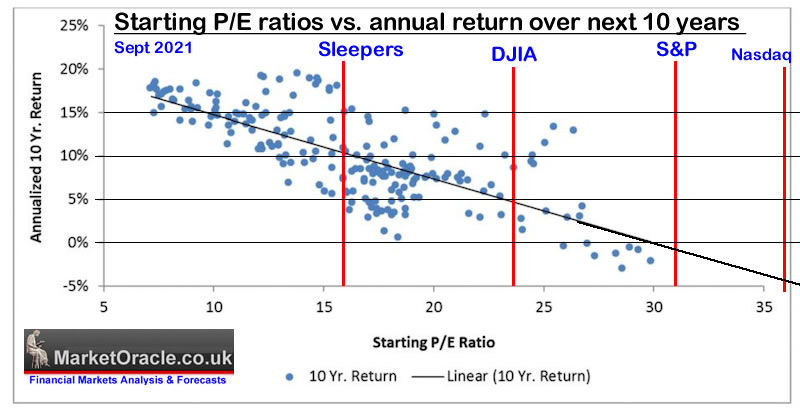

Why Most Stocks May Go Nowhere for the Next 10 Years!

Here's why PE ratio's matter as the following chart shows the return 10 years forward from the starting average PE i.e if the stock market is trading on an average PE of 27 than can basically be expected to go nowhere for the next 10 years. Whilst the lower the PE the higher the expected return (on average), where the safe zone for investing is at a starting PE of between 10 and 20.

The current PE ratios are :

- DJIA 23.66

- Dow Transports 57.25

- Nasdaq 36.35

- S&P500 31.41

- AI portfolio Top 6 AI stocks 42

- AI portfolio Top 10 AI stocks 37

- AI Sleepers 15.8

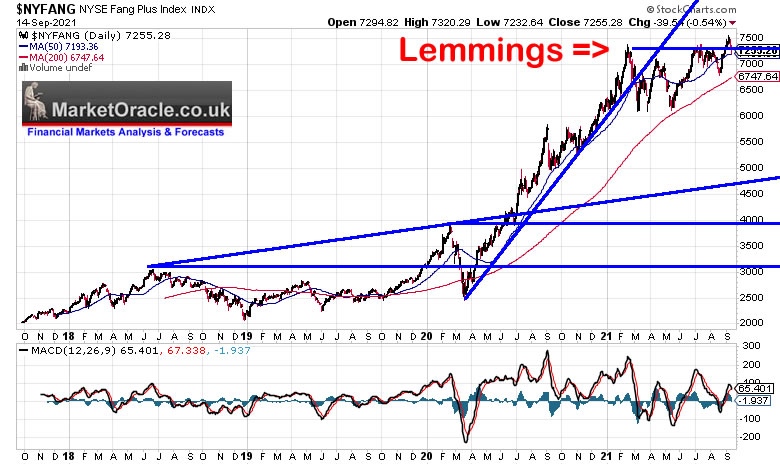

FANG Stocks

The FANG stocks collective (10 stocks) broke to new all time highs early September after putting in a higher low mid August. Technically this is a bullish pattern with strong support at 6800. The normal expected behaviour right now would be for the Fangs to bottom right about now before continuing their March to new all time highs as the resolution of what amounts to a 6 months consolidation trading range.

However, when one zooms out a little then one truly gets to appreciate the madness of the crowd. Do you really think the FANGS are about to replicate the 2020 bull run? Or are we in for more like what happened from Mid 2018 to Mid 2019?. There is nothing like a false break higher to get the last of the lemmings on board before the big cull.

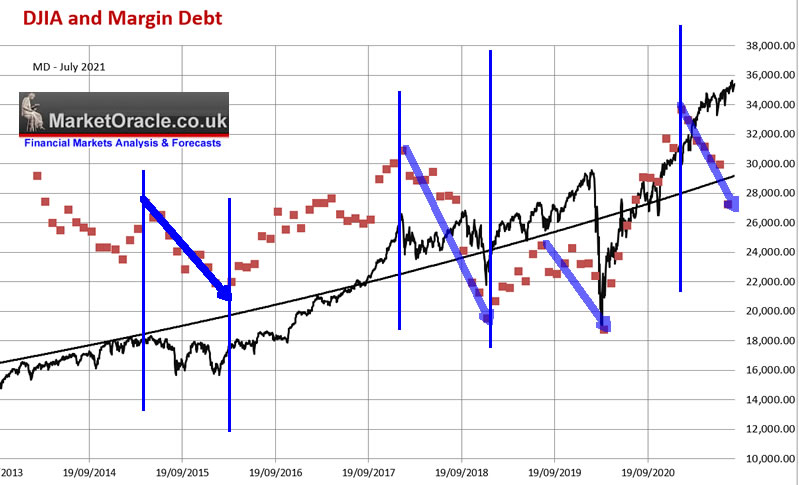

Margin Debt

Margin debt tends to peak and fall long before the stock market turns lower as basically speculators are starting to get cold feet and thus cut back on their bets. Either that or forced closures of their losing shorts due to failure to meet margin calls, probably more of the former than the latter.

Margin debt peaked in January 2021 and has since been falling, this suggests that speculative interest has been reducing for the duration of the 2021 bull run and thus speculative upwards pressure has been falling. The last reported data especially marked a sharp drop in margin debt. Now many mistakenly argue that a fall in margin debt means that investor sentiment is becoming bearish and thus is a good thing for stock prices. However, the observed pattern is that falling margin debt tends to eventually result in significant stock market weakness.

DJIA Stock Market Technical Trend Analysis

This rest of this extensive analysis - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022 has first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

My analysis schedule includes:

- AI Stocks Buying levels update, stock market trend forecast current state.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your crypto's accumulating analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.