What Signals Do Gold, Silver, and Stocks Send to Investors?

Commodities / Gold and Silver 2022 Dec 30, 2022 - 03:22 PM GMTBy: P_Radomski_CFA

While the statistics scream, investors, often blinded by emotions, do not hear them. However, since history seems to rhyme, what do gold, silver, and mining stocks have in store for us?

What a boring month!

At least for those who monitor the performance of junior mining stocks. It’s Dec. 29, and the monthly price change for the GDXJ ETF is $0.15 (0.41%). That’s how much higher the GDXJ is now than it was at the end of November. That’s next to nothing – almost a “statistical error.”

So far today, gold and silver are not doing much (chart courtesy of https://SilverPriceForecast.com), but gold futures rose by $55.90 (3.18%) and silver prices rose by $2.06 (9.45%) in December.

I know that I’ve been writing about this over and over again, but please note how extreme this signal is! It’s crystal-clear even on a monthly basis. The signal, of course, comes from markets’ relative performance.

What Really Happened

Miners tend to underperform the gold price close to market tops, and silver tends to outperform close to market tops. The above monthly numbers are practically screaming: “it’s a top!.” As always, very few are listening, as it’s easy to get carried away by the primary emotion that’s out there in the market, and when prices are rallying, people become bullish. They tend to ignore the signs and focus on the feelings.

Even the wording in the messages that we receive changes. The phrases “I feel the market is about to move higher” or “it seems to me that this rally won’t end” are common, but messages with indications and evidence supporting that bullish case are very rare or (usually) absent.

Please note that while I’ve been analyzing the precious metals sector’s outlook recently, my trading focus has been on the junior mining stocks – and indeed, miners have barely moved higher this month, even despite a sizable move lower in the USD Index.

But you said that miners are driven by stocks, and the S&P 500 is down by over 7% this month. Aren’t miners weak just because of the stocks? As a result, there is no underperformance of gold—no bearish indication? No.

While it’s true that stocks’ performance tends to impact juniors’ prices, it’s also true – to a considerable extent – in the case of the silver market.

Silver’s price hasn’t been weak this month. Quite the opposite – silver soared by almost 10%.

If silver soared so much, then apparently the impact the stock market had on the precious metals sector was not as significant. Consequently, it’s very likely that the indications coming from the relative performance of miners and silver are truly bearish for the precious metals sector.

What most people might have missed recently is that what we’ve seen in the past couple of weeks is very similar to what we already saw in mid-2021.

I copied the mid-2021 topping pattern to the current situation. I marked the period from the first intraday high to the start of the decline, and I marked it from the intraday high to the intraday low of the pattern.

Those are surprisingly identical, don’t you think?

Interestingly, both patterns were preceded by similarly sharp rallies, which were preceded by a broad bottom, which in turn were preceded by a decline of about $2,000.

History appears to be rhyming once again, and the implications are bearish – also in the short run.

Also, did I mention that the volume was declining during both patterns? I marked that in the bottom part of the above chart.

Silver’s strong performance is notable at this time, but please note that we saw the same thing during the mid-2021 top.

And junior miners?

Back in mid-2021, they corrected a bit more than half of their previous decline, and right now they have corrected a bit less than half of their previous decline. The correction is nonetheless similar.

A 2021 Repeat?

Interestingly, after the correction was over, the pace of the decline picked up, and junior miners moved to new lows, even though gold and silver moved approximately to their previous lows.

The pace of decline that followed the mid-2021 top was almost twice as big as the one of the preceding (2020 – early-2021) decline. As history rhymes, we’re likely to see something similar in the following months (and probably weeks) as well.

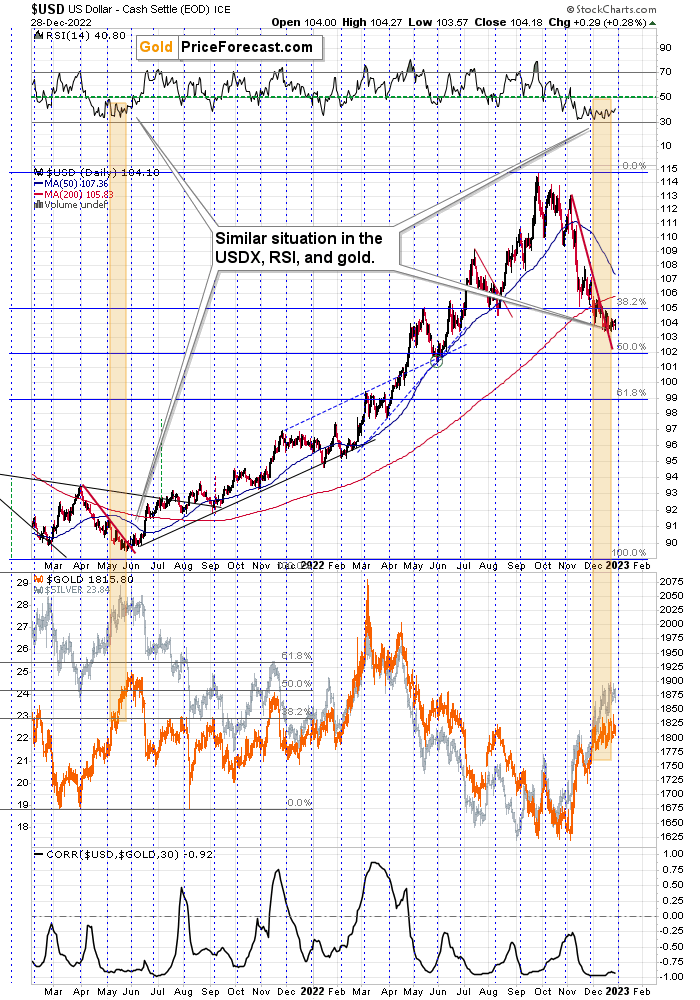

If that wasn’t enough, the link between mid-2021 and today is very clear in the case of the USD Index as well. Since the USDX is one of the key drivers for the price of gold, it’s worth paying attention to it.

The RSI is after a lengthy consolidation right above the 30 level, and the USD Index is after a short-term breakout, which has been more than confirmed.

From a long-term point of view, the breakout above the 2016 and 2020 highs in the USDX has been fully verified.

All this means that the USD Index is likely to move higher, which, in turn, is likely to trigger declines in the precious metals sector. The relative performance of gold, silver, and mining stocks indicates that the precious metals sector just can’t wait for a good reason to start its next huge move lower. It looks like they’re about to get it.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.