Inflation – How It Started And Where We Are Now

Economics / Inflation Jun 26, 2024 - 05:32 AM GMTBy: Kelsey_Williams

INFLATION – HOW IT ALL STARTED

Early ruling monarchs would ‘clip ’ small pieces of the coins they accumulated through taxes and other levies against their subjects. The clipped pieces were melted down and fabricated into new coins. All of the coins were then returned to circulation. The clipped coins circulated side by side with other coins and all were assumed to be equal in value.

As the process evolved, more and more clipped coins showed up in circulation. People became suspicious and were reluctant to accept the clipped coins at full face value. Their concern prompted the ruling powers to reduce the precious metal content of the coins. This lowered the cost to fabricate and issue new coins. Soon, all of the coins in circulation had less precious metal content. Hence, there was no need to clip the coins anymore.

From the above example it is not hard to see how anything used as money could be altered in some way to satisfy the voracious financial appetite of government. However, a process such as this was cumbersome and inconvenient. There had to be a better way. Unfortunately, there was.

ENTER: PAPER MONEY

With the advent of the printing press and continued improvements to the mechanics of replicating words and numbers in an easily recognizable fashion, paper money was a big boost to government ’s propensity to inflate the money supply.

However, people viewed the paper money with healthy skepticism. They preferred the old coins with precious metal content which continued to circulate alongside the new paper money. As a result, it was necessary for government to maintain a link between money of known value (coins) vs. money of no value (paper notes) in order to encourage its use.

The link is called convertibility. It allows the circulating mediums of money to be interchangeable, i.e., exchanged on demand for predetermined amounts. In the case of the U.S. dollar, the predetermined ratio was one ounce of gold @ $20.67 oz. You could exchange paper dollars for gold; or, gold for paper dollars – on demand. (see Gold Convertibility – NOT Gold Backing)

Convertibility tempered the anxiety of consumers regarding the use and acceptance of paper money. As long as convertibility was maintained by government, the acceptance of paper money grew. Over time, though, governments continued to inflate their own money supply far beyond their ability to continue exchange/convertibility at the agreed upon fixed rate. This cheapened the value of the paper money and caused people to actively avoid it; preferring instead to use and own precious metal coins.

To protect its own interests, government severed the link of convertibility; partially at first, then completely. It was done by fiat (a decree or order of government).

Not only does our money today have no intrinsic value. The supply of money is inflated (and, therefore, debased) continuously. Fractional-reserve banking (no reserve requirements since 2020!) allows exponential expansion of the money supply via credit. The printing press is still humming 24/7, but the digital age has ushered in new and ingenious ways to fool the people.

WHAT IS INFLATION?

Inflation is the debasement of money by government and central banks via expansion of the supply of money and credit. All governments intentionally inflate and destroy their own currencies.

Inflation cheapens the value of all the money in circulation which leads to a loss of purchasing power in the currency. The loss of purchasing power shows up in higher prices for goods and services. The higher prices are NOT inflation. The higher prices which result from the loss of purchasing power in the currency are the effects of inflation.

There are other effects of inflation including misinterpretation of financial statistics, misallocation of money and resources, unreliable economic statistics and projections, etc.

The effects of inflation are cumulative, volatile, and unpredictable and are the result of inflation that was already created by the government or central bank.

WHO/WHAT CAUSES INFLATION?

There is only one cause of inflation: government. The term government includes central banks. The United States Federal Reserve Bank is the biggest inflation engine in world history. The Fed ’s conscious and deliberate action to inflate the money supply since its inception in 1913 has brought about a ninety-nine percent decline in the purchasing power of the U.S. dollar. This means that it costs more than one hundred times as much today for what we buy as would be necessary absent the effects of inflation.

Inflation is not caused by “greedy” businesses, excessive wage demands, accelerated consumer spending, or higher energy prices. Even government ’s own propensity to spend, as reckless as it is, does not cause inflation. And that does not contradict my earlier statement that government is the only cause of inflation. The creation of the money comes first. Only after the money or credit is created can the government exercise its wanton disregard for financial restraint by spending its ill-gotten gains. (see Government Spending Is NOT Inflationary)

UNDERSTANDING INFLATION AND ITS EFFECTS

The Arab Oil Embargo in 1973, amid demands for more money for oil, spawned the formation of the Organization Of Petroleum Exporting Countries (OPEC). The underlying fact of the matter was that the dollars being received for oil by OPEC nations were worth much less than when existing contractual agreements were originally written. Oil exporters were receiving fixed-dollar amounts in currency that had been losing value for several decades.

To understand this better, imagine that you were a company selling widgets for $1 each and according to your contract you cannot receive any more than that. Fast forward twenty or thirty years. You are still selling lots of widgets and still receiving $1 for each one you sell. Your production costs over the years have continued to climb; and, it costs you more for everything you buy to maintain your standard of living. Everyone is paying more for everything. On an ongoing, year-to-year basis, things seem reasonably normal, except that prices are now rising more frequently and the rate of increase is higher than before. What is going on?

The effects of inflation are showing up. Those effects can be subtle at first, or not noticed at all. At some point in time, though, the cumulative effects of inflation become more obvious and everyone starts acting differently. Businesses try to plan for it and individuals invest with inflation in mind.

As people become more aware of the effects of inflation, they start looking for reasons; and, for guilty parties. Government is quick to act of course. Sometimes they implement wage and price controls. This is like setting the stove burner on ‘high ’ and putting a lid on the pot with no release for the pressure. The Federal Reserve ’s favorite ‘tool ’ is manipulation of interest rates, both up and down (see Two Reasons The Fed Manipulates Interest Rates and The Fed ’s 2% Inflation Target Is Pointless). And, they talk a lot.

They have talked enough over the past thirty years to frighten us into thinking that our own spending and saving habits are the problem. Sometimes the blame is directed at foreign countries and their currencies. Our sense of ‘unfairness ’ over China ’s attempts to weaken the Yuan seem to be misplaced. We criticize them and other countries for doing the same things the US government and Federal Reserve have been doing for over one hundred years.

Even with the hugely, inflationary response of the Federal Reserve in 2008 and afterwards, we did not see the substantial increase in the general level of prices for goods and services that was expected. It took more than a full decade to see economic activity get back to pre-Great Recession levels. Then, the pandemic scare and a forced economic shutdown hit. Government and the Federal Reserve embarked on another grand scheme to save us from the effects of inflation which they had created. This time, the higher prices for goods and services showed up quickly and in large measure.

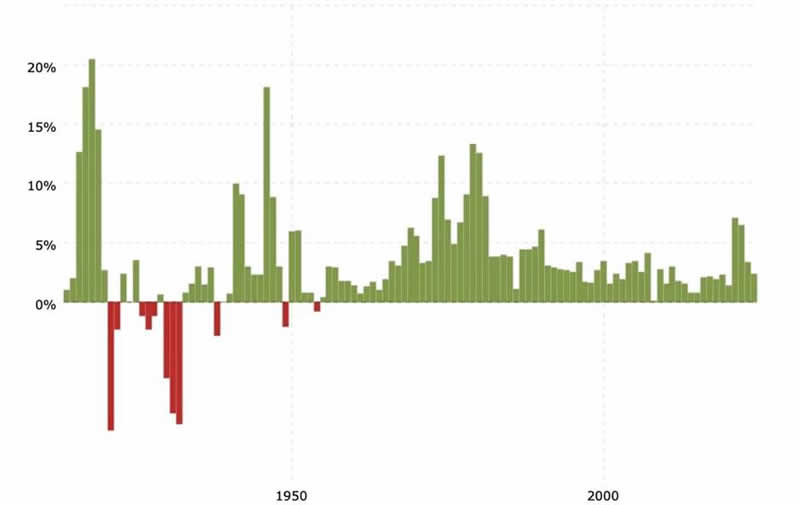

Below is a chart (source) of inflation ’s effects on U.S. dollar purchasing power (CPI). To whatever extent the statistic might be flawed (it is), it still is reasonably representative of the effects of inflation over time…

Historical CPI Rate 1914-2024

We can see on the chart that the annual CPI rate is under 5% almost eighty percent of the time and that prices actually dropped about ten percent of the time (red years 1920 ’s, 1930 ’s). The potential for volatility increases, though, because of the cumulative effects of inflation.

CUMULATIVE EFFECTS OF INFLATION

The first year pictured on the chart is 1914, one year after the inception (1913) of the Federal Reserve. Prices rose by one percent in 1914, followed by a rise of almost two percent in 1915.

Now, imagine that the two percent rise in 1915 was stacked on top of the one percent rise in 1914, followed by each subsequent year being posted similarly. Each succeeding year adds to the height of the first and only column.

The exceptions to the continually increasing height are the years shown in red, which result in reducing the effects of inflation and decreasing the height of the column temporarily.

After a more than one hundred years of inflation, the single column won ’t fit on a single page, if we use the same scale as in the horizontal bar chart above.

The cumulative effects of a century of inflation are thus: the U.S. dollar has lost ninety-nine percent of its purchasing power. That means that it takes one hundred times as much for the goods and services we buy as it would without the effects of inflation.

WHERE WE ARE NOW

In a very real sense, the U.S. dollar has already collapsed. Nearly all of the dollar ’s loss of purchasing power has occurred since the depths of the Great Depression in the 1930s. As much as the Federal Reserve might prefer otherwise, most of its time is spent reacting to the cumulative, more extreme effects of the inflation they have created for more than one hundred years.

When the Fed chair talks about “reducing inflation”, what he means is that the Fed is trying to control the effects of inflation which the Fed, itself, has been creating since its inception in 1913. Interest rate manipulation might affect the activity of consumers and investors in negative ways that exacerbate current problems and/or cause other problems. The announced intention about “fighting inflation” by raising interest rates will likely have unintended consequences that overwhelm any efforts and intentions to restore stability.

A certain amount of inflation is necessary to keep the economy from collapsing. Originally, a little bit of inflation was seen as a stimulant to economic activity and productivity; now it has become a necessity. Keeping the wheels greased can keep the slowly moving wagon in motion. At some point, though, the wheels will come off.

The situation is very similar to that which is experienced by drug addicts. Each successive fix requires a stronger dose and any positive effects are minimal. The cumulative negative effects continue to percolate until manifesting themselves in a crisis of either withdrawal or death.

The U.S. and world economies are dying. Maybe it is not apparent to some, but it will be soon. The worst part is that a painful withdrawal is no longer an option.

As time marches on, the effects of government inflation will become more extreme and more unpredictable. And the loss of purchasing power in the US dollar will reflect that.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2024 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.