Fed Gambles Trillions to Stabilise Financial System

Stock-Markets / Financial Markets Dec 06, 2008 - 07:18 AM GMT Over a Half Million Jobs Axed in November. There is no joy on Main Street this holiday season as 533,000 jobs were axed in November.

Over a Half Million Jobs Axed in November. There is no joy on Main Street this holiday season as 533,000 jobs were axed in November.

“Nonfarm payroll employment fell sharply (-533,000) in November, and the unemployment rate rose from 6.5 to 6.7 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. November's drop in payroll employment followed declines of 403,000 in September and 320,000 in October, as revised. Job losses were large and widespread across the major industry sectors in November.”

“You are seeing the impact of the lack of credit feeding through to a lot of companies, who are very fearful,” said John Silvia , chief economist at Wachovia Corp. in Charlotte, North Carolina, and a former congressional staff economist. “Consumer confidence is going to be bad. Personal income numbers will be awful. It is going to be a difficult winter for a lot of people.”

But you can't eat IOUs!

( Bloomberg ) -- California , the world's eighth largest economy, may pay vendors with IOUs for only the second time since the Great Depression, State Finance Director Mike Genest said.

In a letter to legislative leaders Dec. 2, Genest said the state “will begin delaying payments or paying in registered warrants in March” unless an $11.2 billion deficit is closed or reduced. California, which approved its budget less than three months ago, may run out of cash by March, state officials say.

How many times can you say…Déjà vu all over again?

( Bloomberg ) -- U.S. stocks fell this morning after employers cut jobs at the fastest pace in 34 years last month, spurring concern that the deepening recession will prolong a 15-month slump in corporate profits. The S&P 500 is down 43 percent in 2008, poised for its worst year since 1931, after the collapse of the subprime mortgage market dragged the nation into a recession and reduced average profits for five consecutive quarters… and the market closed UP? What gives?

( Bloomberg ) -- U.S. stocks fell this morning after employers cut jobs at the fastest pace in 34 years last month, spurring concern that the deepening recession will prolong a 15-month slump in corporate profits. The S&P 500 is down 43 percent in 2008, poised for its worst year since 1931, after the collapse of the subprime mortgage market dragged the nation into a recession and reduced average profits for five consecutive quarters… and the market closed UP? What gives?

A growing Risk in a 3 Trillion Dollar Gamble.

( Bloomberg ) -- Federal Reserve officials are throwing everything they have into the fight to stabilize financial markets and restore economic growth. In the process, the Fed balance sheet is ballooning to $3 trillion , if not more. The demand for government debt instruments as a safe haven is even greater than the issuance of new debt. What a conundrum! There are two growing risks in Treasury bonds. The first is market risk, as more investors pile on. The second is credit risk, as the Treasury piles on massive amounts of debt. Is the bailout working ? The Fed thinks so. Do you?

( Bloomberg ) -- Federal Reserve officials are throwing everything they have into the fight to stabilize financial markets and restore economic growth. In the process, the Fed balance sheet is ballooning to $3 trillion , if not more. The demand for government debt instruments as a safe haven is even greater than the issuance of new debt. What a conundrum! There are two growing risks in Treasury bonds. The first is market risk, as more investors pile on. The second is credit risk, as the Treasury piles on massive amounts of debt. Is the bailout working ? The Fed thinks so. Do you?

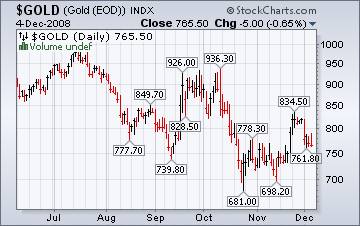

A surprisingly small change in the price of gold from today's news.

( Bloomberg ) – “Gold, little changed in London, may rise on speculation a gain in U.S. unemployment will weaken the dollar and boost bullion's appeal as an alternative investment.” Analysts still are attached to the idea that the stimulus packages are inflationary and should be a boon to gold. They haven't considered that the deflationary aspects of the Great Deleveraging is destroying values faster than the Fed can pump in more liquidity. This is no longer a liquidity issue. It's a solvency issue. The flight to cash and its equivalents is extraordinary.

( Bloomberg ) – “Gold, little changed in London, may rise on speculation a gain in U.S. unemployment will weaken the dollar and boost bullion's appeal as an alternative investment.” Analysts still are attached to the idea that the stimulus packages are inflationary and should be a boon to gold. They haven't considered that the deflationary aspects of the Great Deleveraging is destroying values faster than the Fed can pump in more liquidity. This is no longer a liquidity issue. It's a solvency issue. The flight to cash and its equivalents is extraordinary.

Do Japan's investors think stocks are cheap enough?

( Bloomberg ) -- Japan stocks fell, extending a weekly loss, as a dimmer earnings outlook for lenders prompted Goldman Sachs Group Inc. to cut price targets on the nation's biggest banks, overshadowing benefits to manufacturers from oil's decline. The Nikkei has tumbled 48 percent in 2008, set for its worst year on record, as the collapse of the American mortgage market and ensuing credit crises sparked the first simultaneous recession in the U.S., Japan and Europe since World War II. Japan's three biggest banks in October cut full-year profit targets by more than half on rising bad-loan costs.

( Bloomberg ) -- Japan stocks fell, extending a weekly loss, as a dimmer earnings outlook for lenders prompted Goldman Sachs Group Inc. to cut price targets on the nation's biggest banks, overshadowing benefits to manufacturers from oil's decline. The Nikkei has tumbled 48 percent in 2008, set for its worst year on record, as the collapse of the American mortgage market and ensuing credit crises sparked the first simultaneous recession in the U.S., Japan and Europe since World War II. Japan's three biggest banks in October cut full-year profit targets by more than half on rising bad-loan costs.

Is the rally over for Chinese stocks?

( Bloomberg ) -- China's stock benchmark rose for a fifth day, its longest winning streak this year, on speculation lower energy costs will spur consumer spending and cut corporate overheads as the government adds measures to bolster the economy. On Thursday, the Shanghai market extended gains by pushing the index over 2000 for the first time in December. The question is, “Will it last?”

( Bloomberg ) -- China's stock benchmark rose for a fifth day, its longest winning streak this year, on speculation lower energy costs will spur consumer spending and cut corporate overheads as the government adds measures to bolster the economy. On Thursday, the Shanghai market extended gains by pushing the index over 2000 for the first time in December. The question is, “Will it last?”

The analysts may be right…for the short term.

The U.S. Dollar appears to have run out of steam and may be due for a correction. Here is what the pundits are saying, “ The reality of low interest rates and deep economic recession should finally start to catch up with the U.S. dollar in 2009, after risk aversion and de-leveraging helped push the currency to multi-year highs. The advance is "artificial" and may subside once extreme risk aversion eases and global markets stabilize.” Persistent, aren't they?

The U.S. Dollar appears to have run out of steam and may be due for a correction. Here is what the pundits are saying, “ The reality of low interest rates and deep economic recession should finally start to catch up with the U.S. dollar in 2009, after risk aversion and de-leveraging helped push the currency to multi-year highs. The advance is "artificial" and may subside once extreme risk aversion eases and global markets stabilize.” Persistent, aren't they?

Banks are finding more fraud in their applications.

Reported incidents of mortgage fraud grew by 45% in the second quarter compared to the year-ago period, as borrowers misstated their financial information to maneuver around tighter lending standards, industry data released Tuesday showed. Nationally, more than 65% of fraud incidents in the first two quarters were categorized as general application misrepresentation of the buyer's true name or assets. Among the other more common mortgage fraud cases were misrepresentation of income, appraisals, employment history, and debt and assets.

Reported incidents of mortgage fraud grew by 45% in the second quarter compared to the year-ago period, as borrowers misstated their financial information to maneuver around tighter lending standards, industry data released Tuesday showed. Nationally, more than 65% of fraud incidents in the first two quarters were categorized as general application misrepresentation of the buyer's true name or assets. Among the other more common mortgage fraud cases were misrepresentation of income, appraisals, employment history, and debt and assets.

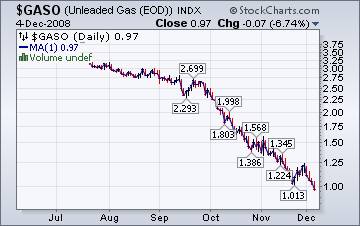

The expected bounce in gasoline prices fizzled. Next, $1.35 at the pump.

The Energy Information Administration reports that, “The average price of regular gasoline fell in all regions of the country and for the first time since January 31, 2005, the average price slipped below $2 a gallon in all major regions of the country. The national average dipped 8.1 cents to 181.1 cents per gallon; the price is now 230.3 cents below the all-time high set on July 7 of this year, and 125 cents lower than the price a year ago.”

The Energy Information Administration reports that, “The average price of regular gasoline fell in all regions of the country and for the first time since January 31, 2005, the average price slipped below $2 a gallon in all major regions of the country. The national average dipped 8.1 cents to 181.1 cents per gallon; the price is now 230.3 cents below the all-time high set on July 7 of this year, and 125 cents lower than the price a year ago.”

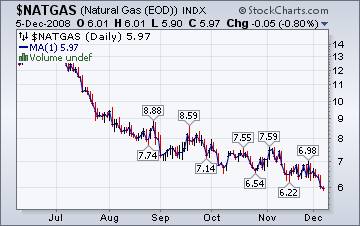

Declining industrial use countering colder temps for natural gas prices.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Despite somewhat chillier temperatures and an imminent arctic blast expected to move into the Midwest, natural gas spot prices remained relatively soft, as prices declined in most market locations in the Lower 48 States. Factors contributing to the relative softness of natural gas prices likely included the robust levels of domestic natural gas production and working gas in storage, falling crude oil prices, and the effects of the weakening economy on industrial demand for natural gas.”

The Energy Information Agency's Natural Gas Weekly Update reports, “ Despite somewhat chillier temperatures and an imminent arctic blast expected to move into the Midwest, natural gas spot prices remained relatively soft, as prices declined in most market locations in the Lower 48 States. Factors contributing to the relative softness of natural gas prices likely included the robust levels of domestic natural gas production and working gas in storage, falling crude oil prices, and the effects of the weakening economy on industrial demand for natural gas.”

Too big not to fail?

Have you ever felt that doing certain things left you feeling as if you were bumping your head against a wall? Is that what Mr. Bernanke and Paulsen might be doing. Why aren't their bailout efforts working? Is the economy on a stable footing again, or are we still sliding into a quagmire? Elliot Spitzer tells us we need to stop using the bailouts to rescue gigantic financial institutions that aren't working.

What are we getting for the trillions of dollars in rescue funds? If we are merely extending a fatally flawed status quo, we should invest those dollars elsewhere. Nobody disputes that radical action was needed to forestall total collapse. But we are creating the significant systemic risk not just of rewarding imprudent behavior by private actors but of preventing, through bailouts and subsidies, the process of creative destruction that capitalism depends on.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.