Gold and Silver Forecast 2009

Commodities / Gold & Silver 2009 Dec 23, 2008 - 10:44 AM GMTBy: Mark_OByrne

Gold Outperformed Most Assets in 2008 - Gold Up 3.9% in USD; Up 5.3% in EUR and Up 34.4% in GBP

Gold Outperformed Most Assets in 2008 - Gold Up 3.9% in USD; Up 5.3% in EUR and Up 34.4% in GBP

Today’s London AM fix (23/12/08) was $844.01 (USD), £570.85 (GBP) and €603.72 (EUR). At the start of 2008 ( January 2nd 2008), gold’s London AM Fix was at $840.75 (USD), £424.81 (GBP) and €573.34 (EUR).

Thus, in 2008 gold is up by 3.9% against the dollar, up 5.3% against the euro and up 34.4% against the pound. The London AM Fix is a widely followed benchmark for physical gold and silver prices and is reported in major newspapers and at many gold-related websites.

This has led to a sharp outperformance of gold vis-à-vis every major equity indices and commodity in the word, not to mention most property markets (see Chart and Performance table).

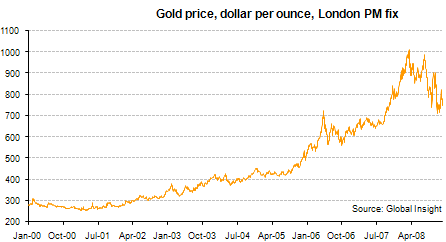

In March, gold fell from a record nominal high of just over $1,000/oz but it is important to remember that gold is only down some 15% from that record nominal high and this is after surging nearly 60% in the previous 7 months. In the seven months from the start of the credit crunch and the collapse of Bear Stearns, gold had surged by nearly 60% - from $640 in August 2007 to over $1,000 in March 2008.

Thus after a 60% surge in just 7 months, gold had become overvalued and was due a correction. This is exactly what has happened and despite carnage in equity, commodity and property markets internationally gold remains higher in 2008 in all major currencies including one of the strongest currencies in the world during the second half of 2008 – the US dollar.

Considering that gold had already outperformed all other asset classes in the last 7 years (a roughly 20% return per annum), this is quite an achievement. Especially given the extraordinary and unprecedented financial and economic times that have confronted us in 2008.

Gold and silver may rise or fall a small number of percent between here and actual year end. Should gold close down on the year, it will be only very marginally and will be the first annual fall in gold prices in dollar terms since 2000. Even were gold to end up being down some 5% in dollar terms in the year – that would be quite an achievement considering how badly property markets and major equity indices such as the FTSE (-33.4%), S&P 500 (-41%) and Nikkei (-43%) have performed in 2008.

Equity indices are down by even larger amounts from peak to trough or from their recent record highs.

Gold has done exactly what it should do in a financial and economic crisis – it has outperformed other asset classes and preserved the wealth of those who have prudently diversified.

Silver Outperformed Most Assets in 2008

Silver fell some 50% from recent multiyear record highs this year but will still outperform all major equity indices in 2008. This is quite an achievement especially given the fact that silver has surged in value in recent years and particularly in late 2007 and the start of the financial and economic crisis.

Silver is down 24.6% in USD terms, 22.5% in EUR terms but is up 1.46% in sterling terms (see Performance tables), clearly showing it’s safe haven credentials.

This is a sterling performance, pun intended, especially considering the carnage in equity, commodity and property markets internationally. Silver, like gold, has outperformed nearly all commodities, all indices and most asset classes in 2008 in all major currencies including one of the strongest currencies in the world last year – the US dollar.

Silver did fall from a record nominal high of $20.86/oz, but it is important to remember that it is down some 50% after surging 83% in the previous 7 months. In the seven months from the start of the credit crunch and the collapse of Bear Stearns, silver had surged by 83%. Indeed, silver has risen sharply in recent years and had risen from some $6.70 in August 2005 to a nominal high of $20.86 in August 2007 or over 200% in just 2 years. Clearly despite very strong fundamentals, some irrational exuberance had entered the silver market and a sharp correction and consolidation has been taking place. Today silver looks extremely good both from a fundamental and technical perspective.

Outlook for 2009

Never in modern history has the outlook for global financial markets and economies been so uncertain.

The financial markets and global economy remain in a state of heightened flux. Deflation is clearly winning the early to middle rounds of the titanic “flation” battle. But the concern is that inflation and stagflation will come out swinging in the following rounds. The taboo word of ‘hyperinflation’ may soon become a topic of debate in the coming months as stagflation and deflation have done in recent months.

Bernanke’s academic knowledge of the Great Depression and Japan’s ‘Lost decade’ while useful is quite obsessive and myopic . He would do well to also study Weimar Germany as there are parallels with America’s massive fiscal deficits and world’s largest debtor status with those of Germany after World War I that are increasing by the day.

There are real concerns of a disorderly run on the dollar as the creditors of the world’s largest debtor nation get worried about their US dollar denominated assets and need their own currency reserves to help protect and stimulate their own struggling economies.

A prime distinction between the 1930’s deflation and Great Depression and today is that then the US was the world’s largest creditor nation and the dollar was backed by gold. Thus the US dollar strengthened in value as everything deflated in value versus it (stocks and property fell by some 80%). Gold was even stronger as Roosevelt devalued the dollar by 60% and revalued gold by 60% from $22/oz to $35/oz in 1933.

Today, the US is the largest debtor nation the world has ever seen and the levels of debt are increasing dramatically. And the US dollar is now a fiat paper currency, only backed by the “good faith and credit” of the US government.

It would not require significant selling by the Chinese, Japanese, Russian or OPEC nations to create a run on the dollar and sharp move upwards in long term interest rates (as US government bonds are sold) rather only a sharp reduction in their purchases of US debt instruments. This possibility is looking more probable and could see President elect Obama facing a monetary crisis in his first term.

Especially as the economic meltdown is leading to the US’ creditor nations having their own domestic financial and economic crisis to deal with. A sharp decline in the dollar will likely see other nations devaluing their currencies in competitive currency devaluations which would see the value of all currencies decline relative to gold. Competitive currency devaluations are already taking place in many countries internationally including in Japan (just last week Japanese Finance Minister Shoichi Nakagawa signaled Japan is ready to sell yen in order to artificially manipulate a weaker currency), Russia and China.

Massive and Deepening Macroeconomic Risk in the form of Deflation now and likely Stagflation or Hyperinflation in the Medium to Long Term

Deflation Now

Vicious deflation (particularly in asset markets that were based on massive amounts of debt and leverage) looks set to be the prevailing theme of 2009 or at least most of 2009. However, in the medium to long term we are likely to get a sharp bout of stagflation which, if not tendered to carefully or should there be a run on the dollar, could lead to a more serious bout of hyperinflation in the US and in other debtor nations.

Contrary to misinformed commentators and “expert” claims that gold does not perform well in deflation, it is worth noting that gold outperforms other asset classes not just in periods of inflation or stagflation. Gold also outperforms in deflationary depressions as it did in the 1930s when the dollar (which was backed by gold unlike today in our modern floating fiat currency monetary system) was sharply devalued overnight by Roosevelt from $22/oz to $35/oz. Thus overnight in January 1934, gold was revalued by 59%.

It is worth remembering that the Dow Jones fell by 90% during the period and property prices fell by more than 50%.

Stagflation and potentially Hyperinflation

President Obama must be careful that his fiscal stimulus and efforts to reflate the rapidly deflating economy do not result in deepening inflation and stagflation. As this would then necessitate a Paul Volker style Federal Reserve Chairman who would hawkishly increase interest rates in order to tame inflation and encourage Americans to forego consumption and rebuild a culture of prudent saving, manufacturing and exports which will be necessary if America wishes to regain its economic health again.

With central bankers, President Obama and politicians internationally desperately trying to inflate their way out of the current deflationary spiral, the concern is that while they may succeed in vanquishing the Charybdis of deflation they are eventually slaughtered by the Scylla of inflation, stagflation and potentially even hyperinflation.

Investors and savers should be cognoscente of the big picture historical trends and prepare, invest and save accordingly.

Solvency of the U.S. government

America is the largest debtor nation the world has ever seen and its global ascendancy is now threatened by this staggering debt and by the emergence of new powers and a new multipolar world.

American consumers have $14 trillion worth of personal debt and the national debt has risen sharply to some $11 trillion ($5.7 Trillion when President Bush came to power) and projections that this debt could surge to as high as $20 trillion in the coming years. And this does not count the staggering unfunded liabilities of either Social Security, Medicaid and Medicare. The head of the Federal Reserve Bank of Dallas, Richard W. Fisher has said that the unfunded liabilities from Medicare and Social Security adds up to $99.2 trillion.

There is absolutely no way that the American people can fund these Social Security and Medicare obligations. The United States has been living way beyond its means and will become a third world country unless something is immediately done to drastically cut humongous military expenditures and government spending.

The demographic time bomb facing the US as 78 million baby-boomers begin to retire in the coming years may make the current financial crisis look like child's play.

Mr. David Walker, the US Comptroller General, chief accountability officer and head of the US Government Accountability Office (GAO) has drawn parallels between the US today and the end of the Roman Empire, warning there are "striking similarities" between America's current situation and the factors that brought down Rome, including "declining moral values and political civility at home, an over-confident and over-extended military in foreign lands and fiscal irresponsibility by the central government" (see David Walker's recent article in CNN via Fortune magazine in the COMMENTARY section today).

The US government fiscal position increasingly resembles that of a Latin American ‘Banana Republic’. While levels of corruption are not on a par with these Banana Republics, corruption is rife and it increasingly looks like the lower and middle classes of America have been pillaged by the Wall Street moneyed elite and their appointed lackeys in the higher echelons of the US government.

This is not "anti American" as "pro American" liberals and conservatives alike have echoed these warnings in recent years. The Government Accountability Office (GAO) has rightly earned a reputation for professional, objective, fact-based, nonpartisan, non ideological, fair and balanced reviews of government programs and operations.

Walker has said that fiscal responsibility must be a top priority and if this is done the problems challenging the US can be overcome but "if they don't, I think the risk of a serious crisis rises considerably". This crisis would almost certainly be monetary in nature with a possible collapse in the dollar and the dollar losing its privileged status as the global reserve currency.

The new President will face a herculean task if he is to succeed in preventing America from becoming a second tier power as happened to Great Britain at the turn of the last century. This has obvious ramifications for investors who should focus on wealth preservation in the coming years.

Even the most sanguine, tunnel-visioned bull would have to admit that the fundamentals of the US economy are bad and deteriorating.

Solvency of UK and of many other debtor nations

Sterling has fallen precipitously in recent weeks leading to fears of a currency crisis. The Bank of England resisted cutting interest rates by more than 1 per cent earlier this month amid fears that the economy and sterling would collapse. The bank revealed yesterday that its Monetary Policy Committee had "considered cutting rates further", but it feared that "there was a risk that going further could cause an excessive fall in the exchange rate" causing inflation in the long term.

Ben Read, managing economist at Centre for Economics and Business Research, told the Telegraph: that “with the credibility of UK fiscal and monetary policy now under serious scrutiny across the international markets, each policy option comes with potentially serious consequences for the credit worthiness of UK plc."

As governments and central banks internationally engage in a global currency debasement those who think that printing money is a risk free panacea to our deflationary woes will be found wrong once again. The UK is now in the midst of a sterling crisis and the risk is that given the scale of debt internationally, the scale of the global imbalances (huge US trade, current account and now budget deficits) and the scale of currency debasement that a global monetary crisis could be the ultimate unfortunate outcome.

Competitive Currency Devaluations

Competitive currency devaluations on an international scale are a recipe for wealth destruction on a massive scale. Devaluation is a short term panacea which fails to address underlying uncompetitive challenges facing economies. Countries that devalue their currencies tend not to do well over the long term as seen in many emerging markets and South American economies in modern history.

Countries that have strong currencies in modern history (such as Germany and Switzerland) tend to move up the value chain in terms of exports and prosper in the long term. A sound currency is a prerequisite for a sound economy and alas the UK ,US (after years of profligacy ) and many other nations face major challenges on both fronts.

Gold is a finite currency will be the default currency of choice and a monetary safety valve where large sums of capital will flow - thus resulting in sharply higher prices.

Supply/ Demand Situation in Gold and Silver Remains Very Bullish

Global gold production is now estimated at some 2,500 tonnes per annum and demand is around 4,000 tonnes. The supply demand deficit has been made up for many years by sales by certain imprudent central banks (such as Gordon Brown’s Bank of England) and these central banks are now greatly reducing their sales and many central banks internationally, especially large creditor nations with huge US dollar reserves, are now diversifying their currency reserves with gold.

Gold ETFs have created hundreds of tonnes (the world's largest ETF, the SPDR Gold Trust, said its bullion holdings rose 6.1 tonnes, or almost 1 percent, on Dec. 17 to a record high of 775.33 tonnes of bullion) and billions of dollars worth of extra demand for gold in recent years. As have the creation of many other gold storage and ownership programmes such as digital gold and Perth Mint Certificates (the Perth Mint refines and produces some 10% of the world’s bullion, doubled output in the past six months).

Meanwhile, global gold production has not increased despite the increase in demand and increase in gold prices in recent years. Gold is a precious, finite metal and gold production only increases at a rate of some 2 to 2.5% per annum and falling.

Of the world’s three biggest gold producers (China, South Africa and Australia), only China has managed to increase gold production in recent years and their increase in production has been met with a corresponding sharp increase in Chinese demand meaning that Chinese gold does not add to supply in the international marketplace as it is all consumed in China which is a net importer and increasingly so.

South African gold output has been falling since 1970 when annual production was over 1,000 tonnes. Last year South Africa produced 272 tonnes of gold. South African gold output fell to its lowest level in 84 years in 2006 because of declining mining grades. The last time South Africa produced less than 260 tonnes of gold was in 1920.

This means that the supply/demand balance in gold is becoming increasingly tight and likely to lead to markedly higher prices in the coming years.

Massive Systemic Risk

The risk posed to the entire global financial system has never been as high and counter party risk has never been as high. In a world where huge banks such as Bear Stearns and Lehman Brothers can collapse and behemoths such as Fannie Mae, Freddie Mac, General Motors and a long list of others need to be bailed out, investors need to again consider systemic risk and counter party risk. Systemic risk hasn’t gone away, and it’s entirely possible that the risk may re-elevate in the next six months.

Stockbrokers, pension providers and many other financial intermediaries will be at risk of failure in the coming months and investors need to be aware of counter party risk and intermediation. They should only deal with financial entities and investment providers who they have done much due diligence on and who they are reassured regarding the solvency. Credit ratings of providers should again be evaluated and scrutinized.

http://www.research.gold.org/prices/daily/

Conclusion

As long as the markets continue to be volatile and uncertain which unfortunately seems very likely - demand for physical gold and silver bullion will likely stay very strong and should result in higher prices.

Thus, the confluence of decreasing supply (as outlined above) and increasing demand due to strong international geopolitical, systemic and macroeconomic factors is leading to extremely bullish conditions for the gold and silver markets. Probably even more bullish than in the 1970s when silver rose from $1.39/oz to over $50/oz or 3,600% and gold rose some 2,400% from $35 to over $850 in just 9 years.

Taken individually, any one of these factors would be bullish for gold but in unison, these combination of factors will likely lead to gold prices surging in 2009. The inflation adjusted high of $2,400/oz in 1980 remains a conservative estimate for gold to reach in the next 2 to 5 years. Similarly, the inflation adjusted high for silver in 1980 of some $120/oz remains a conservative price target that will very likely be reached within to 2 to 5 years.

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.