Hyperinflation Begining in China and Will Destroy the U.S. Dollar

Economics / HyperInflation Jan 19, 2009 - 03:31 AM GMTBy: Eric_deCarbonnel

The conventional wisdom on China is dead wrong. Specifically, there is a widespread belief, as expressed by Goldman Sachs, that "China will keep the yuan trading within a narrow range in 2009 due concerns about exporters." Worse still, others are even predicting that China will devalue its currency! The sheer wishful thinking is astounding! The idea that "China will keep the dollar peg to help its exporters" ranks all the way up there with "Housing prices always go up" and "You can spend your way to prosperity".

The conventional wisdom on China is dead wrong. Specifically, there is a widespread belief, as expressed by Goldman Sachs, that "China will keep the yuan trading within a narrow range in 2009 due concerns about exporters." Worse still, others are even predicting that China will devalue its currency! The sheer wishful thinking is astounding! The idea that "China will keep the dollar peg to help its exporters" ranks all the way up there with "Housing prices always go up" and "You can spend your way to prosperity".

THERE ARE NO FREE LUNCHES

If you have learned nothing else in the last year and a half, you should have learned that if something sounds too good to be true, that is because it IS too good to be true . The media overwhelmingly presents China's dollar peg as a win-win situation: Americans get cheap imports and low interest rates while China gets a strong manufacturing sector. While commentators do sometimes debates whether China will keep lending us money forever, they never talk about the REAL problem with the dollar peg.

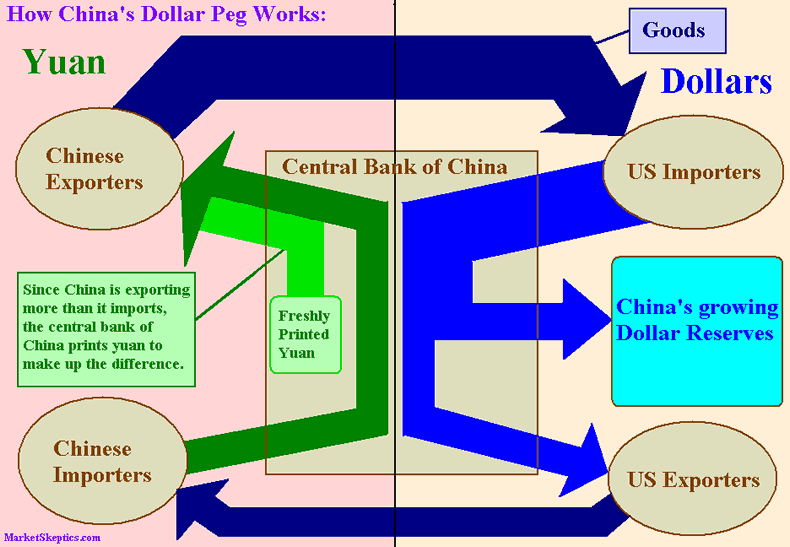

Below is a chart which shows how China's dollar peg works. See if you can spot the downside that the media never seems to mention.

The US's trade deficit requires China to print money!

The little discussed downside of the dollar peg is all the money China has to print to maintain it. China's Central Bank puts the extra dollars it receives from its trade surplus into its growing foreign reserves and then prints yuan to pay Chinese exporters. This results in an increase in China's base money supply by an amount equal to the increase in its foreign exchange reserves. While China's ability to keep accumulating US reserves is endless, its ability to keep its money supply under control is not.

The true threat to the dollar peg

If there is one development which could force China to drop its dollar peg, it is out of control inflation. Rampant inflation would result in millions of citizens starving and would create widespread social unrest. Keeping food prices low is a matter of political survival for Chinese authorities. So, facing the choice between losing their grip on power and losing the dollar peg, they will not hesitate for a second to sacrifice the dollar to save their own skin.

So far China been able to contain inflation, but…

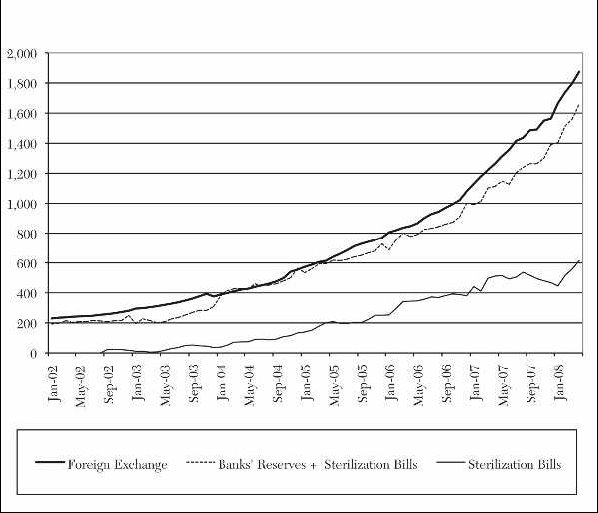

In recent years, China has been able to contain the inflationary effects of its trade surplus by soaking up or "sterilizing" all the extra liquidity (printed yuan). These sterilization efforts mostly involved:

A) Raising the reserve requirements of commercial banks. In essence, the PBOC (People's Bank of China) prints money to fund its trade surplus and then increases the amount of yuan banks have to keep as reserves at the Central bank, preventing the printed cash from reaching the economy. As of May of last year, commercial banks' reserve requirements were at 16.5 percent

B) Selling RMB -denominated sterilization bills. The state owned and controlled banking system has been forced to absorb the majority of these bills. As of May of last year, the value of sterilization bills reached 10 percent of bank deposits.

Taken together, these two steps have immobilized roughly 26.5 percent of Chinese commercial banks' deposits. This shows the magnitude China has had to intervene so far, as the value of sterilization instruments outstanding has been increasing at roughly the same rate as its foreign reserves.

PBC Foreign Reserves and Sterilization Instruments (US$ Billions)

While China has been able to contain inflation to single digits for the last decade, that is about to change. All economic forces are aligning in China for a surge in inflation.

1) China has abandoned its sterilization operations

Currently, the PBOC has abandoned its sterilization efforts all together:

A) The PBOC has lowered reserve requirements by 2 percentage point for China's big banks and by 4 percentage point for all other banks.

B) The PBOC has scaled back sterilization efforts by reducing liquidity-draining three-month and 52-week bill sales from once a week to once every two weeks. As a result of these decreasing sales, the clearing house for China's interbank bond market expects PBOC's 2009 bill issues to be down over 70% , which will increase the Chinese base money supply by 2 trillion yuan.

These actions signify that the PBOC has ceased sterilizing its currency interventions and is focusing on (imaginary) deflation risks. A flood of cash has been unleashed, and a tsunami of pent-up inflation will soon hit China.

2) China is running record trade surpluses

China's imports are crashing much faster than its exports. In December, Chinese imports fell 21.3% while exports fell only 2.8%. As a result, China has been running record trade surpluses these last three months: $35 billion, $40 billion, and 39 billion.

The reason for China's surplus is obvious when you think about it. Consider the following list of goods a country can exports and ask yourself what would hold up best during a severe global economic downturn.

*** Commodities (Oil, gas, steel, etc)

*** Capital goods (Airplanes, Caterpillars, Machinery for new factories, Machinery for new mining/oil exploration projects, etc)

*** Durable goods ( SUVs , CARs , appliances, business equipment, electronic equipment, home furnishings, etc)

*** Luxury goods (brand name products, designer clothing, artwork, etc...)

*** Cheap consumer goods (everything you buy at Wal -Mart)

The answer is that the demand for cheap consumer goods will hold up better than anything else. This can easily be seen in the retail sales this holiday shopping season . Wal -Mart, which imports 70% of its products from China, was the only retail to post a year-on-year increase in sales. So while the world economy might be imploding spectacularly, demand for Wal -Mart's cheap Chinese goods is holding up quite well. The implications of this is that while China's exports will fall, they will fall less than those of any other country.

The current trade surplus is still completely unsustainable. If China's continues running a 40 billion dollar trade surplus all year, its base money supply will double by the end of 2009. Also, since China has halted the appreciation of the yuan, its trade surplus is unlikely to shrink as demand for cheap consumer goods is set to remain strong.

3) The Chinese economy will shrink in 2009

Consistently amazing economic growth is the biggest factor which has helped China contain inflation. Inflation happens when the money supply is growing faster than the economy, and china's economy has been growing fast. This economic growth has helped absorb the enormous quantities of yuan that have been printed to support the dollar. However, this will change in 2009. Due to falling global demand, China's economy is set for zero, if not negative, growth which will remove a significant mitigating force against inflation and amplify the inflationary impact of China's printing press.

Side note: China's economic strength is underestimated

It is important to note that, while economic growth will go probably go negative, China's economy will not crash. The strength of the Chinese economy is widely underestimate in the media today. In addition to the resilient worldwide demand for its cheap consumer goods, China is also benefiting for import substitution at home. This is why imports to China are falling so fast: Chinese are switching to cheap domestic product instead of expensive foreign imports. So while there has been a sharp drop in Chinese demand for big-ticket brands (Dior, Chanel, Hermes, etc…) and others luxury items, knock-offs and other cheap goods are still flying off the shelves. Chinese consumers are downshifting, but they are still spending strong, as reflected by the 21% year-over-year growth in 2008.

However, despite China's strong fundamentals, the current worldwide downturn is too strong for it to escape. The worldwide financial carnage is so severe that even the demand for cheap consumer goods will decrease. As a result, while China may outperform every country on Earth, its economy will still suffer in 2009.

4) Deflation in China would be too good to be true

China has been in a constant war with the inflation caused by the dollar peg. Economic growth and sterilization operations alone have not been enough to absorb the growing liquidity, and China has been forced to turn to ever more drastic steps in its efforts to contain inflation. These stifling policy measures together with its sterilization efforts have enormously suppressed domestic demand and have distracting the government from developing key services enjoyed by other developed nations. This suppressed domestic demand has also distorted China's economy, as reflected by the undersized service sector, and has lowered the quality of life for Chinese citizens.

Chinese financial repression and market socialism

In its losing battle with inflation, China has adopted stifling policy measures to suppress domestic demand and keep prices down:

(these are only a few of the anti-inflation measures China has adopted)

A) Strict price controls. ( ie : Large wholesalers must seek central government approval if they want to raise prices by 6 percent within the space of 10 days or by 10 percent within a month.)

B) Credit ceilings. (limits on how much commercial banks can lend)

C) Floors on lending rates and ceilings on deposit rates

D) Strict rules governing lending decisions

E) Tight land purchase and lending requirements

F) Direct government intervention to limited expansion in certain industries ( ie : aluminum, steel, autos and textiles sectors in 2004)

G) Penalty taxes on anyone buying and selling real estate in a short period of time.

H) Forcing local government to cut back spending by delaying approval of their investment projects

I) High sales taxes.

J) Etc...

Suppressed domestic demand has distorted China's economy

The distortions caused by sterilization operations and stifling policy measures are best seen when comparing China's and the US's economy:

A) US home buyers get tax incentives VS Chinese home buyers get tax penalties

B) US gets artificially low interest rates VS China's artificially high interest rates

C) US's "service economy" VS China's "service-less economy"

D) Etc…

In the US, the overvalued dollar and easy credit environment have caused the service sector to become oversized , artificially raising America's standard of living. In contrast, China's suppressed domestic demand has led its service sector to become undersized, artificially decreasing its standard of living.

Focus on inflation has lead to a lack of key government services

With Chinese authorities sidetracked by their export oriented focus and battle with overheating, the development of key government services enjoyed by other developed nations has been neglected. As a result, Chinese citizens' lack of social security, free education, and available consumer credit, which has forced them to save far more than their Western counterparts, leaving them with less disposable income.

Deflation would be a godsend to China

Chinese authorities must be thrilled about the prospect of fighting deflation instead of inflation. Fighting deflation would allow China to:

A) Scale back its increasingly costly sterilization efforts.

B) Lower interest rates.

C) Get rid of all the controls which are distorting domestic property markets.

D) Promote consumer spending without worrying about the inflationary impact.

E) Develop a comprehensive social security net.

F) Increase funding of public education.

E) Accelerate the development of a system to rate people's credit.

F) Encourage growth in underdeveloped domestic sectors (housing, health care, education, entertainment, etc)

G) Etc…

Most of the steps above are already being taken by Chinese authorities. Unfortunately, there are no free lunches. The possibility that China can maintain a highly inflationary currency peg, reverse years of anti-inflation policies, release a flood of sterilized yuan back into circulation, and go on a Western-style stimulus/bailout binge without experiencing double digit inflation is zero.

5) No deleveraging

There is no chance of real deflation happening in China. None. The Strength of China's Banking System makes it impossible.

A) Apart from Bank of China, Chinese banks have little exposure to overseas debt. So, although toxic US securities were sold to banks around the world, China's capital controls protected its banking system from America's bad debt

B) As a side effect of the country's sterilization operations, 26.5 percent of Chinese commercial banks' deposits were placed with the central bank last year (reserve requirements and forced underwriting of PBOC bills).

C) Unlike Western banks, who have been enjoying a credit bonanza for decades, Chinese banks have only recently gotten into the credit game, after years of being ridiculed for being overly cash-centric. Because of this late entry, Chinese banks completely missed the subprime party.

D) China is also in the enviable position of being one of the few countries which doesn't need to deleverage . While Western banks were going insane with high leverage and off-balance sheet financial vehicles, Chinese banks were doing the opposite, as can be seen on the chart below (from Tao Wang of UBS ).

E) China has been waging a war against NPLs (non-performing loans) in the last few years. For example, with heavy penalties having been imposed on bank managers responsible for new NPLs , Chinese banks have become much more concerned about the loan safety than profitability. This battle again NPLs has paid off. As of September 30, 2008, nonperforming loans totaled only 2 percent for Chinese banks, compared to the 2.3 percent for FDIC-insured banks in the US. Loan loss provisions have also improved substantially, with provisions of Chinese banks amounting to an impressive 123 percent of their NPLs .

F) Finally, China's money supply itself is underleveraged when compared to the rest of the world. For example, the US's M2 to M1 ratio is 65% higher than China's. The Chinese M2 to GDP ratio is also more 160 percent, perhaps, the highest in the world.

When considering the strength of Chinese Banks and underlying strength of China's economy, no debt deflation is possible.

If there is no chance of deflation, then why is China's cpi slowing down?

There are three main reasons for the slowdown in China's cpi :

A) The bursting of the commodity bubble. Because of speculator dominated futures markets in the US , commodity prices were boosted to artificial level going into the summer of 2008. As these inflated commodity prices fell back down to Earth, they caused a temporary worldwide slowdown in inflation.

B) In the second half of the year, deleveraging and hedge fund redemption caused the outflow of a large amount of hot money from China. This outflow temporary depressed asset prices.

C) The unwinding of the commodity bubble spread deflation fears worldwide and caused the velocity of money to drop.

6) Deflation fears are paralyzing China's money supply

"deflation fears" have slowed the Chinese money supply to a crawl. While they are still spending, Chinese consumers are delaying big purchases and downshifting to discount stores. Businesses are strapped for cash, and scared Chinese banks are dumping riskier borrowers, like credit-card holders. China is experiencing one of the brief deflationary periods which typically precede hyperinflation .

Deflation fears in China also provide the perfect example of how a slowdown in the "velocity of money" and makes prices fall. Right now, Chinese banks are hoarding cash and delaying payments on personal credit cards . Only a year ago, most banks paid credit-card transactions in 14 days, but now merchants are having to have to wait 20, 40 or even 90 days to get paid. With lenders making credit-card transactions as unattractive as possible, many merchants are refusing to take credit cards from Chinese consumers. Think about that for a second, all that purchasing power from Chinese credit cards wiped out due to nothing but fear itself.

The important point to note about the price deflation caused by the deflation fears is that it will reverse sharply once inflation picks up. Banks will begin paying credit cards normally, and merchants will start accepting them again. The enormous amount of purchasing power which disappeared will reappear just as suddenly, causing a wild jump in inflation.

7) Sterilization operations have become a loss generating ventures

Until last year, China's sterilization operations had been profitable, since the rate of interest that Beijing earned on foreign exchange reserves (mainly US Treasuries) had been higher than the rates it was paying on its yuan-denominated sterilization bills at home. However, now that the fed has lowered US interest rates to zero for the foreseeable future, China's dollar peg has become a loss-making policy. When inflation hits china and interest rates rise again, China's losses from its currency sterilization will become staggering.

8) China likely to attract a flood of hot money in 2009

China has had a problem with hot money inflows in the past, and those problems are likely to get worse this year. Hot money refers to the money that flows regularly between financial markets in search for the highest short term interest rates possible. This hot money has found ways around China's capital controls and flows freely in and out of China to the authorities great frustration.

When hot money flows into china, it forces the PBOC to print money the same way as the trade surplus does. At the beginning of last year, these hot money inflows were one of China's biggest problems, bringing inflation up to 8.6 despite the authorities best efforts. The country's hot money problem ended temporarily with the bursting of the commodity bubble.

In the second half of last year, deflation fears and hedge fund deleveraging cause much of this hot money to leave China and seek the "safety" of US treasuries. This small exodus is what is responsible for the brief fall in China's foreign reserves. However, the outflow of hot money from China has ended, and it now looks set to reverse.

In the next month or so, rising inflation will start pushing up Chinese interest rates at a time when central banks around the world have set their rates at or near zero. Since the entire world knows that the yuan is undervalued, these higher rates will make China the most attractive destination on Earth for those seeking safe high yielding interest rates, and the hot money problem will return with a vengeance.

9) Chinese authorities are pulling out all the stops

The Chinese authorities are pulling out all the stops to get the country back on track. In order to prop up economic growth, Chinese authorities have:

A) Raised tax rebates for exporters of everything from high-tech and electronic products (motorcycles, sewing machines and robots, etc) to some rubber and wood products.

B) scraped export taxes for some steel products, aluminum, rice, wheat, flour and fertilizers

C) Cut the lock-up period beyond which people can resell their property without paying a business tax from five years to two years.

D) scraped the urban property tax for foreign firms and individuals

E) Allowed people to buy second homes on the same preferential terms normally reserved for first time buyers.

F) Announced plan to spend 900 billion yuan over three years to build affordable housing

G) Cut the deed tax payable by first-time buyers of homes smaller than 90 sq m is to 1 percent.

H) Announced measures such as cash subsidies and tax cuts to encourage home purchases

I) Announced plans for a 4 trillion yuan (586 billion) stimulus package to boost domestic demand through 2010.

J) Announced plans to invest 5 trillion yuan roads, waterways and ports in the next three to five years (over 2 trillion yuan more than originally planned).

K) Approved 2 trillion yuan for railway investment

M) Announced a tax break for public infrastructure projects.

N) Abolished the 5 percent withholding tax on interest income.

O) Scraped the 0.1 percent tax on purchases of equities.

P) Instructed Central Huijin (a government investment arm) to buy shares of listed Chinese firms.

Q) Encouraged state-owned firms to buy back shares.

R) Raised minimum grain purchase prices by 15 percent

S) Approved landmark reforms that give peasants the right to lease or transfer their land-use rights

T) Issued a stimulus package for its auto sector, including a tax cut

U) Set a price floor for air tickets

V) Handed out cash gifts to brighten their mood before the Chinese New Year

W) Etc...

10) Banks are flooding the economy with new loans

Chinese authorities are pushing banks to extend credit and help fight "deflation". To encourage this money supply growth and new lending, the PBOC (the People's Bank Of China) has halted sterilization operations and has cut the benchmark one-year lending rate by 2.16 percent and the deposit rate by 1.89 percent. Also, as part of these efforts, Chinese officials are reversing decades of financial repression and freeing up their banking system.

As China lifts restrictions on lending, banks are flooding the economy with new loans. Credit ceilings under which commercial banks have been operating have now been removed, and credit controls have been relaxed to give banks more leeway in making lending decisions. Chinese lenders will now be able to restructure loans and adjust the types and maturities of debt. Banks are being pressured to use this new financial freedom to "promote and consolidate the expansion of consumer credit".

In addition to stimulating consumption, credit constraints are being relaxed to give loan access to small and medium privately owned businesses, which have until now been mostly shut out of credit by the state-owned financial system. As part of this effort and in order to help banks overcome their deflation fears, China has said it will tolerate more bad debt . This step is particularly significant, as the heavy penalties imposed for the creation of new non-performing loans has been a big restraint on credit expansion.

Finally, the commitment of Chinese authorities to fight deflation is so great that regulators have stated they will support the sale and securitization of loans. I repeat, China is moving towards securitization of loans ! The adoption of securitization holds the potential to enormously accelerate money supply growth.

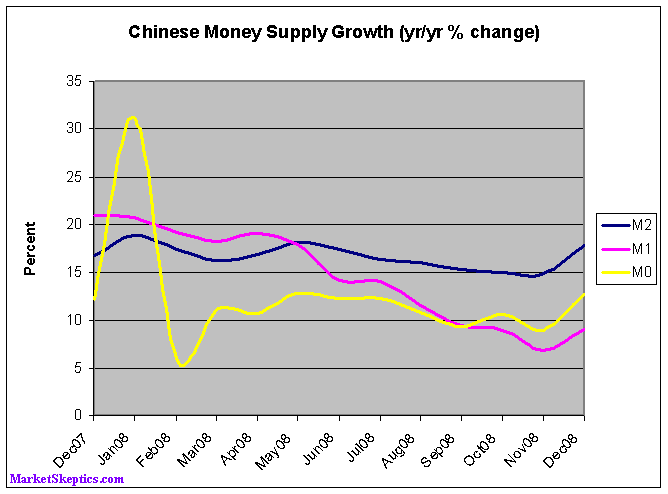

China's efforts to boost lending are working. In December, China's M2 money and loan growth soared . Just look at the graph of Chinese money supply growth below.

Does it look like China is headed towards deflation to you? (this chart will become much scarier once January's numbers are added in)

Conclusion

I view hyperinflation in China as absolutely guaranteed. Zero doubt. China is dismantling all the measures it has put in place over the years to fight inflation. It is dropping restrictions on purchasing property, eliminating price controls, getting rid of loan quotas, lowering interest rates, ceasing its sterilization efforts, etc… It is also pulling out all the stops to boost government spending and new loan creation.

Meanwhile, China's 40 billion dollar trade surplus means that its base money supply looks set to double in 2009. There is also the fact that China's money supply is frozen due to cash hoarding and will cause inflation to increase when it accelerates. Finally, the commodity bubble has finished bursting, and China's economy looks set to shrink.

Every economic factor in China suggests an enormous wave of hyperinflation will begin early this year. While I have written about the threats facing the dollar , this will be the event that finally ends the US's borrowing binge and destroys our currency.

Hyperinflation in China will be a monumental event

Because China makes most of the world cheap consumer goods, it will export its hyperinflation around the world. This means that no fiat/paper currencies will survive this with its purchasing power intact. Some will lose all value (dollar) while others will only survive but experience a loss of purchasing power (yuan, euro, yen, etc...). The only money that will retain its full value in the face of Chinese hyperinflation is gold.

China will sink the dollar to save the yuan

Once hyperinflation kicks into gear, Chinese authorities will find it impossible to bring it under control without sacrificing the dollar. Since hyperinflation would hurt Chinese exporters as much as losing their US exports, China will face a clear cut decision. By dumping the dollar peg and selling its USD holdings, China will help contain domestic inflation in many ways:

1) China will no longer be printing massive quantities of yuan to support the dollar.

2) By selling dollars in exchange for yuan, China will be able to take those yuan out of circulation, shrinking its monetary base.

3) Since the yuan will strengthen enormously again foreign currencies, Chinese exports will fall and that means there will be a lot more goods available for domestic consumption.

4) Since the yuan will be stronger against foreign currencies like the dollar, Chinese imports will rise. That means cheaper commodity prices across the board.

5) Dropping the dollar peg will make the yuan a major reserve currency. That means lower interests rates in China as foreign central banks build up yuan reserves.

Those expecting deflation are in for a surprise

Western nations who are lowering interest rate very sharply, without fearing inflation, are mainly concentrating on the domestic dynamics of their economies and the value of their currency. My bet is that no one is even considering the possibility that inflation could be imported from China, and, when cheap Chinese imports stop being cheap anymore, it will catch everybody completely by surprise.

By Eric deCarbonnel

http://www.marketskeptics.com

Eric is the Editor of Market Skeptics

© 2009 Copyright Eric deCarbonnel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Eric deCarbonnel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.