Credit Collapse - May 10th

Interest-Rates / Credit Crunch May 10, 2007 - 10:47 PM GMTBy: Paul_Lamont

On May 10 th 1837 , the banks of New York suspended gold and silver payments for their notes. Fear ignited bank runs throughout the United States . The young country fell into a 7 year depression. How could two decades of prosperity end so suddenly? According to America : A Narrative History : “monetary inflation had fueled an era of speculation in real estate, canals, and railroad stocks.” Cracks in the dam were visible much earlier, as the stock market peaked in inflation-adjusted value three years prior. According to Rolf Nef, debt levels in the private sector rose to 150% of GDP. In late 1836, the Bank of England concerned with inflation raised interest rates. As rates rose in England , credit tightened, and U.S. asset prices began to fall.

On May 10 th 1837 , the banks of New York suspended gold and silver payments for their notes. Fear ignited bank runs throughout the United States . The young country fell into a 7 year depression. How could two decades of prosperity end so suddenly? According to America : A Narrative History : “monetary inflation had fueled an era of speculation in real estate, canals, and railroad stocks.” Cracks in the dam were visible much earlier, as the stock market peaked in inflation-adjusted value three years prior. According to Rolf Nef, debt levels in the private sector rose to 150% of GDP. In late 1836, the Bank of England concerned with inflation raised interest rates. As rates rose in England , credit tightened, and U.S. asset prices began to fall.

On May 10 th , investors panicked and scrambled for cash. “By the fall of 1837 one third of the work force was jobless, and those still fortunate to have jobs saw their wages fall 30-50% within 2 years. At the same time, prices for food and clothing soared.” Murray Rothbard in A History of Money and Banking in the United States described the impact on financial institutions: “unsound banks were finally eliminated; unsound investments generated in the boom were liquidated. The number of banks fell during these years by 23 percent.”

2007

Much like in 1837, the stock market peaked in inflation-adjusted value years ago (in 2000). Private debt levels are now over 250% of GDP . Dr. Marc Faber has recently described the current environment as “ a buying frenzy or buying panic during which investors collectively believe that they can play the asset inflation game until it stops and then all get out profitably at the same time.” Others are noting similarities to the credit boom of the 1830s. Edward Chancellor, author of Devil Take the Hindmost: A History of Financial Speculation , has recently penned a second book titled Crunch Time for Credit . According to Chancellor, “The growth of credit has created an illusory prosperity while producing profound imbalances in the British and American economies...

When credit ceases to grow, the weakened state of these economies will become apparent." Chancellor warns: "It will also become clear that the credit boom, by inflating asset prices and boosting profits, has lead to inappropriate balance sheets (both for the private sector and in general). At some stage, balance sheets will have to be adjusted to face a new reality. The process of adjustment is likely to be painful. It may well end in either an extraordinary deflation...or an extraordinary inflation." As our readers know, we first expect deflation as the asset bubble fizzles. The economy has already started the painful adjustment process in one asset class: real estate.

Mortgage Default Crisis Just Starting

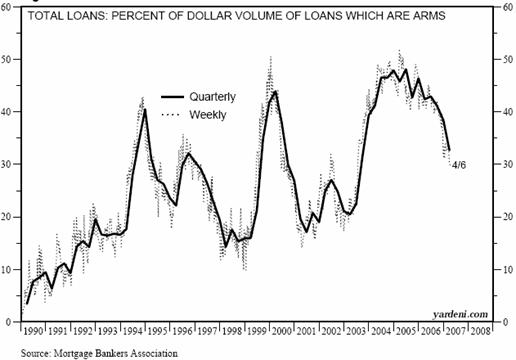

The investment herd now believes that residential real estate can fall in value without creating any spillover effects into the rest of the economy. They have forgotten our financial institutions are largely based on real estate loans. As you can see from the chart below, of total loans created since 2002, 20%-50% have been adjustable rate mortgages ‘ARMs'.

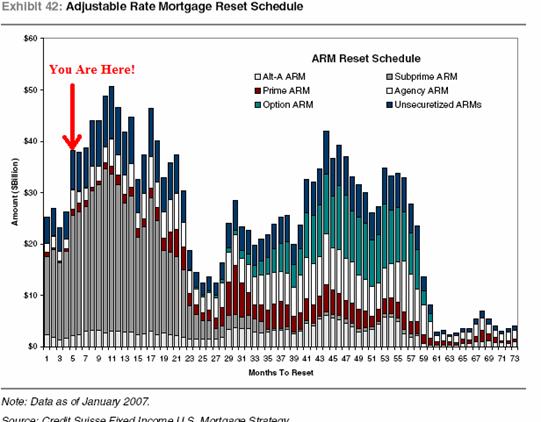

In the Reset Schedule below from Credit Suisse, over a trillion dollars in ARMS will adjust in rates over the next 5 years.

We expect more foreclosures as these rates rise. Currently here in Alabama , 18.2% of subprime loans are delinquent according to the Mortgage Bankers Association. As Wells Fargo CEO Richard Kovacevich said in December about the subprime market: ``I am not a forecaster of the future; I'm a historian. And history says this will blow up. It always has. And there will be some blood on the street.'' But whose blood?

Investors ‘Shocked'

UBS, the Swiss bank and largest wealth manager in the world, reported on May 3 rd that they were closing their hedge fund arm Dillon Read Capital Management at a cost of $300 million. The reason? It lost $124 million in the first quarter due to the defaults in the subprime market. Looking back at our last report from April 19 :

“Current ‘thinking' is that financial institutions have passed on much of the mortgage risk to hedge funds. However when hedge funds fail, ‘prime brokers' historically have been forced to accept the hedge fund's losing positions. Illiquid arrangements (for instance credit derivatives) will then be the responsibility of the prime brokers. They will be forced to sell at any price as they try to prevent losses on their own books.”

To reiterate: In a crisis, a financial institution's capital cannot be separated from a hedge fund arm, proprietary trading desk or prime brokerage unit. In a forgotten lesson of history, investment bank Goldman Sachs' Trading Corporation failed due to trading losses in 1929. Goldman Sachs was only resurrected by refocusing the company on investment banking and abandoning trading altogether. But after a long bull market, memories get foggy. Almost 70% of Goldman Sachs' profit in 2006 was earned from trading and principal investments. Goldman Sachs and Morgan Stanley are also the two largest prime brokers, whose service includes providing leverage to hedge funds.

How You Should Prepare

Investors should remove investment risk from their portfolio by holding cash. But they should also be moving accounts to financially healthy institutions. Sometime in the near future, as in 1837, there will be a realization point that preservation of funds is paramount in a deleveraging economy.

***Starting in July, our free monthly investment analysis report will require a subscription fee of $40 a month for non-clients. Clients with assets under management will receive reports free of charge. Until July, current free readers may ‘reserve their seat' here for half price ($20 a month). A yearly PayPal billing notice will arrive in an email in June.***

By Paul Lamont

www.LTAdvisors.net

Copyright ©2007 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.