Stocks Rally Towards Double Top?, Whilst U.S. Dollar Holds onto Critical Support

News_Letter / Financial Markets 2009 Oct 11, 2009 - 02:11 PM GMTBy: NewsLetter

The Market Oracle Newsletter

October 11th, 2009 Issue #78 Vol. 3

The Market Oracle Newsletter

October 11th, 2009 Issue #78 Vol. 3

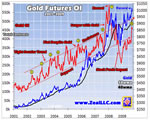

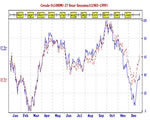

Stocks Rally Towards Double Top?, Whilst U.S. Dollar Holds onto Critical SupportDear Reader This week was the turn of UK Conservative party to announce how they will deal with Britain's budget deficit. Their answer was for cuts of £7 billion, a drop in the debt ocean. My Analysis clearly showed that it would require an additional £50 billion a year of spending cuts and tax rises to bring the deficit to under 6% of GDP, £7 billion is not going to do anything but set in motion another Black Wednesday when we wake up to the Financial Markets dumping sterling, and UK bonds, stocks and assets Iceland style. Do the politicians and their academic economist guru's NOT GET IT ? That it is NOT future generations that will pay the price for this debt but THIS generation, because the markets do NOT wait for the children in nursery schools to grow up and take up the debt burden, the markets tend to act in the PRESENT on the basis of FUTURE expectations! But no they just do not get it and neither does the mainstream press that continues to regurgitate press releases and duplicated reporting of what we have all already seen on the BBC. To this end I am working on a 50+ page ebook that will attempt to forecast the UK economy for the next 5 years which will be made available for FREE at the Market Oracle. Financial Market's Quick Review and Outlook Gold - New High, Gold bugs getting carried away with $1,200, $1300, $1500 and beyond on inflation expectations. Gold is being driven by sentiment rather than fundamentals, exuberant sentiment can spike prices much higher, though the chart suggests were not at that stage, trend channel analysis is suggestive of a mild correction next week forecasting a trend lower to $1020. Silver at 17.91 is significantly below its high of 21.44 so may prove a better option for precious metal speculators, especially as the chart trend in percentage terms is towards relative out performance. U.S. Dollar - As warned of last week, failure to trend higher is a sign of weakness not strength, though existing bull market scenario just manages to remain intact as long as USD remains above 75, last weeks low of 75.77 came pretty close to a break which would target 71. Forecast - Given the proximity to a breakdown this is a very close call, but holding USD 75 is a signal in it's own right that is suggestive of a higher dollar trend next week. UK Interest Rates - On hold at -1.1%, as savers finance the government passing cash to the bankster's, retail customers financing huge profit margins to enable bankster's to repay capital for political reasons. Dow Jones Trading - Technical long trigger on break above 7780 at 1/6th position. Bull market remains in tact, correction to date has been remarkably weak, despite being a bull since early March I am skeptical of last weeks price action (rally), the market NEEDS to correct more than it has else it accumulates too many bulls. What does this mean, well the decline to 9430 and subsequent rally would fit that of a double top pattern with a resultant measuring move into the 8900 to 9000 target zone so the significant correction scenario has not yet been completely negated. Forecast conclusion - Look for downtrend to resume early weak, confirming triggers are 9740, 9650, and 9430 enroute to 8900-9000 zone. Trading the existing rally, break above 9920 would trigger another 1/6th long position to 1/3rd total, with initial stop at 9740 sell and reverse trigger (SAR). Crude Oil - December 08 forecast is for sideways trend of between $70 and $35 into year end 2010. Current phase is suggestive of a downtrend, though crude oil mega trend will ultimately pass $200. Natural gas has soared to 5.31, I have given number of warnings to accumulate at less than 3.5. Remains a mega-trend despite doubling from 2.6. This Weeks Trading Lesson - How to Learn to Trade ? From technical analysis books ? , website's ? magazines ? trading guru's ? The real secret of how to learn to trade is by practicing trading in real time (not with paper money but real money). The act of trading reinforces positive behaviour patterns i.e. you are rewarded by profits, punished by losses, whilst at the same time you have not learned any of the negative behaviour patterns which comprise approx 80% of that which is printed in trading books. You DON'T NEED to READ A SINGLE TRADING BOOK TO TRADE ! Where Trading is concerned the more you learn the more confused you will become as the act of analysis supplants the act of trading. After all if its a 5th of a 5th Elliott Wave then it MUST NOW GO DOWN! The MACD has Crossed it MUST be a Buy ? The 61.8% ratio has been hit it MUST now retrace?, The Moving Averages have now crossed it MUST rally? The Seasonal pattern is strong for a Down month so it MUST start to fall ? Example here from 1987. Your analyst By Nadeem Walayat Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: STRATFOR Two major leaks occurred this weekend over the Iran matter. In the first, The New York Times published an article reporting that staff at the International Atomic Energy Agency (IAEA), the U.N. nuclear oversight group, had produced an unreleased report saying that Iran was much more advanced in its nuclear program than the IAEA had thought previously. According to the report, Iran now has all the data needed to design a nuclear weapon. The New York Times article added that U.S. intelligence was re-examining the National Intelligence Estimate (NIE) of 2007, which had stated that Iran was not actively pursuing a nuclear weapon.

By: Martin_D_Weiss When our leaders have no awareness of the disastrous consequences of their actions, they can claim ignorance and take no action. Or when our leaders have no hard evidence as to what might happen in the future, they can at least claim uncertainty.

By: Bill_Downey There was financial life before the 2008 meltdown……….and there is going to be life after the 2008 meltdown. It is the most significant event in modern day financial history as far as the total effect and financial drawdown that it has unleashed. It’s a shock wave and repercussion that stems from the August 1971 removal of the United States Dollar from the gold standard by Richard M Nixon. If you have time I urge you to watch the broadcast from that evening. You can Google it. It’s worth the listen, especially listening to Nixon telling the American people that this is being done for their sake and their well being. Telling us that it’s to make the nation competitive again (sic). To teach the dollar speculators a lesson proclaimed Nixon. Watching it now, I couldn’t help but ponder how naïve we must all have been to swallow that dialogue.

By: Bob_Chapman The bear market rally will soon be over. It rallied 1,300 Dow points that it should have. All the back up data as to why this is in process was included in the last issue. The rally induced many investors to stay long and they did recoup as much as 80% of their losses in some instances. Now it is time to exit and move into gold and silver shares. Probably the biggest key is that gold recently spent two weeks above $1,000 and we believe gold is prepared for a breakout that will take its price anywhere from $1,200 to $1,700 an ounce. Gold’s long-term reverse head and shoulders pattern, one of the most powerful patterns in charting is in a breakout mode.

By: Nadeem_Walayat The Stock markets continued to correct following the preceding weeks sell signals as confirmed in last weeks newsletter. The market has now given a ABC pattern which allows me to generate a trend channel within which I can trade more closely to the price, i.e. rather than leaving stops far distant due to the lack of price action as the below chart illustrates (more on trading, eventually at walayatstreet.com).

By: John_Mauldin We all know that a large wave of Baby Boomers in the US are approaching retirement. But what about the rest of the world? And what happens when those retirees need to spend out of savings? There is more than just a credit crisis and a government deficit crisis in our future. A rising level of retirrees to workers is happening even as I write. And the US is not, for once, the center of the problem. As this week's writer of your Outside the Box Niels Jensen explains, we cannot all export our way out of the problem. There is a global adjustment that must happen and when it does, it will have serious consequences for all. This week's letter is guaranteed to make you think. Set aside a few minutes to do so.

By: Jim_Willie_CB The story hit like a thief in the night, even bearing Biblical proportions. The end of the exlusive sale of MidEast oil in USDollars, the rise of Russian and Chinese influence in the Persian Gulf, the rise in importance for the Intl Monetary Fund basket of currencies, the final clarion call for the free ride by Americans on the Dollar Credit Card, and hidden implications that the Saudis must shop for a new security lord in the region with broad military might, these are revolutionary steps with profound geopolitical implications.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.